Questões de Concurso

Comentadas para professor - inglês

Foram encontradas 12.090 questões

Resolva questões gratuitamente!

Junte-se a mais de 4 milhões de concurseiros!

Choose the best option to fill in the blanks CORRECTLY and RESPECTIVELY

I. ‘________ abroad was surely the best experience I’ve ever had

II. ‘________ abroad for one year, and you’ll completely change your mind about your own country.’

III. ‘________ abroad, you need to be resilient.’

Choose the best option to fill in the blanks CORRECTLY and RESPECTIVELY

I. ‘She’d left when you got there, ________ she?’

II. ‘She’d love this dress, ______ she?’

III. ‘She’s worked a lot this week, ______ she?’

Two US banks collapse

Last week, Silicon Valley Bank failed, and it left customers in a tough spot as the government took ______ 1 .

The so-called bank run happened because there ______ 2 news that the bank couldn’t meet its deposit obligations. It means that it had invested the money in various things that weren’t making the money back. Typically, that’s the point where the Federal Deposit Insurance Corporation, ______ 3 insures deposits ______ 4 250,000 dollars, comes in. However, 98% of Silicon Valley Bank customers didn’t have 250,000 dollars but billions of dollars. The government announced that it would step in and secure the depositors, with US president Joe Biden ______ 5 that the US banking system was safe.

Shortly after the fall of Silicon Valley Bank, regulators closed New York-based Signature Bank, too, citing systemic risk. Experts said that these stories would continue repeating themselves because many corporations were overleveraged in dollar debt.

After the collapse, European banks lost 100 billion dollars in value in a week, and despite tough regulations that should make a similar banking failure in Europe unlikely, the contagion is accelerating.

Source: https://www.newsinlevels.com/products/two-usbanks-collapse-level-3/

Two US banks collapse

Last week, Silicon Valley Bank failed, and it left customers in a tough spot as the government took ______ 1 .

The so-called bank run happened because there ______ 2 news that the bank couldn’t meet its deposit obligations. It means that it had invested the money in various things that weren’t making the money back. Typically, that’s the point where the Federal Deposit Insurance Corporation, ______ 3 insures deposits ______ 4 250,000 dollars, comes in. However, 98% of Silicon Valley Bank customers didn’t have 250,000 dollars but billions of dollars. The government announced that it would step in and secure the depositors, with US president Joe Biden ______ 5 that the US banking system was safe.

Shortly after the fall of Silicon Valley Bank, regulators closed New York-based Signature Bank, too, citing systemic risk. Experts said that these stories would continue repeating themselves because many corporations were overleveraged in dollar debt.

After the collapse, European banks lost 100 billion dollars in value in a week, and despite tough regulations that should make a similar banking failure in Europe unlikely, the contagion is accelerating.

Source: https://www.newsinlevels.com/products/two-usbanks-collapse-level-3/

Two US banks collapse

Last week, Silicon Valley Bank failed, and it left customers in a tough spot as the government took ______ 1 .

The so-called bank run happened because there ______ 2 news that the bank couldn’t meet its deposit obligations. It means that it had invested the money in various things that weren’t making the money back. Typically, that’s the point where the Federal Deposit Insurance Corporation, ______ 3 insures deposits ______ 4 250,000 dollars, comes in. However, 98% of Silicon Valley Bank customers didn’t have 250,000 dollars but billions of dollars. The government announced that it would step in and secure the depositors, with US president Joe Biden ______ 5 that the US banking system was safe.

Shortly after the fall of Silicon Valley Bank, regulators closed New York-based Signature Bank, too, citing systemic risk. Experts said that these stories would continue repeating themselves because many corporations were overleveraged in dollar debt.

After the collapse, European banks lost 100 billion dollars in value in a week, and despite tough regulations that should make a similar banking failure in Europe unlikely, the contagion is accelerating.

Source: https://www.newsinlevels.com/products/two-usbanks-collapse-level-3/

Two US banks collapse

Last week, Silicon Valley Bank failed, and it left customers in a tough spot as the government took ______ 1 .

The so-called bank run happened because there ______ 2 news that the bank couldn’t meet its deposit obligations. It means that it had invested the money in various things that weren’t making the money back. Typically, that’s the point where the Federal Deposit Insurance Corporation, ______ 3 insures deposits ______ 4 250,000 dollars, comes in. However, 98% of Silicon Valley Bank customers didn’t have 250,000 dollars but billions of dollars. The government announced that it would step in and secure the depositors, with US president Joe Biden ______ 5 that the US banking system was safe.

Shortly after the fall of Silicon Valley Bank, regulators closed New York-based Signature Bank, too, citing systemic risk. Experts said that these stories would continue repeating themselves because many corporations were overleveraged in dollar debt.

After the collapse, European banks lost 100 billion dollars in value in a week, and despite tough regulations that should make a similar banking failure in Europe unlikely, the contagion is accelerating.

Source: https://www.newsinlevels.com/products/two-usbanks-collapse-level-3/

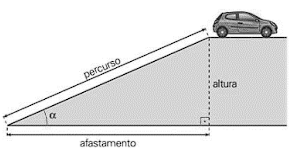

Sabendo que a = 60º e a altura da rampa igual a 2,5 metros, então o comprimento da rampa é:

possui como solução dois números

inteiros. A soma desses dois números inteiros é

possui como solução dois números

inteiros. A soma desses dois números inteiros é

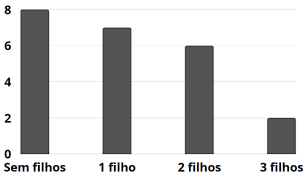

Um prêmio foi sorteado entre todos os filhos dessas funcionárias. A probabilidade de que a criança premiada tenha sido um filho único é de