Questões de Concurso

Comentadas para consulpam

Foram encontradas 3.450 questões

Resolva questões gratuitamente!

Junte-se a mais de 4 milhões de concurseiros!

Two US banks collapse

Last week, Silicon Valley Bank failed, and it left customers in a tough spot as the government took ______ 1 .

The so-called bank run happened because there ______ 2 news that the bank couldn’t meet its deposit obligations. It means that it had invested the money in various things that weren’t making the money back. Typically, that’s the point where the Federal Deposit Insurance Corporation, ______ 3 insures deposits ______ 4 250,000 dollars, comes in. However, 98% of Silicon Valley Bank customers didn’t have 250,000 dollars but billions of dollars. The government announced that it would step in and secure the depositors, with US president Joe Biden ______ 5 that the US banking system was safe.

Shortly after the fall of Silicon Valley Bank, regulators closed New York-based Signature Bank, too, citing systemic risk. Experts said that these stories would continue repeating themselves because many corporations were overleveraged in dollar debt.

After the collapse, European banks lost 100 billion dollars in value in a week, and despite tough regulations that should make a similar banking failure in Europe unlikely, the contagion is accelerating.

Source: https://www.newsinlevels.com/products/two-usbanks-collapse-level-3/

Two US banks collapse

Last week, Silicon Valley Bank failed, and it left customers in a tough spot as the government took ______ 1 .

The so-called bank run happened because there ______ 2 news that the bank couldn’t meet its deposit obligations. It means that it had invested the money in various things that weren’t making the money back. Typically, that’s the point where the Federal Deposit Insurance Corporation, ______ 3 insures deposits ______ 4 250,000 dollars, comes in. However, 98% of Silicon Valley Bank customers didn’t have 250,000 dollars but billions of dollars. The government announced that it would step in and secure the depositors, with US president Joe Biden ______ 5 that the US banking system was safe.

Shortly after the fall of Silicon Valley Bank, regulators closed New York-based Signature Bank, too, citing systemic risk. Experts said that these stories would continue repeating themselves because many corporations were overleveraged in dollar debt.

After the collapse, European banks lost 100 billion dollars in value in a week, and despite tough regulations that should make a similar banking failure in Europe unlikely, the contagion is accelerating.

Source: https://www.newsinlevels.com/products/two-usbanks-collapse-level-3/

Two US banks collapse

Last week, Silicon Valley Bank failed, and it left customers in a tough spot as the government took ______ 1 .

The so-called bank run happened because there ______ 2 news that the bank couldn’t meet its deposit obligations. It means that it had invested the money in various things that weren’t making the money back. Typically, that’s the point where the Federal Deposit Insurance Corporation, ______ 3 insures deposits ______ 4 250,000 dollars, comes in. However, 98% of Silicon Valley Bank customers didn’t have 250,000 dollars but billions of dollars. The government announced that it would step in and secure the depositors, with US president Joe Biden ______ 5 that the US banking system was safe.

Shortly after the fall of Silicon Valley Bank, regulators closed New York-based Signature Bank, too, citing systemic risk. Experts said that these stories would continue repeating themselves because many corporations were overleveraged in dollar debt.

After the collapse, European banks lost 100 billion dollars in value in a week, and despite tough regulations that should make a similar banking failure in Europe unlikely, the contagion is accelerating.

Source: https://www.newsinlevels.com/products/two-usbanks-collapse-level-3/

Two US banks collapse

Last week, Silicon Valley Bank failed, and it left customers in a tough spot as the government took ______ 1 .

The so-called bank run happened because there ______ 2 news that the bank couldn’t meet its deposit obligations. It means that it had invested the money in various things that weren’t making the money back. Typically, that’s the point where the Federal Deposit Insurance Corporation, ______ 3 insures deposits ______ 4 250,000 dollars, comes in. However, 98% of Silicon Valley Bank customers didn’t have 250,000 dollars but billions of dollars. The government announced that it would step in and secure the depositors, with US president Joe Biden ______ 5 that the US banking system was safe.

Shortly after the fall of Silicon Valley Bank, regulators closed New York-based Signature Bank, too, citing systemic risk. Experts said that these stories would continue repeating themselves because many corporations were overleveraged in dollar debt.

After the collapse, European banks lost 100 billion dollars in value in a week, and despite tough regulations that should make a similar banking failure in Europe unlikely, the contagion is accelerating.

Source: https://www.newsinlevels.com/products/two-usbanks-collapse-level-3/

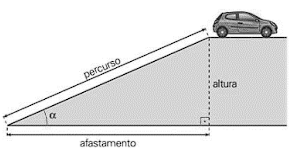

Sabendo que a = 60º e a altura da rampa igual a 2,5 metros, então o comprimento da rampa é:

(Disponível em: https://pt-br.facebook.com/linguaportuguesa07/posts/mais-tirinhas-wwwlinguaportuguesablogbrtirinhas-relacionadas-as-letras/2736670563013564/)

É possível inferir, com base na leitura realizada, que o papel do professor é:

Assinale a alternativa que classifica CORRETAMENTE os termos destacados no fragmento acima.