Questões de Concurso

Comentadas para analista legislativo - contabilidade

Foram encontradas 443 questões

Resolva questões gratuitamente!

Junte-se a mais de 4 milhões de concurseiros!

Uma dessas investidas telefônicas alcança Carlos, um colaborador recém-contratado que está com um problema legítimo em seu computador.

O cibercriminoso oferece ajuda e, agradecido por alguém do suporte técnico estar ligando para ajudá-lo, Carlos compartilha informações sensíveis, como senhas e dados de cadastro, em troca de resolver o seu problema.

Carlos foi vítima de um ataque de engenharia social denominado

A respeito da estratégia de utilizar este tipo de firewall como ponto único de controle, assinale a afirmativa correta.

(+) com (+) é igual a (+)

(–) com (–) é igual a (+)

(+) com (–) é igual a (–).

Assim, temos que:

(+) (+) (+) = (–) (+) (–) = (+) e (+) (+) (–) = (–) (–) (–) = (–).

Permutações da ordem dos sinais não alteram o resultado.

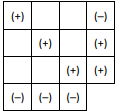

Na tabela a seguir, devemos completar os quadrados em branco de modo que:

• a operação dos três primeiros sinais da linha i tenha como resultado o sinal da última coluna dessa linha, para i = 1, 2, 3.

• a operação dos três primeiros sinais da coluna j tenha como resultado o sinal da última linha dessa coluna, para j = 1, 2, 3.

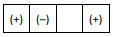

Por exemplo, se em uma linha tivermos

concluímos que o quadrado branco deve ser preenchido com (–)porque (+) com (–) com (–) dá (+).

Considere agora a tabela a seguir:

O número de soluções distintas da tabela é igual a

Diante dessa situação hipotética, à luz do disposto na Lei nº 14.133/2021, é correto afirmar que o Poder Público poderá realizar

Acerca do tema objeto da apreensão de Kristofer, à luz do disposto na Lei nº 8.112/90, é correto afirmar que

À luz da sistemática estabelecida na Constituição da República de

1988, é correto afirmar que Antony

( ) It is clear that accountants will need to do away with earlier core competencies.

( ) The impact of technology in accountancy tends to move more sluggishly than in areas like procurement.

( ) There was some fear earlier that accountants’ work would soon be taken over by automation.

The statements are, respectively,