Questões de Concurso

Comentadas para cvm

Foram encontradas 1.101 questões

Resolva questões gratuitamente!

Junte-se a mais de 4 milhões de concurseiros!

The hard cell

Thanks to politics, stem cell research in the United States is suffering. But not so in Sweden, which is poised to capture what could be the biggest new market to hit biotech in a decade.

By Stephan Herrera

February 13, 2003

New York, January 1, 2006:

Sweden announces that one of its biotechnology companies is the first in the world to enter clinical trials with a new drug that could cure Alzheimer's disease. Four years ago this type of research was all but stopped in the United States by political and ethical questions − which is ...61... Sweden now seems in the best position to capture a $25 billion market.

Any day now, the U.S. Congress is expected to pass a sweeping new law that could dramatically inhibit researchers from working with stem cells taken from human embryos. Such cells, which can be used to grow a whole host of new cells and organs, could fundamentally change the way we treat heretofore intractable maladies like Alzheimer's disease, Parkinson's disease, cancer, stroke, liver failure, and heart disease. The only problem is that these cells by definition are derived from human embryos, many of which are cloned or come from unused fetuses collected at fertility clinics. The argument, from a certain segment of the American political spectrum, is that ...62... methods are morally wrong. They are ...63... a form of abortion or an activity that could eventually lead to human cloning.

Those working in stem cell research say the short-term effect of the legislation will be to further chill all forms of scientific inquiry and commercialization efforts in the field. Entrepreneurs and investors are already eschewing such research − in large part because of the additional uncertainty and risk that politics introduce.

Of the nearly 50 private stem cell companies in the United States, only a handful are still viable. Meanwhile, across the Atlantic, Sweden has avoided many of the political and ethical quagmires surrounding this type of research. It currently has 40 private stem cell companies, a number that's growing. Sweden's leading research universities have 32 percent of the world's stem cell inventory, close on the heels of the United States' 35 percent.

Sweden, say analysts, is now in the best position to

capture a worldwide market for drugs based on stem cell

therapies that could grow to $25 billion in the next three to five

years − nearly equal to the whole biotech industry at present.

This estimate doesn't even address the market for stem cells

capable of repairing damaged vital organs like the brain, heart,

and kidneys. If the United States offers an object lesson of what

can happen when scientific inquiry and investment capital fall victim to politics, Sweden and its leading stem cell startup,

NeuroNova, offer the opposite example. How odd that the

United States, which for generations has been the envy of the

world for its progressive views of science and commercialization,

should now have a biomedical climate chillier than a Swedish

winter.

One company feeling a lot of pain is StemCells, which at first glance seems to have it all: founding scientists include Stanford's Dr. Weissman and Fred Gage of the Salk Institute in La Jolla, California. An equally well-regarded expert in the treatment of Alzheimer's, Dr. Gage spent five years in Sweden as a researcher and now sits on a national committee on stem cell research there. The firm's chairman is Roger Perlmutter, Amgen's head of research.

Yet over the past two years, none of management's efforts to help investors and even critics reconsider the stem cell field have worked. At press time, the stock was thinly traded and sitting in the neighborhood of 50 cents. With less than $15 million in cash, the company likely won't exist at this time next year. (CEO Martin McGlynn, who joined the firm in January 2001, would not talk to Red Herring, despite repeated efforts.)

Some observers on Wall Street are asking, If StemCells can't make it, who can? Geron, the only other publicly held stem cell firm to speak of, is in a fix, too. The company's stock price is also moribund, at $3.85 per share. Thanks to some capital infusions a few years ago, when money came easy, Geron still has $40 million on hand, but by the end of next year, that too will likely be gone. Once a media darling, Geron focuses on diagnostic tests and drugs derived from stem cells, a strategy that's not going well. For the nine months ended last September, revenue fell 68 percent to $955,000 and net loss widened 18 percent to $26.7 million. The company's financials were also hit hard after it terminated an agreement with Pharmacia and acquired research technology from Lynx Therapeutics, which Geron bought in a desperate attempt to be seen as something more than just a stem cell company.

The situation is quite different, however, for Sweden's NeuroNova, which has 30 academic partners and a staff of 20. NeuroNova is working on ways to inject stem cells into the human brain to trigger a process called neurogenesis (the growth of new neural cells), which could combat diseases like Parkinson's, Alzheimer's, and even schizophrenia.

If NeuroNova is the first to develop a drug capable of

treating one of several central nervous system disorders − by far

the most lucrative after heart disease products − it will have

done so not because it raised more money or got more media

buzz than the rest. It will have succeeded because the science

is solid, and academe, government, and the investment

community are supportive. Meanwhile, the United States will

look on with envy and wonder how it, a country known for its

entrepreneurial innovation, ever got so short-sighted.

(Adapted from

http://www.redherring.com/investor/2003/02/biotech021303.html)

The hard cell

Thanks to politics, stem cell research in the United States is suffering. But not so in Sweden, which is poised to capture what could be the biggest new market to hit biotech in a decade.

By Stephan Herrera

February 13, 2003

New York, January 1, 2006:

Sweden announces that one of its biotechnology companies is the first in the world to enter clinical trials with a new drug that could cure Alzheimer's disease. Four years ago this type of research was all but stopped in the United States by political and ethical questions − which is ...61... Sweden now seems in the best position to capture a $25 billion market.

Any day now, the U.S. Congress is expected to pass a sweeping new law that could dramatically inhibit researchers from working with stem cells taken from human embryos. Such cells, which can be used to grow a whole host of new cells and organs, could fundamentally change the way we treat heretofore intractable maladies like Alzheimer's disease, Parkinson's disease, cancer, stroke, liver failure, and heart disease. The only problem is that these cells by definition are derived from human embryos, many of which are cloned or come from unused fetuses collected at fertility clinics. The argument, from a certain segment of the American political spectrum, is that ...62... methods are morally wrong. They are ...63... a form of abortion or an activity that could eventually lead to human cloning.

Those working in stem cell research say the short-term effect of the legislation will be to further chill all forms of scientific inquiry and commercialization efforts in the field. Entrepreneurs and investors are already eschewing such research − in large part because of the additional uncertainty and risk that politics introduce.

Of the nearly 50 private stem cell companies in the United States, only a handful are still viable. Meanwhile, across the Atlantic, Sweden has avoided many of the political and ethical quagmires surrounding this type of research. It currently has 40 private stem cell companies, a number that's growing. Sweden's leading research universities have 32 percent of the world's stem cell inventory, close on the heels of the United States' 35 percent.

Sweden, say analysts, is now in the best position to

capture a worldwide market for drugs based on stem cell

therapies that could grow to $25 billion in the next three to five

years − nearly equal to the whole biotech industry at present.

This estimate doesn't even address the market for stem cells

capable of repairing damaged vital organs like the brain, heart,

and kidneys. If the United States offers an object lesson of what

can happen when scientific inquiry and investment capital fall victim to politics, Sweden and its leading stem cell startup,

NeuroNova, offer the opposite example. How odd that the

United States, which for generations has been the envy of the

world for its progressive views of science and commercialization,

should now have a biomedical climate chillier than a Swedish

winter.

One company feeling a lot of pain is StemCells, which at first glance seems to have it all: founding scientists include Stanford's Dr. Weissman and Fred Gage of the Salk Institute in La Jolla, California. An equally well-regarded expert in the treatment of Alzheimer's, Dr. Gage spent five years in Sweden as a researcher and now sits on a national committee on stem cell research there. The firm's chairman is Roger Perlmutter, Amgen's head of research.

Yet over the past two years, none of management's efforts to help investors and even critics reconsider the stem cell field have worked. At press time, the stock was thinly traded and sitting in the neighborhood of 50 cents. With less than $15 million in cash, the company likely won't exist at this time next year. (CEO Martin McGlynn, who joined the firm in January 2001, would not talk to Red Herring, despite repeated efforts.)

Some observers on Wall Street are asking, If StemCells can't make it, who can? Geron, the only other publicly held stem cell firm to speak of, is in a fix, too. The company's stock price is also moribund, at $3.85 per share. Thanks to some capital infusions a few years ago, when money came easy, Geron still has $40 million on hand, but by the end of next year, that too will likely be gone. Once a media darling, Geron focuses on diagnostic tests and drugs derived from stem cells, a strategy that's not going well. For the nine months ended last September, revenue fell 68 percent to $955,000 and net loss widened 18 percent to $26.7 million. The company's financials were also hit hard after it terminated an agreement with Pharmacia and acquired research technology from Lynx Therapeutics, which Geron bought in a desperate attempt to be seen as something more than just a stem cell company.

The situation is quite different, however, for Sweden's NeuroNova, which has 30 academic partners and a staff of 20. NeuroNova is working on ways to inject stem cells into the human brain to trigger a process called neurogenesis (the growth of new neural cells), which could combat diseases like Parkinson's, Alzheimer's, and even schizophrenia.

If NeuroNova is the first to develop a drug capable of

treating one of several central nervous system disorders − by far

the most lucrative after heart disease products − it will have

done so not because it raised more money or got more media

buzz than the rest. It will have succeeded because the science

is solid, and academe, government, and the investment

community are supportive. Meanwhile, the United States will

look on with envy and wonder how it, a country known for its

entrepreneurial innovation, ever got so short-sighted.

(Adapted from

http://www.redherring.com/investor/2003/02/biotech021303.html)

The hard cell

Thanks to politics, stem cell research in the United States is suffering. But not so in Sweden, which is poised to capture what could be the biggest new market to hit biotech in a decade.

By Stephan Herrera

February 13, 2003

New York, January 1, 2006:

Sweden announces that one of its biotechnology companies is the first in the world to enter clinical trials with a new drug that could cure Alzheimer's disease. Four years ago this type of research was all but stopped in the United States by political and ethical questions − which is ...61... Sweden now seems in the best position to capture a $25 billion market.

Any day now, the U.S. Congress is expected to pass a sweeping new law that could dramatically inhibit researchers from working with stem cells taken from human embryos. Such cells, which can be used to grow a whole host of new cells and organs, could fundamentally change the way we treat heretofore intractable maladies like Alzheimer's disease, Parkinson's disease, cancer, stroke, liver failure, and heart disease. The only problem is that these cells by definition are derived from human embryos, many of which are cloned or come from unused fetuses collected at fertility clinics. The argument, from a certain segment of the American political spectrum, is that ...62... methods are morally wrong. They are ...63... a form of abortion or an activity that could eventually lead to human cloning.

Those working in stem cell research say the short-term effect of the legislation will be to further chill all forms of scientific inquiry and commercialization efforts in the field. Entrepreneurs and investors are already eschewing such research − in large part because of the additional uncertainty and risk that politics introduce.

Of the nearly 50 private stem cell companies in the United States, only a handful are still viable. Meanwhile, across the Atlantic, Sweden has avoided many of the political and ethical quagmires surrounding this type of research. It currently has 40 private stem cell companies, a number that's growing. Sweden's leading research universities have 32 percent of the world's stem cell inventory, close on the heels of the United States' 35 percent.

Sweden, say analysts, is now in the best position to

capture a worldwide market for drugs based on stem cell

therapies that could grow to $25 billion in the next three to five

years − nearly equal to the whole biotech industry at present.

This estimate doesn't even address the market for stem cells

capable of repairing damaged vital organs like the brain, heart,

and kidneys. If the United States offers an object lesson of what

can happen when scientific inquiry and investment capital fall victim to politics, Sweden and its leading stem cell startup,

NeuroNova, offer the opposite example. How odd that the

United States, which for generations has been the envy of the

world for its progressive views of science and commercialization,

should now have a biomedical climate chillier than a Swedish

winter.

One company feeling a lot of pain is StemCells, which at first glance seems to have it all: founding scientists include Stanford's Dr. Weissman and Fred Gage of the Salk Institute in La Jolla, California. An equally well-regarded expert in the treatment of Alzheimer's, Dr. Gage spent five years in Sweden as a researcher and now sits on a national committee on stem cell research there. The firm's chairman is Roger Perlmutter, Amgen's head of research.

Yet over the past two years, none of management's efforts to help investors and even critics reconsider the stem cell field have worked. At press time, the stock was thinly traded and sitting in the neighborhood of 50 cents. With less than $15 million in cash, the company likely won't exist at this time next year. (CEO Martin McGlynn, who joined the firm in January 2001, would not talk to Red Herring, despite repeated efforts.)

Some observers on Wall Street are asking, If StemCells can't make it, who can? Geron, the only other publicly held stem cell firm to speak of, is in a fix, too. The company's stock price is also moribund, at $3.85 per share. Thanks to some capital infusions a few years ago, when money came easy, Geron still has $40 million on hand, but by the end of next year, that too will likely be gone. Once a media darling, Geron focuses on diagnostic tests and drugs derived from stem cells, a strategy that's not going well. For the nine months ended last September, revenue fell 68 percent to $955,000 and net loss widened 18 percent to $26.7 million. The company's financials were also hit hard after it terminated an agreement with Pharmacia and acquired research technology from Lynx Therapeutics, which Geron bought in a desperate attempt to be seen as something more than just a stem cell company.

The situation is quite different, however, for Sweden's NeuroNova, which has 30 academic partners and a staff of 20. NeuroNova is working on ways to inject stem cells into the human brain to trigger a process called neurogenesis (the growth of new neural cells), which could combat diseases like Parkinson's, Alzheimer's, and even schizophrenia.

If NeuroNova is the first to develop a drug capable of

treating one of several central nervous system disorders − by far

the most lucrative after heart disease products − it will have

done so not because it raised more money or got more media

buzz than the rest. It will have succeeded because the science

is solid, and academe, government, and the investment

community are supportive. Meanwhile, the United States will

look on with envy and wonder how it, a country known for its

entrepreneurial innovation, ever got so short-sighted.

(Adapted from

http://www.redherring.com/investor/2003/02/biotech021303.html)

The hard cell

Thanks to politics, stem cell research in the United States is suffering. But not so in Sweden, which is poised to capture what could be the biggest new market to hit biotech in a decade.

By Stephan Herrera

February 13, 2003

New York, January 1, 2006:

Sweden announces that one of its biotechnology companies is the first in the world to enter clinical trials with a new drug that could cure Alzheimer's disease. Four years ago this type of research was all but stopped in the United States by political and ethical questions − which is ...61... Sweden now seems in the best position to capture a $25 billion market.

Any day now, the U.S. Congress is expected to pass a sweeping new law that could dramatically inhibit researchers from working with stem cells taken from human embryos. Such cells, which can be used to grow a whole host of new cells and organs, could fundamentally change the way we treat heretofore intractable maladies like Alzheimer's disease, Parkinson's disease, cancer, stroke, liver failure, and heart disease. The only problem is that these cells by definition are derived from human embryos, many of which are cloned or come from unused fetuses collected at fertility clinics. The argument, from a certain segment of the American political spectrum, is that ...62... methods are morally wrong. They are ...63... a form of abortion or an activity that could eventually lead to human cloning.

Those working in stem cell research say the short-term effect of the legislation will be to further chill all forms of scientific inquiry and commercialization efforts in the field. Entrepreneurs and investors are already eschewing such research − in large part because of the additional uncertainty and risk that politics introduce.

Of the nearly 50 private stem cell companies in the United States, only a handful are still viable. Meanwhile, across the Atlantic, Sweden has avoided many of the political and ethical quagmires surrounding this type of research. It currently has 40 private stem cell companies, a number that's growing. Sweden's leading research universities have 32 percent of the world's stem cell inventory, close on the heels of the United States' 35 percent.

Sweden, say analysts, is now in the best position to

capture a worldwide market for drugs based on stem cell

therapies that could grow to $25 billion in the next three to five

years − nearly equal to the whole biotech industry at present.

This estimate doesn't even address the market for stem cells

capable of repairing damaged vital organs like the brain, heart,

and kidneys. If the United States offers an object lesson of what

can happen when scientific inquiry and investment capital fall victim to politics, Sweden and its leading stem cell startup,

NeuroNova, offer the opposite example. How odd that the

United States, which for generations has been the envy of the

world for its progressive views of science and commercialization,

should now have a biomedical climate chillier than a Swedish

winter.

One company feeling a lot of pain is StemCells, which at first glance seems to have it all: founding scientists include Stanford's Dr. Weissman and Fred Gage of the Salk Institute in La Jolla, California. An equally well-regarded expert in the treatment of Alzheimer's, Dr. Gage spent five years in Sweden as a researcher and now sits on a national committee on stem cell research there. The firm's chairman is Roger Perlmutter, Amgen's head of research.

Yet over the past two years, none of management's efforts to help investors and even critics reconsider the stem cell field have worked. At press time, the stock was thinly traded and sitting in the neighborhood of 50 cents. With less than $15 million in cash, the company likely won't exist at this time next year. (CEO Martin McGlynn, who joined the firm in January 2001, would not talk to Red Herring, despite repeated efforts.)

Some observers on Wall Street are asking, If StemCells can't make it, who can? Geron, the only other publicly held stem cell firm to speak of, is in a fix, too. The company's stock price is also moribund, at $3.85 per share. Thanks to some capital infusions a few years ago, when money came easy, Geron still has $40 million on hand, but by the end of next year, that too will likely be gone. Once a media darling, Geron focuses on diagnostic tests and drugs derived from stem cells, a strategy that's not going well. For the nine months ended last September, revenue fell 68 percent to $955,000 and net loss widened 18 percent to $26.7 million. The company's financials were also hit hard after it terminated an agreement with Pharmacia and acquired research technology from Lynx Therapeutics, which Geron bought in a desperate attempt to be seen as something more than just a stem cell company.

The situation is quite different, however, for Sweden's NeuroNova, which has 30 academic partners and a staff of 20. NeuroNova is working on ways to inject stem cells into the human brain to trigger a process called neurogenesis (the growth of new neural cells), which could combat diseases like Parkinson's, Alzheimer's, and even schizophrenia.

If NeuroNova is the first to develop a drug capable of

treating one of several central nervous system disorders − by far

the most lucrative after heart disease products − it will have

done so not because it raised more money or got more media

buzz than the rest. It will have succeeded because the science

is solid, and academe, government, and the investment

community are supportive. Meanwhile, the United States will

look on with envy and wonder how it, a country known for its

entrepreneurial innovation, ever got so short-sighted.

(Adapted from

http://www.redherring.com/investor/2003/02/biotech021303.html)

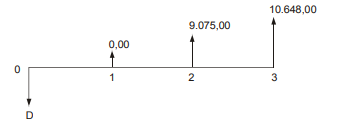

Sabendo-se que a taxa interna de retorno (TIR) é de 10% ao ano, o valor do desembolso inicial (D) é de

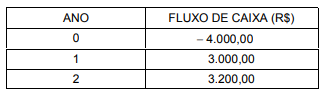

Se a taxa mínima de atratividade for de 25% ao ano (capitalização anual), o valor presente líquido deste investimento no ano 0 será de

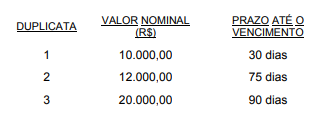

O valor líquido recebido pela empresa foi de

I. É uma comunhão de recursos, captados por meio do sistema de distribuição de valores mobiliários e destinados à aplicação em empreendimentos imobiliários.

II. É constituído sob a forma de condomínio aberto, com cotas resgatáveis. III. Parte de seu patrimônio pode ser alocado em títulos de renda fixa, dentro do limite regulamentar.

IV. Permite auferir ganhos mediante locação das unidades do empreendimento adquirido pelo Fundo.

Estão corretas APENAS as afirmativas

I. Nenhuma emissão pública de valores mobiliários será distribuída no mercado sem prévio registro na Comissão de Valores Mobiliários.

II. Cabe à Comissão de Valores Mobiliários autorizar os agentes autônomos de investimento.

III. Somente as empresas de auditoria contábil ou auditores contábeis independentes registrados na Comissão de Valores Mobiliários podem auditar, para os efeitos da Lei nº 6.385, de 7 de dezembro de 1976, as demonstrações financeiras de companhias abertas e das instituições, sociedades ou empresas que integram o sistema de distribuição e intermediação de valores mobiliários.

Destas afirmações, pode-se considerar que