Questões de Concurso Público TCU 2022 para Auditor Federal de Controle Externo

Foram encontradas 100 questões

Posteriormente, no século XX, a população mundial aumentou de tal modo que, para encontrar novas terras, os homens invadiram os espaços selvagens. Foram derrubadas imensas florestas e, assim, numerosos animais desapareceram em função da destruição de seus hábitats. Também a poluição e a instalação de linhas elétricas mataram muitas espécies de peixes e aves. Por fim, uma nova caça intensiva, destinada ao comércio, suprimiu certas espécies, como a dos rinocerontes, cujos chifres eram empregados na fabricação de afrodisíacos.

O homem sabe hoje que a vida sobre a terra é uma vasta cadeia em que cada ser vivo é um elo. Quando uma espécie desaparece, outros animais e outras plantas passam a ficar ameaçadas. Progressivamente, a vida humana se empobrece.”

Esse texto foi didaticamente estruturado; a única afirmativa abaixo inadequada em relação à sua estruturação é:

Abaixo está o início de um conto de Lygia Fagundes Telles, denominado A Ceia.

“O restaurante era modesto e pouco frequentado, com mesinhas ao ar livre, espalhadas debaixo das árvores. Em cada mesinha, um abajur de garrafa projetava sobre a toalha de xadrez vermelho e branco um pálido círculo de luz.”

Todos sabemos que os termos de um texto podem indicar valores

bem variados. Nesse segmento foram sublinhados alguns que

funcionam como adjetivos; a afirmação correta sobre um deles é:

Observe a charge a seguir.

A interpretação de texto refere-se à decodificação dos significados dos componentes textuais, enquanto a compreensão diz respeito aos processos geradores de significação.

A pergunta abaixo que diz respeito à interpretação, e não à

compreensão, é:

É festa na fazenda! Para tratar a Tristeza Parasitária e fazer a alegria tomar conta do rebanho. A Tristeza Parasitária pode afetar o rebanho a qualquer momento e em qualquer fase da vida. Contudo, existe uma dupla capaz de reanimar e proteger o potencial produtivo dos animais. Com você, Ganaseg™ 7% & Kinetomax® Ganaseg™ 7% Combate da Babesiose (Piroplasmose) Curto período de carência para o leite (apenas 96 horas) Ótimo índice de segurança Kinetomax® Rápida ação contra a Anaplasmose Dose única Curto período de carência (Leite: 5 dias/Carne: 8 dias para animais tratados via intramuscular e 4 dias para animais tratados via subcutânea) Xô, tristeza!

Sobre os elementos estruturais desse texto e suas estratégias de produção, é correto afirmar que:

“Acabo de ler o trecho a seguir num livro de História: ‘Os cristãos tinham uma moral, mas os pagãos, não’. Ah! Senhor autor desta obra: onde o senhor aprendeu essa tolice? O que dizer da moral de Sócrates, de Cícero, de Marco Antônio e de tantos outros? Leitor: reflita e tire suas conclusões.”

A afirmativa inadequada sobre esse depoimento a respeito da leitura de uma obra histórica é:

Texto 1 – “Um mestre (Jesus) em que parece haver tanta autoridade, ainda que sua doutrina seja obscura, merece que seja crido por palavra... pode-se reconhecer sua autoridade, tendo em vista o respeito que lhe rendem Moisés e Elias; isto é, a lei e os profetas, como já expliquei... Não procuremos as razões das verdades que ele nos ensina: toda a razão, é que ele as falou.”

Texto 2 – “Certas pessoas têm fé porque seus pais os ensinaram a crer. Num sentido, é satisfatório: nenhum axioma filosófico abalará essa fé; num outro sentido, é insatisfatório, porque sua fé não vem de conhecimento pessoal. Outros chegam à fé pela convicção após estudos. Isso é satisfatório num ponto: eles conhecem Deus por íntima convicção; por outro lado, é insatisfatório porque se outros lhes demonstram a falsidade de seu raciocínio, eles podem tornar-se descrentes.”

Comparando os dois textos, é correto afirmar que:

Internal audit’s role in ESG reporting

Conversations and focus on sustainability, typically grouped into environmental, social and governance (ESG) issues, are quickly evolving — from activist investor groups and inquisitive regulators pushing for change to governing bodies and C-suite executives struggling to understand and embrace the concept. At the forefront of this new risk area is pressure for organizations to make public commitments to sustainability and provide routine updates to ESG-related strategies, goals, and metrics that are accurate and relevant. However, ESG reporting is still immature, and there is not a lot of definitive guidance for organizations in this space. For example, there is no single standard for what should be reported.

What is clear is that strong governance over ESG — as with effective governance overall — requires alignment among the principal players as outlined in The Internal Institute of Auditors (IIA) Three Lines Model. As with any risk area, internal audit should be well-positioned to support the governing body and management with objective assurance, insights, and advice on ESG matters.

Embarking on the ESG journey

Efforts to mitigate the accelerating effects of climate change and address perceived historical social inequities are two powerful issues driving change globally. These movements have enhanced awareness of how all organizations impact, influence, and interact with society and the environment.

They also have spurred organizations to better recognize and manage ESG risks (i.e., risks associated with how organizations operate in respect to their impact on the world around them). This broad risk category includes areas that are dynamic and often driven by factors that can be difficult to measure objectively.

Still, there is growing urgency for organizations to understand and manage ESG risks, particularly as investors and regulators focus on organizations producing high-quality reporting on sustainability efforts. What’s more, that pressure is being reflected increasingly in executive performance as more organizations tie incentive compensation metrics to ESG goals.

As ESG reporting becomes increasingly common, it should be treated with the same care as financial reporting. Organizations need to recognize that ESG reporting must be built on a strategically crafted system of internal controls and accurately reflect how an organization’s ESG efforts relate to each other, the organization’s finances, and value creation.

Internal audit can and should play a significant role in an organization’s ESG journey. It can add value in an advisory capacity by helping to identify and establish a functional ESG control environment. It also can offer critical assurance support by providing an independent and objective review of the effectiveness of ESG risk assessments, responses, and controls.

Source: Adapted from https://na.theiia.org/about-ia/PublicDocuments/WhitePaper-Internal-Audits-Role-in-ESG-Reporting.pdf

( ) One of the hurdles of ESG issues is that they have been restricted to a single group of experts.

( ) There has been such a great demand for publicizing government efforts towards ESG that reports have become accurate and systematized.

( ) Part of the internal auditor’s job is to be knowledgeable enough in the area of ESG so as to be able to provide solid guidance to those in charge of the administration.

The statements are, respectively:

Internal audit’s role in ESG reporting

Conversations and focus on sustainability, typically grouped into environmental, social and governance (ESG) issues, are quickly evolving — from activist investor groups and inquisitive regulators pushing for change to governing bodies and C-suite executives struggling to understand and embrace the concept. At the forefront of this new risk area is pressure for organizations to make public commitments to sustainability and provide routine updates to ESG-related strategies, goals, and metrics that are accurate and relevant. However, ESG reporting is still immature, and there is not a lot of definitive guidance for organizations in this space. For example, there is no single standard for what should be reported.

What is clear is that strong governance over ESG — as with effective governance overall — requires alignment among the principal players as outlined in The Internal Institute of Auditors (IIA) Three Lines Model. As with any risk area, internal audit should be well-positioned to support the governing body and management with objective assurance, insights, and advice on ESG matters.

Embarking on the ESG journey

Efforts to mitigate the accelerating effects of climate change and address perceived historical social inequities are two powerful issues driving change globally. These movements have enhanced awareness of how all organizations impact, influence, and interact with society and the environment.

They also have spurred organizations to better recognize and manage ESG risks (i.e., risks associated with how organizations operate in respect to their impact on the world around them). This broad risk category includes areas that are dynamic and often driven by factors that can be difficult to measure objectively.

Still, there is growing urgency for organizations to understand and manage ESG risks, particularly as investors and regulators focus on organizations producing high-quality reporting on sustainability efforts. What’s more, that pressure is being reflected increasingly in executive performance as more organizations tie incentive compensation metrics to ESG goals.

As ESG reporting becomes increasingly common, it should be treated with the same care as financial reporting. Organizations need to recognize that ESG reporting must be built on a strategically crafted system of internal controls and accurately reflect how an organization’s ESG efforts relate to each other, the organization’s finances, and value creation.

Internal audit can and should play a significant role in an organization’s ESG journey. It can add value in an advisory capacity by helping to identify and establish a functional ESG control environment. It also can offer critical assurance support by providing an independent and objective review of the effectiveness of ESG risk assessments, responses, and controls.

Source: Adapted from https://na.theiia.org/about-ia/PublicDocuments/WhitePaper-Internal-Audits-Role-in-ESG-Reporting.pdf

Internal audit’s role in ESG reporting

Conversations and focus on sustainability, typically grouped into environmental, social and governance (ESG) issues, are quickly evolving — from activist investor groups and inquisitive regulators pushing for change to governing bodies and C-suite executives struggling to understand and embrace the concept. At the forefront of this new risk area is pressure for organizations to make public commitments to sustainability and provide routine updates to ESG-related strategies, goals, and metrics that are accurate and relevant. However, ESG reporting is still immature, and there is not a lot of definitive guidance for organizations in this space. For example, there is no single standard for what should be reported.

What is clear is that strong governance over ESG — as with effective governance overall — requires alignment among the principal players as outlined in The Internal Institute of Auditors (IIA) Three Lines Model. As with any risk area, internal audit should be well-positioned to support the governing body and management with objective assurance, insights, and advice on ESG matters.

Embarking on the ESG journey

Efforts to mitigate the accelerating effects of climate change and address perceived historical social inequities are two powerful issues driving change globally. These movements have enhanced awareness of how all organizations impact, influence, and interact with society and the environment.

They also have spurred organizations to better recognize and manage ESG risks (i.e., risks associated with how organizations operate in respect to their impact on the world around them). This broad risk category includes areas that are dynamic and often driven by factors that can be difficult to measure objectively.

Still, there is growing urgency for organizations to understand and manage ESG risks, particularly as investors and regulators focus on organizations producing high-quality reporting on sustainability efforts. What’s more, that pressure is being reflected increasingly in executive performance as more organizations tie incentive compensation metrics to ESG goals.

As ESG reporting becomes increasingly common, it should be treated with the same care as financial reporting. Organizations need to recognize that ESG reporting must be built on a strategically crafted system of internal controls and accurately reflect how an organization’s ESG efforts relate to each other, the organization’s finances, and value creation.

Internal audit can and should play a significant role in an organization’s ESG journey. It can add value in an advisory capacity by helping to identify and establish a functional ESG control environment. It also can offer critical assurance support by providing an independent and objective review of the effectiveness of ESG risk assessments, responses, and controls.

Source: Adapted from https://na.theiia.org/about-ia/PublicDocuments/WhitePaper-Internal-Audits-Role-in-ESG-Reporting.pdf

Internal audit’s role in ESG reporting

Conversations and focus on sustainability, typically grouped into environmental, social and governance (ESG) issues, are quickly evolving — from activist investor groups and inquisitive regulators pushing for change to governing bodies and C-suite executives struggling to understand and embrace the concept. At the forefront of this new risk area is pressure for organizations to make public commitments to sustainability and provide routine updates to ESG-related strategies, goals, and metrics that are accurate and relevant. However, ESG reporting is still immature, and there is not a lot of definitive guidance for organizations in this space. For example, there is no single standard for what should be reported.

What is clear is that strong governance over ESG — as with effective governance overall — requires alignment among the principal players as outlined in The Internal Institute of Auditors (IIA) Three Lines Model. As with any risk area, internal audit should be well-positioned to support the governing body and management with objective assurance, insights, and advice on ESG matters.

Embarking on the ESG journey

Efforts to mitigate the accelerating effects of climate change and address perceived historical social inequities are two powerful issues driving change globally. These movements have enhanced awareness of how all organizations impact, influence, and interact with society and the environment.

They also have spurred organizations to better recognize and manage ESG risks (i.e., risks associated with how organizations operate in respect to their impact on the world around them). This broad risk category includes areas that are dynamic and often driven by factors that can be difficult to measure objectively.

Still, there is growing urgency for organizations to understand and manage ESG risks, particularly as investors and regulators focus on organizations producing high-quality reporting on sustainability efforts. What’s more, that pressure is being reflected increasingly in executive performance as more organizations tie incentive compensation metrics to ESG goals.

As ESG reporting becomes increasingly common, it should be treated with the same care as financial reporting. Organizations need to recognize that ESG reporting must be built on a strategically crafted system of internal controls and accurately reflect how an organization’s ESG efforts relate to each other, the organization’s finances, and value creation.

Internal audit can and should play a significant role in an organization’s ESG journey. It can add value in an advisory capacity by helping to identify and establish a functional ESG control environment. It also can offer critical assurance support by providing an independent and objective review of the effectiveness of ESG risk assessments, responses, and controls.

Source: Adapted from https://na.theiia.org/about-ia/PublicDocuments/WhitePaper-Internal-Audits-Role-in-ESG-Reporting.pdf

Internal audit’s role in ESG reporting

Conversations and focus on sustainability, typically grouped into environmental, social and governance (ESG) issues, are quickly evolving — from activist investor groups and inquisitive regulators pushing for change to governing bodies and C-suite executives struggling to understand and embrace the concept. At the forefront of this new risk area is pressure for organizations to make public commitments to sustainability and provide routine updates to ESG-related strategies, goals, and metrics that are accurate and relevant. However, ESG reporting is still immature, and there is not a lot of definitive guidance for organizations in this space. For example, there is no single standard for what should be reported.

What is clear is that strong governance over ESG — as with effective governance overall — requires alignment among the principal players as outlined in The Internal Institute of Auditors (IIA) Three Lines Model. As with any risk area, internal audit should be well-positioned to support the governing body and management with objective assurance, insights, and advice on ESG matters.

Embarking on the ESG journey

Efforts to mitigate the accelerating effects of climate change and address perceived historical social inequities are two powerful issues driving change globally. These movements have enhanced awareness of how all organizations impact, influence, and interact with society and the environment.

They also have spurred organizations to better recognize and manage ESG risks (i.e., risks associated with how organizations operate in respect to their impact on the world around them). This broad risk category includes areas that are dynamic and often driven by factors that can be difficult to measure objectively.

Still, there is growing urgency for organizations to understand and manage ESG risks, particularly as investors and regulators focus on organizations producing high-quality reporting on sustainability efforts. What’s more, that pressure is being reflected increasingly in executive performance as more organizations tie incentive compensation metrics to ESG goals.

As ESG reporting becomes increasingly common, it should be treated with the same care as financial reporting. Organizations need to recognize that ESG reporting must be built on a strategically crafted system of internal controls and accurately reflect how an organization’s ESG efforts relate to each other, the organization’s finances, and value creation.

Internal audit can and should play a significant role in an organization’s ESG journey. It can add value in an advisory capacity by helping to identify and establish a functional ESG control environment. It also can offer critical assurance support by providing an independent and objective review of the effectiveness of ESG risk assessments, responses, and controls.

Source: Adapted from https://na.theiia.org/about-ia/PublicDocuments/WhitePaper-Internal-Audits-Role-in-ESG-Reporting.pdf

Utilize a aproximação: (1,027)12=1,4 e (1,04)12=1,6

Um montante de R$ 50.400,00 é financiado, em 5 anos, à taxa de juros compostos de 10% ao ano. Durante todo o período do financiamento, o devedor arca apenas com o pagamento dos juros anuais do capital emprestado, ou seja, o tomador do empréstimo paga somente o valor dos juros que incidem sobre o valor original da dívida. Ao final do período de 5 anos, a dívida é amortizada de uma só vez, com a quitação integral do débito.

Em contrapartida, o credor exige que o devedor efetue depósitos anuais de parcelas iguais, constituindo, assim, um fundo de reserva cujo montante amortizará o principal ao final do período de 5 anos. Esse fundo rende à taxa de juros compostos de 5% ao ano, e os depósitos são efetuados concomitantemente aos pagamentos dos juros anuais do capital emprestado. Desse modo, tanto o pagamento dos juros quanto os depósitos do fundo de reserva são postecipados.

Diante do exposto, é possível concluir que a taxa anual de juros efetivamente paga pelo devedor (i) está no intervalo:

Utilize os dados aproximados a seguir.

(1,05)5 =1,28

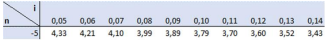

Resultados de (1 – (1 + i)-n) / i

i. entrada de R$ 10.000,00;

ii. 3 parcelas anuais antecipadas de R$ 5.000,00, com pagamento da primeira concomitantemente com a entrada, à taxa de juros compostos de 3% ao mês;

iii. o restante financiado em 36 prestações mensais, à taxa de juros compostos de 3% ao mês.

Se o tomador do empréstimo optar pela opção alternativa, o valor aproximado do montante a ser financiado mensalmente, em reais, é de:

Utilize a aproximação: (1,03)-12=0,7

i. juros compostos de 5% ao mês;

ii. taxa de abertura de crédito de 5% sobre o valor financiado, sendo o pagamento no ato;

iii. amortizações mensais constantes;

iv. prazo total de 2 meses.

A taxa positiva que representa o custo efetivo total mensal desse empréstimo é, aproximadamente, de: Utilize a aproximação: (2,2975)0,5=1,52