Questões de Concurso

Comentadas para petrobras

Foram encontradas 6.798 questões

Resolva questões gratuitamente!

Junte-se a mais de 4 milhões de concurseiros!

A respeito de sistemas de alimentação ou energização elétrica, julgue o item a seguir.

Em um sistema de alimentação elétrica de emergência com o

uso de nobreaks, a bateria nada mais é que um conversor do

tipo CC-CC que alimenta o inversor de saída do

equipamento.

A respeito de sistemas de alimentação ou energização elétrica, julgue o item a seguir.

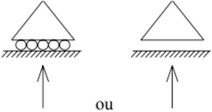

Para retificadores monofásicos com diodos, a tensão média

na saída de um retificador de onda completa é maior que a

tensão média na saída de um retificador de meia onda.

Um amperímetro no modo CA (corrente alternada) é comumente usado para indicar, em hertz, a frequência da rede elétrica.

Acerca de variáveis elétricas básicas comumente monitoradas em circuitos elétricos e eletrônicos, julgue o item que se segue.

Para que a medição de resistência possa ser realizada, é

necessário que o ohmímetro excite eletricamente o resistor.

O valor eficaz de uma tensão alternada é fornecido pelo voltímetro, se adequadamente configurado, e corresponderá a um valor constante caso a amplitude e a forma de onda permaneçam inalteradas ao longo do tempo.

No que se refere a equipamentos de proteção individual e coletiva com ênfase em eletricidade, julgue o próximo item.

Na segurança de instalações elétricas, o uso adequado de

equipamentos de proteção individual elimina completamente

a necessidade de equipamentos de proteção coletiva.

Para proteção contra arco elétrico, uniformes de algodão são recomendados devido à sua resistência térmica, sendo considerados adequados para ambientes de trabalho com riscos elétricos.

Acerca de segurança e higiene do trabalho, julgue o próximo item.

Para mitigar o ruído no ambiente de trabalho, as estratégias

devem-se concentrar, exclusivamente, no fornecimento e na

utilização, pelos funcionários, de protetores auditivos,

considerados a solução definitiva para o controle de ruído.

A ergonomia no local de trabalho, ao implementar ajustes nos postos de trabalho e no mobiliário de escritório, objetiva, exclusivamente, minimizar lesões musculoesqueléticas dos funcionários.

A respeito de sistema trifásico, julgue o item a seguir.

Em um sistema trifásico equilibrado, com cargas resistivas e

capacitivas, a corrente de neutro do circuito é cerca de um

décimo da corrente de fase.

Julgue o próximo item, referentes a organização do trabalho e normas técnicas.

No âmbito da organização do trabalho, o taylorismo e o

fordismo possuem em comum o foco na alta especialização

do trabalho no processo produtivo.

Julgue o próximo item, referentes a organização do trabalho e normas técnicas.

Caso uma caldeira não possua prontuário, somente seu

fabricante poderá assumir a responsabilidade técnica pela sua

reconstituição.

As empresas poderão ter setor próprio para a inspeção de caldeiras somente se este for certificado por organismo de certificação acreditado pelo INMETRO.

Com relação a conceitos relativos à manutenção de caldeiras, julgue o item a seguir.

A importância da manutenção de uma caldeira não se dá

somente por motivo de segurança das operações, mas

também para prevenção de perdas de eficiência.

Com relação a conceitos relativos à manutenção de caldeiras, julgue o item a seguir.

Fazem parte das etapas de manutenção de uma caldeira a

análise de espessura de paredes por ultrassom e o ensaio de

líquidos penetrantes.

Com relação a conceitos relativos à manutenção de caldeiras, julgue o item a seguir.

É dispensado o registro da manutenção de queimadores no

prontuário de caldeiras elétricas.

Com relação a conceitos relativos à manutenção de caldeiras, julgue o item a seguir.

A manutenção preditiva é um programa baseado na

durabilidade de materiais e equipamentos, com

um cronograma de substituições e paradas.

Considera-se profissional legalmente habilitado (PLH) aquele que tem competência técnica nas atividades referentes à manutenção e à inspeção de caldeiras, independentemente da sua formação.

No que se refere a ensaios de materiais, julgue o próximo item.

A maioria dos materiais metálicos, quando submetidos a

uma tensão de tração elevada, apresenta uma

proporcionalidade entre a tensão aplicada e a deformação

observada, conforme a relação  , em que E é o módulo de Hooke e fornece uma indicação da rigidez do

material.

, em que E é o módulo de Hooke e fornece uma indicação da rigidez do

material.