Questões de Concurso Público TCE-SP 2012 para Auxiliar de Fiscalização Financeira

Foram encontradas 80 questões

Paula ? Hoje é sexta-feira e ontem foi domingo, mas amanhã será quarta-feira.

Júlia ? Ontem foi segunda-feira, mas amanhã será terça.

Luíza ? Hoje é terça-feira, mas ontem foi quinta.

Apesar de as frases serem inconsistentes como um todo, cada amiga registrou exatamente uma informação correta em seu diário. Desse modo, o almoço ocorreu numa

Se o vencimento de uma conta não cair em um dia útil, então ele deverá automaticamente ser transferido para o próximo dia útil.

Para que esta regra não tenha sido cumprida, basta que

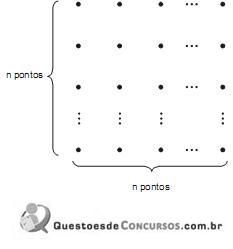

No jogo do "liga-pontos", dois jogadores, de maneira alternada, vão unindo os pontos de uma malha quadriculada por meio de linhas retas horizontais ou verticais.

Cada linha deve ligar dois pontos adjacentes da malha, como exemplificado na figura, em que já foram traçadas sete linhas retas.

Quando um quadrado pequeno da malha é cercado por quatro linhas retas, diz-se que uma casa foi fechada.

O número total de casas que podem ser fechadas nessa malha é dado por

No jogo do "liga-pontos", dois jogadores, de maneira alternada, vão unindo os pontos de uma malha quadriculada por meio de linhas retas horizontais ou verticais.

Cada linha deve ligar dois pontos adjacentes da malha, como exemplificado na figura, em que já foram traçadas sete linhas retas.

Quando um quadrado pequeno da malha é cercado por quatro linhas retas, diz-se que uma casa foi fechada.

Amiga 1 ? Se usar a calça azul, então vá com os sapatos azuis.

Amiga 2 ? Se vestir a calça preta, então não use a camisa branca.

Amiga 3 ? Se optar pela camisa branca, então calce os sapatos pretos.

Amiga 4 ? Se escolher a camisa vermelha, então vá com a calça azul.

Sabendo que Estela acatou as sugestões das quatro amigas, conclui-se que ela vestiu

Cada uma das 32 seleções que participarão da Copa do Mundo de 2014 terá de escolher uma única dentre as 12 cidades sedes para se concentrar ao longo de todo o torneio.

Considerando o conteúdo da manchete, conclui-se que, necessariamente,

Making Performance Budgeting Work: New IMF Book

October 04, 2007

Member countries will find valuable advice on how to reform their budgeting practices to improve the effectiveness and

efficiency of public expenditure in a major new work on performance budgeting produced by the Fiscal Affairs Department. The book,

Performance Budgeting: Linking Funding and Results (500pp), came off the presses of the top UK publisher Palgrave Macmillan in

September.

Edited by FAD staff member Marc Robinson, the book contains a comprehensive treatment of contemporary performance

budgeting practice and theory. In a series of thematic chapters and case studies, the book discusses:

- The key forms of performance budgeting which [TO IMPLEMENT] around the world - how they differ, and what they have in

common points.

- Lessons from the experience of governments around the world - ranging from OECD nations to developing, middle-income

and transition countries - about what forms of performance budgeting work, under what circumstances, and with what

implementation strategies.

- How successful performance budgeting can improve aggregate fiscal discipline.

- The information requirements of performance budgeting, and

- The links between performance budgeting and other budgeting and public management reforms.

Many of the contributors to this work are leaders in performance budgeting implementation in their countries. Others are

respected academics and technical experts from the International Monetary Fund and other international organizations. Countries

covered in the case studies include the UK, USA, Australia, France, Chile, Spain, Russia, Colombia and Ethiopia.

One major focus of the book is performance budgeting as a tool for improved expenditure prioritization - that is, for helping to

shift limited public resources to the services of greatest social benefit. A key finding is that this type of performance budgeting will only

work if the budget process is fundamentally changed so that top politicians and bureaucrats systematically consider expenditure

priorities when formulating the budget. This means more than just considering the priorities for new spending. It requires also having

mechanisms to systematically review existing spending programs to identify what is ineffective and low priority and can, therefore, be

cut. This is what countries such as Chile and the United Kingdom have successfully done, and the United States is currently attempting

to achieve with its Program Assessment Rating Tool instrument. Conversely, it is a mistake to believe that merely changing the budget

classification and developing performance indicators will in itself improve the allocation of resources in the budget.

(Adapted from http://blog-pfm.imf.org/pfmblog/2007/10/making-performa.html)

Making Performance Budgeting Work: New IMF Book

October 04, 2007

Member countries will find valuable advice on how to reform their budgeting practices to improve the effectiveness and

efficiency of public expenditure in a major new work on performance budgeting produced by the Fiscal Affairs Department. The book,

Performance Budgeting: Linking Funding and Results (500pp), came off the presses of the top UK publisher Palgrave Macmillan in

September.

Edited by FAD staff member Marc Robinson, the book contains a comprehensive treatment of contemporary performance

budgeting practice and theory. In a series of thematic chapters and case studies, the book discusses:

- The key forms of performance budgeting which [TO IMPLEMENT] around the world - how they differ, and what they have in

common points.

- Lessons from the experience of governments around the world - ranging from OECD nations to developing, middle-income

and transition countries - about what forms of performance budgeting work, under what circumstances, and with what

implementation strategies.

- How successful performance budgeting can improve aggregate fiscal discipline.

- The information requirements of performance budgeting, and

- The links between performance budgeting and other budgeting and public management reforms.

Many of the contributors to this work are leaders in performance budgeting implementation in their countries. Others are

respected academics and technical experts from the International Monetary Fund and other international organizations. Countries

covered in the case studies include the UK, USA, Australia, France, Chile, Spain, Russia, Colombia and Ethiopia.

One major focus of the book is performance budgeting as a tool for improved expenditure prioritization - that is, for helping to

shift limited public resources to the services of greatest social benefit. A key finding is that this type of performance budgeting will only

work if the budget process is fundamentally changed so that top politicians and bureaucrats systematically consider expenditure

priorities when formulating the budget. This means more than just considering the priorities for new spending. It requires also having

mechanisms to systematically review existing spending programs to identify what is ineffective and low priority and can, therefore, be

cut. This is what countries such as Chile and the United Kingdom have successfully done, and the United States is currently attempting

to achieve with its Program Assessment Rating Tool instrument. Conversely, it is a mistake to believe that merely changing the budget

classification and developing performance indicators will in itself improve the allocation of resources in the budget.

(Adapted from http://blog-pfm.imf.org/pfmblog/2007/10/making-performa.html)

Making Performance Budgeting Work: New IMF Book

October 04, 2007

Member countries will find valuable advice on how to reform their budgeting practices to improve the effectiveness and

efficiency of public expenditure in a major new work on performance budgeting produced by the Fiscal Affairs Department. The book,

Performance Budgeting: Linking Funding and Results (500pp), came off the presses of the top UK publisher Palgrave Macmillan in

September.

Edited by FAD staff member Marc Robinson, the book contains a comprehensive treatment of contemporary performance

budgeting practice and theory. In a series of thematic chapters and case studies, the book discusses:

- The key forms of performance budgeting which [TO IMPLEMENT] around the world - how they differ, and what they have in

common points.

- Lessons from the experience of governments around the world - ranging from OECD nations to developing, middle-income

and transition countries - about what forms of performance budgeting work, under what circumstances, and with what

implementation strategies.

- How successful performance budgeting can improve aggregate fiscal discipline.

- The information requirements of performance budgeting, and

- The links between performance budgeting and other budgeting and public management reforms.

Many of the contributors to this work are leaders in performance budgeting implementation in their countries. Others are

respected academics and technical experts from the International Monetary Fund and other international organizations. Countries

covered in the case studies include the UK, USA, Australia, France, Chile, Spain, Russia, Colombia and Ethiopia.

One major focus of the book is performance budgeting as a tool for improved expenditure prioritization - that is, for helping to

shift limited public resources to the services of greatest social benefit. A key finding is that this type of performance budgeting will only

work if the budget process is fundamentally changed so that top politicians and bureaucrats systematically consider expenditure

priorities when formulating the budget. This means more than just considering the priorities for new spending. It requires also having

mechanisms to systematically review existing spending programs to identify what is ineffective and low priority and can, therefore, be

cut. This is what countries such as Chile and the United Kingdom have successfully done, and the United States is currently attempting

to achieve with its Program Assessment Rating Tool instrument. Conversely, it is a mistake to believe that merely changing the budget

classification and developing performance indicators will in itself improve the allocation of resources in the budget.

(Adapted from http://blog-pfm.imf.org/pfmblog/2007/10/making-performa.html)

Making Performance Budgeting Work: New IMF Book

October 04, 2007

Member countries will find valuable advice on how to reform their budgeting practices to improve the effectiveness and

efficiency of public expenditure in a major new work on performance budgeting produced by the Fiscal Affairs Department. The book,

Performance Budgeting: Linking Funding and Results (500pp), came off the presses of the top UK publisher Palgrave Macmillan in

September.

Edited by FAD staff member Marc Robinson, the book contains a comprehensive treatment of contemporary performance

budgeting practice and theory. In a series of thematic chapters and case studies, the book discusses:

- The key forms of performance budgeting which [TO IMPLEMENT] around the world - how they differ, and what they have in

common points.

- Lessons from the experience of governments around the world - ranging from OECD nations to developing, middle-income

and transition countries - about what forms of performance budgeting work, under what circumstances, and with what

implementation strategies.

- How successful performance budgeting can improve aggregate fiscal discipline.

- The information requirements of performance budgeting, and

- The links between performance budgeting and other budgeting and public management reforms.

Many of the contributors to this work are leaders in performance budgeting implementation in their countries. Others are

respected academics and technical experts from the International Monetary Fund and other international organizations. Countries

covered in the case studies include the UK, USA, Australia, France, Chile, Spain, Russia, Colombia and Ethiopia.

One major focus of the book is performance budgeting as a tool for improved expenditure prioritization - that is, for helping to

shift limited public resources to the services of greatest social benefit. A key finding is that this type of performance budgeting will only

work if the budget process is fundamentally changed so that top politicians and bureaucrats systematically consider expenditure

priorities when formulating the budget. This means more than just considering the priorities for new spending. It requires also having

mechanisms to systematically review existing spending programs to identify what is ineffective and low priority and can, therefore, be

cut. This is what countries such as Chile and the United Kingdom have successfully done, and the United States is currently attempting

to achieve with its Program Assessment Rating Tool instrument. Conversely, it is a mistake to believe that merely changing the budget

classification and developing performance indicators will in itself improve the allocation of resources in the budget.

(Adapted from http://blog-pfm.imf.org/pfmblog/2007/10/making-performa.html)

I. Making Performance Budgeting Work

II. ... is a major new work...

Leia as sentenças abaixo:

- This work is protected under copyright laws and reproduction is strictly prohibited.

- Institutions such as the rule of law will rarely work if they are simply copied from abroad.

- Theory of the Firm builds models to help explain how markets work.

- His new book is called " Making Our Democracy Work: A Judge's View."

- She wanted it to be the definitive work on the subject of voting and women's rights around the world.

A alternativa que representa a ordem correta em que os sentidos aparecem no conjunto das sentenças é

Making Performance Budgeting Work: New IMF Book

October 04, 2007

Member countries will find valuable advice on how to reform their budgeting practices to improve the effectiveness and

efficiency of public expenditure in a major new work on performance budgeting produced by the Fiscal Affairs Department. The book,

Performance Budgeting: Linking Funding and Results (500pp), came off the presses of the top UK publisher Palgrave Macmillan in

September.

Edited by FAD staff member Marc Robinson, the book contains a comprehensive treatment of contemporary performance

budgeting practice and theory. In a series of thematic chapters and case studies, the book discusses:

- The key forms of performance budgeting which [TO IMPLEMENT] around the world - how they differ, and what they have in

common points.

- Lessons from the experience of governments around the world - ranging from OECD nations to developing, middle-income

and transition countries - about what forms of performance budgeting work, under what circumstances, and with what

implementation strategies.

- How successful performance budgeting can improve aggregate fiscal discipline.

- The information requirements of performance budgeting, and

- The links between performance budgeting and other budgeting and public management reforms.

Many of the contributors to this work are leaders in performance budgeting implementation in their countries. Others are

respected academics and technical experts from the International Monetary Fund and other international organizations. Countries

covered in the case studies include the UK, USA, Australia, France, Chile, Spain, Russia, Colombia and Ethiopia.

One major focus of the book is performance budgeting as a tool for improved expenditure prioritization - that is, for helping to

shift limited public resources to the services of greatest social benefit. A key finding is that this type of performance budgeting will only

work if the budget process is fundamentally changed so that top politicians and bureaucrats systematically consider expenditure

priorities when formulating the budget. This means more than just considering the priorities for new spending. It requires also having

mechanisms to systematically review existing spending programs to identify what is ineffective and low priority and can, therefore, be

cut. This is what countries such as Chile and the United Kingdom have successfully done, and the United States is currently attempting

to achieve with its Program Assessment Rating Tool instrument. Conversely, it is a mistake to believe that merely changing the budget

classification and developing performance indicators will in itself improve the allocation of resources in the budget.

(Adapted from http://blog-pfm.imf.org/pfmblog/2007/10/making-performa.html)

House G.O.P. Leaders Agree to Extension of Payroll Tax Cut

By JENNIFER STEINHAUER

Published: December 22, 2011

WASHINGTON - Under a deal reached between House and Senate leaders, the House will now approve as early as Friday the

two-month extension of a payroll tax holiday and unemployment benefits approved by the Senate last Saturday, and the Senate will

appoint members of a House-Senate conference committee to negotiate legislation to extend both benefits through 2012.

House Republicans - who rejected an almost identical deal on Tuesday - collapsed under the political rubble that has

accumulated over the week, much of it from their own party, worried that the blockade would do serious damage to their appeal to

voters.

The House speaker, John A. Boehner, announced the decision over the phone to members on Thursday, and did not permit the

usual back and forth that is common on such calls, enraging many of them.

After his conversation with lawmakers, the speaker conceded to reporters that it might not have been "politically the smartest

thing in the world" for House Republicans to put themselves between a tax cut and the 160 million American workers who would benefit

from it, and to allow President Obama and Congressional Democrats to seize the momentum on the issue.

The agreement ended a partisan fight that threatened to keep Congress and Mr. Obama in town through Christmas and was

just the latest of the bitter struggles over fiscal policy involving House conservatives, the president and the Democratic-controlled

Senate.

Under the deal, the employee's share of the Social Security payroll tax will stay at the current level, 4.2 percent of wages,

through Feb. 29. In the absence of Congressional action, it would revert to the usual 6.2 percent next month. The government will also

continue paying unemployment insurance benefits under current policy through February. Without Congressional action, many of the

long-term unemployed would begin losing benefits next month.

In addition, under the agreement, Medicare will continue paying doctors at current rates for two months, averting a 27 percent

cut that would otherwise occur on Jan. 1.

The new deal makes minor adjustments to make it easier for small businesses to cope with the tax changes and prevents

manipulation of an employee's pay should the tax cut extension fail to go beyond two months.

Mr. Obama, who has reaped political benefits from the standoff, welcomed the outcome.

"This is good news, just in time for the holidays," he said in a statement. "This is the right thing [VERB 1] to strengthen our

families, grow our economy, and create new jobs. This is real money that will [VERB 2] a real difference in people's lives."

(Adapted from http://www.nytimes.com/2011/12/23/us/politics/senate-republican-leader-suggests-a-payroll-tax-deal.html?_r=1&nl=

todays hea dlines & emc=tha2&pagewanted=all)

House G.O.P. Leaders Agree to Extension of Payroll Tax Cut

By JENNIFER STEINHAUER

Published: December 22, 2011

WASHINGTON - Under a deal reached between House and Senate leaders, the House will now approve as early as Friday the

two-month extension of a payroll tax holiday and unemployment benefits approved by the Senate last Saturday, and the Senate will

appoint members of a House-Senate conference committee to negotiate legislation to extend both benefits through 2012.

House Republicans - who rejected an almost identical deal on Tuesday - collapsed under the political rubble that has

accumulated over the week, much of it from their own party, worried that the blockade would do serious damage to their appeal to

voters.

The House speaker, John A. Boehner, announced the decision over the phone to members on Thursday, and did not permit the

usual back and forth that is common on such calls, enraging many of them.

After his conversation with lawmakers, the speaker conceded to reporters that it might not have been "politically the smartest

thing in the world" for House Republicans to put themselves between a tax cut and the 160 million American workers who would benefit

from it, and to allow President Obama and Congressional Democrats to seize the momentum on the issue.

The agreement ended a partisan fight that threatened to keep Congress and Mr. Obama in town through Christmas and was

just the latest of the bitter struggles over fiscal policy involving House conservatives, the president and the Democratic-controlled

Senate.

Under the deal, the employee's share of the Social Security payroll tax will stay at the current level, 4.2 percent of wages,

through Feb. 29. In the absence of Congressional action, it would revert to the usual 6.2 percent next month. The government will also

continue paying unemployment insurance benefits under current policy through February. Without Congressional action, many of the

long-term unemployed would begin losing benefits next month.

In addition, under the agreement, Medicare will continue paying doctors at current rates for two months, averting a 27 percent

cut that would otherwise occur on Jan. 1.

The new deal makes minor adjustments to make it easier for small businesses to cope with the tax changes and prevents

manipulation of an employee's pay should the tax cut extension fail to go beyond two months.

Mr. Obama, who has reaped political benefits from the standoff, welcomed the outcome.

"This is good news, just in time for the holidays," he said in a statement. "This is the right thing [VERB 1] to strengthen our

families, grow our economy, and create new jobs. This is real money that will [VERB 2] a real difference in people's lives."

(Adapted from http://www.nytimes.com/2011/12/23/us/politics/senate-republican-leader-suggests-a-payroll-tax-deal.html?_r=1&nl=

todays hea dlines & emc=tha2&pagewanted=all)

House G.O.P. Leaders Agree to Extension of Payroll Tax Cut

By JENNIFER STEINHAUER

Published: December 22, 2011

WASHINGTON - Under a deal reached between House and Senate leaders, the House will now approve as early as Friday the

two-month extension of a payroll tax holiday and unemployment benefits approved by the Senate last Saturday, and the Senate will

appoint members of a House-Senate conference committee to negotiate legislation to extend both benefits through 2012.

House Republicans - who rejected an almost identical deal on Tuesday - collapsed under the political rubble that has

accumulated over the week, much of it from their own party, worried that the blockade would do serious damage to their appeal to

voters.

The House speaker, John A. Boehner, announced the decision over the phone to members on Thursday, and did not permit the

usual back and forth that is common on such calls, enraging many of them.

After his conversation with lawmakers, the speaker conceded to reporters that it might not have been "politically the smartest

thing in the world" for House Republicans to put themselves between a tax cut and the 160 million American workers who would benefit

from it, and to allow President Obama and Congressional Democrats to seize the momentum on the issue.

The agreement ended a partisan fight that threatened to keep Congress and Mr. Obama in town through Christmas and was

just the latest of the bitter struggles over fiscal policy involving House conservatives, the president and the Democratic-controlled

Senate.

Under the deal, the employee's share of the Social Security payroll tax will stay at the current level, 4.2 percent of wages,

through Feb. 29. In the absence of Congressional action, it would revert to the usual 6.2 percent next month. The government will also

continue paying unemployment insurance benefits under current policy through February. Without Congressional action, many of the

long-term unemployed would begin losing benefits next month.

In addition, under the agreement, Medicare will continue paying doctors at current rates for two months, averting a 27 percent

cut that would otherwise occur on Jan. 1.

The new deal makes minor adjustments to make it easier for small businesses to cope with the tax changes and prevents

manipulation of an employee's pay should the tax cut extension fail to go beyond two months.

Mr. Obama, who has reaped political benefits from the standoff, welcomed the outcome.

"This is good news, just in time for the holidays," he said in a statement. "This is the right thing [VERB 1] to strengthen our

families, grow our economy, and create new jobs. This is real money that will [VERB 2] a real difference in people's lives."

(Adapted from http://www.nytimes.com/2011/12/23/us/politics/senate-republican-leader-suggests-a-payroll-tax-deal.html?_r=1&nl=

todays hea dlines & emc=tha2&pagewanted=all)

House G.O.P. Leaders Agree to Extension of Payroll Tax Cut

By JENNIFER STEINHAUER

Published: December 22, 2011

WASHINGTON - Under a deal reached between House and Senate leaders, the House will now approve as early as Friday the

two-month extension of a payroll tax holiday and unemployment benefits approved by the Senate last Saturday, and the Senate will

appoint members of a House-Senate conference committee to negotiate legislation to extend both benefits through 2012.

House Republicans - who rejected an almost identical deal on Tuesday - collapsed under the political rubble that has

accumulated over the week, much of it from their own party, worried that the blockade would do serious damage to their appeal to

voters.

The House speaker, John A. Boehner, announced the decision over the phone to members on Thursday, and did not permit the

usual back and forth that is common on such calls, enraging many of them.

After his conversation with lawmakers, the speaker conceded to reporters that it might not have been "politically the smartest

thing in the world" for House Republicans to put themselves between a tax cut and the 160 million American workers who would benefit

from it, and to allow President Obama and Congressional Democrats to seize the momentum on the issue.

The agreement ended a partisan fight that threatened to keep Congress and Mr. Obama in town through Christmas and was

just the latest of the bitter struggles over fiscal policy involving House conservatives, the president and the Democratic-controlled

Senate.

Under the deal, the employee's share of the Social Security payroll tax will stay at the current level, 4.2 percent of wages,

through Feb. 29. In the absence of Congressional action, it would revert to the usual 6.2 percent next month. The government will also

continue paying unemployment insurance benefits under current policy through February. Without Congressional action, many of the

long-term unemployed would begin losing benefits next month.

In addition, under the agreement, Medicare will continue paying doctors at current rates for two months, averting a 27 percent

cut that would otherwise occur on Jan. 1.

The new deal makes minor adjustments to make it easier for small businesses to cope with the tax changes and prevents

manipulation of an employee's pay should the tax cut extension fail to go beyond two months.

Mr. Obama, who has reaped political benefits from the standoff, welcomed the outcome.

"This is good news, just in time for the holidays," he said in a statement. "This is the right thing [VERB 1] to strengthen our

families, grow our economy, and create new jobs. This is real money that will [VERB 2] a real difference in people's lives."

(Adapted from http://www.nytimes.com/2011/12/23/us/politics/senate-republican-leader-suggests-a-payroll-tax-deal.html?_r=1&nl=

todays hea dlines & emc=tha2&pagewanted=all)

House G.O.P. Leaders Agree to Extension of Payroll Tax Cut

By JENNIFER STEINHAUER

Published: December 22, 2011

WASHINGTON - Under a deal reached between House and Senate leaders, the House will now approve as early as Friday the

two-month extension of a payroll tax holiday and unemployment benefits approved by the Senate last Saturday, and the Senate will

appoint members of a House-Senate conference committee to negotiate legislation to extend both benefits through 2012.

House Republicans - who rejected an almost identical deal on Tuesday - collapsed under the political rubble that has

accumulated over the week, much of it from their own party, worried that the blockade would do serious damage to their appeal to

voters.

The House speaker, John A. Boehner, announced the decision over the phone to members on Thursday, and did not permit the

usual back and forth that is common on such calls, enraging many of them.

After his conversation with lawmakers, the speaker conceded to reporters that it might not have been "politically the smartest

thing in the world" for House Republicans to put themselves between a tax cut and the 160 million American workers who would benefit

from it, and to allow President Obama and Congressional Democrats to seize the momentum on the issue.

The agreement ended a partisan fight that threatened to keep Congress and Mr. Obama in town through Christmas and was

just the latest of the bitter struggles over fiscal policy involving House conservatives, the president and the Democratic-controlled

Senate.

Under the deal, the employee's share of the Social Security payroll tax will stay at the current level, 4.2 percent of wages,

through Feb. 29. In the absence of Congressional action, it would revert to the usual 6.2 percent next month. The government will also

continue paying unemployment insurance benefits under current policy through February. Without Congressional action, many of the

long-term unemployed would begin losing benefits next month.

In addition, under the agreement, Medicare will continue paying doctors at current rates for two months, averting a 27 percent

cut that would otherwise occur on Jan. 1.

The new deal makes minor adjustments to make it easier for small businesses to cope with the tax changes and prevents

manipulation of an employee's pay should the tax cut extension fail to go beyond two months.

Mr. Obama, who has reaped political benefits from the standoff, welcomed the outcome.

"This is good news, just in time for the holidays," he said in a statement. "This is the right thing [VERB 1] to strengthen our

families, grow our economy, and create new jobs. This is real money that will [VERB 2] a real difference in people's lives."

(Adapted from http://www.nytimes.com/2011/12/23/us/politics/senate-republican-leader-suggests-a-payroll-tax-deal.html?_r=1&nl=

todays hea dlines & emc=tha2&pagewanted=all)