Questões de Concurso

Comentadas para analista de pesquisa energética - petróleo - exploração

Foram encontradas 68 questões

Resolva questões gratuitamente!

Junte-se a mais de 4 milhões de concurseiros!

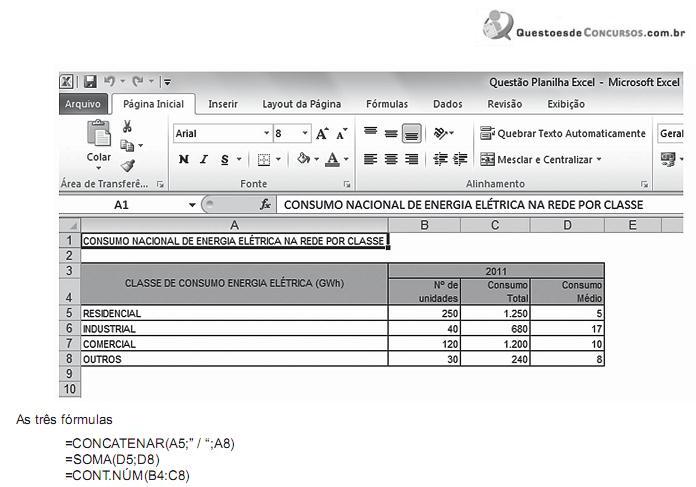

fornecem como resultado, respectivamente,

=SE((SE(G7>5;10;20))>G8;G9;G10)

Considerando que os conteúdos das células G7, G8, G9 e G10 são, respectivamente, 6, 17,15 e 11, qual é o valor apresentado pela célula H7?

Sendo assim, sobre os mecanismos de geração ou migração de hidrocarbonetos em bacias sedimentares, está em DESACORDO o seguinte aspecto:

A partir de óleos naftênicos, é possível a obtenção de

Associe corretamente os diferentes tipos de limites de placa aos respectivos processos e feições geológicas.

I - Limite Convergente

II - Limite Transformante

III - Limite Divergente

P - É marcado por amplas áreas cratônicas, que apresentam uma grande estabilidade sísmica e tectônica.

Q - Associa-se a atividade vulcânica e terremotos nas cristas dos dorsais meso-oceânicas

R - As placas deslizam uma em relação à outra, a litosfera não é criada nem destruída, sendo reconhecido por formas lineares de relevo e atividades de terremoto.

S - Associa-se a fossas de mar profundo, cinturões de montanha, vulcões e terremotos.

As associações corretas são:

Sendo assim, na classificação quanto aos movimentos citados, verifica-se que a(s) falha(s)

A maior parte das reservas conhecidas encontra-se em

I - Informações litológicas são obtidas com frequência a partir dos perfis de raios gama, uma vez que estes permitem inferir a argilosidade de rochas sedimentares através da medida de sua radioatividade natural.

II - Os perfis de Dipmeter são ferramentas importantes na análise estrutural, pois registram a orientação espacial de superfícies internas nos poços.

III - As variações no diâmetro do poço são frequentemente determinadas através dos perfis sônicos, pois estes medem a resistência ao fluxo de uma corrente elétrica, permitindo, assim, inferir intervalos onde as paredes do poço se encontram com diâmetros mais largos ou estreitos em relação ao diâmetro padrão do poço.

IV - Perfis de densidade são úteis na identigicação de camadas de evaporitos e carbonatos compactos.

É correto o que se afirma em

Estão nesse caso as seguintes rochas:

I - O intervalo anóxico do Frasniano da Bacia do Amazonas, associado à Formação Barreirinhas, constitui-se no principal intervalo gerador dessa bacia.

II - A Formação Irati, do Permiano da Bacia do Paraná, apresenta um excelente potencial gerador para gás.

III - Na seção siluriana da Bacia do Parnaíba são registrados horizontes potencialmente geradores de hidrocarbonetos no Grupo Serra Grande.

IV - A Formação Ponta Grossa (Devoniano da Bacia do Paraná) apresenta condições potencialmente favoráveis à geração de gás na bacia.

V - As principais ocorrências de hidrocarbonetos na seção pós-sal da Bacia de Campos associam-se a geradores posicionados na seção pré-sal.

Está correto APENAS o que se afirma em

Associe os tipos de perfis mais utilizados na perfilagem de poços indicados na 1º coluna com a respectiva propriedade da rocha, na 2º coluna

I – Dipmeter

II – Raios gama

III – Sônico

IV – Neutrônicos

P - Porosidade, velocidade, constantes elásticas

Q - Porosidade/presença de HC leves nas rochas

R - Mergulho e direção das camadas.

S - Litologia

T - Resistividade de grandes volumes de rocha

As associações corretas são

I - Os ciclos de granocrescência ascendentes são frequentes.

II - Os conglomerados heterolíticos com estratificação cruzada plano paralela representam registros significativos.

III - Os arenitos grossos com estratificações cruzadas acanaladas são abundantes em rios entrelaçados

IV - Os níveis argilosos com marcas de raízes e estruturas de exposição subaérea identificam zonas de extravasamento

V - As bioturbações podem ser preservadas.

Está correto APENAS o que se afirma em

Reducing the dependence on oil

Ildo Sauer, Gas and Energy Director, Petrobras.

Brazil's energy sector is following the worldwide

tendency towards greater diversification of primary energy

sources and the increased use of natural gas and

biofuels. There are several reasons for this change. The

most important are the environmental restrictions that

are gradually being adopted in the world's principal

energy-consuming markets and the need to reduce the

dependence on oil, set against a scenario of accelerated

depletion in oil reserves and escalating prices.

The share of gas in Brazilian primary energy

consumption has more than doubled in a short period,

increasing from 4.1% in 1999 to 8.9% in 2004, and this

share is forecast to rise to 12% by 2010.

Over the past two decades, the world gas industry

has experienced a structural and regulatory

transformation. These changes have altered the strategic

behaviour of gas firms, with an intensification of

competition, the search for diversification (especially in

the case of power generation) and the internationalisation

of industry activities. Together, these changes have

radically changed the economic environment and the level

of competition in the industry.

Brazil's gas industry is characterised by its late

development, although in recent years, internal supply

imports and demand have grown significantly - the

growth trajectory of recent years exceeds that of countries

with more mature markets, such as Spain, Argentina,

the UK and the US. And the outlook is positive for

continued growth over the next few years, particularly

when set against the investment plans already

announced in Brazil.

The country has a small transportation network

concentrated near the coast. The distribution network is

concentrated in the major consumption centres.

Domestic gas sources are largely offshore in the Campos

basin and Bolivia provides imports. Given the degree

of gas penetration in the country's primary energy

consumption, the industry is poorly developed when

compared with other countries. The industry requires

heavy investment in expanding the transport and

distribution (T&D) networks, as well as in diversifying and

increasing its supplies. Such investments are necessary

for realising the industry's enormous potential.

Another key industry highlight is the changing profile

of gas supply. A large part of the gas produced

domestically to date has been associated with oil

production. The latter diluting or even totally absorbing

the costs of exploiting the gas. In most cases, gas

production was feasible only in conjunction with oil

production activities. However, the country's latest gas

finds are non-associated. Thus, an exclusively dedicated

structure must be developed to produce this gas -

translating into a significant rise in production costs. This

is more significant when analysed against the high costs

associated with the market for exploration and production

(E&P) sector equipment. In recent years, the leasing costs

of drilling rigs and E&P equipment have been climbing in

parallel with escalating oil prices. This directly affects endconsumer

prices.

In a world of primary energy consumption

diversification, of greater environmental restrictions and

the reduced dependence on oil, Brazil has been seeking

to develop alternative energy sources - principally natural

gas and biofuels. The gas industry holds enormous

potential for Brazil, although there is still a long way to go

before it reaches maturity and major investment is

required.

p.29-31 (adapted)

"Natural gas is fast becoming the economic and environmental fuel of choice. The last 30 years have seen the global industry almost triple in size and similar growth can be expected in the next 30, as national governments and global industry look to gas to ensure the stability and diversity of their energy supplies."

This comment by Linda Cook, Executive Director of a British Gas and Power Company, reproduces a similar idea to that in the following segment from Ildo Sauer's text:

Reducing the dependence on oil

Ildo Sauer, Gas and Energy Director, Petrobras.

Brazil's energy sector is following the worldwide

tendency towards greater diversification of primary energy

sources and the increased use of natural gas and

biofuels. There are several reasons for this change. The

most important are the environmental restrictions that

are gradually being adopted in the world's principal

energy-consuming markets and the need to reduce the

dependence on oil, set against a scenario of accelerated

depletion in oil reserves and escalating prices.

The share of gas in Brazilian primary energy

consumption has more than doubled in a short period,

increasing from 4.1% in 1999 to 8.9% in 2004, and this

share is forecast to rise to 12% by 2010.

Over the past two decades, the world gas industry

has experienced a structural and regulatory

transformation. These changes have altered the strategic

behaviour of gas firms, with an intensification of

competition, the search for diversification (especially in

the case of power generation) and the internationalisation

of industry activities. Together, these changes have

radically changed the economic environment and the level

of competition in the industry.

Brazil's gas industry is characterised by its late

development, although in recent years, internal supply

imports and demand have grown significantly - the

growth trajectory of recent years exceeds that of countries

with more mature markets, such as Spain, Argentina,

the UK and the US. And the outlook is positive for

continued growth over the next few years, particularly

when set against the investment plans already

announced in Brazil.

The country has a small transportation network

concentrated near the coast. The distribution network is

concentrated in the major consumption centres.

Domestic gas sources are largely offshore in the Campos

basin and Bolivia provides imports. Given the degree

of gas penetration in the country's primary energy

consumption, the industry is poorly developed when

compared with other countries. The industry requires

heavy investment in expanding the transport and

distribution (T&D) networks, as well as in diversifying and

increasing its supplies. Such investments are necessary

for realising the industry's enormous potential.

Another key industry highlight is the changing profile

of gas supply. A large part of the gas produced

domestically to date has been associated with oil

production. The latter diluting or even totally absorbing

the costs of exploiting the gas. In most cases, gas

production was feasible only in conjunction with oil

production activities. However, the country's latest gas

finds are non-associated. Thus, an exclusively dedicated

structure must be developed to produce this gas -

translating into a significant rise in production costs. This

is more significant when analysed against the high costs

associated with the market for exploration and production

(E&P) sector equipment. In recent years, the leasing costs

of drilling rigs and E&P equipment have been climbing in

parallel with escalating oil prices. This directly affects endconsumer

prices.

In a world of primary energy consumption

diversification, of greater environmental restrictions and

the reduced dependence on oil, Brazil has been seeking

to develop alternative energy sources - principally natural

gas and biofuels. The gas industry holds enormous

potential for Brazil, although there is still a long way to go

before it reaches maturity and major investment is

required.

p.29-31 (adapted)