Questões de Vestibular

Comentadas sobre interpretação de texto | reading comprehension em inglês

Foram encontradas 680 questões

TEXTO 3:

THIS SIMPLE MIND TRICK CAN INSTANTLY BOOST

YOUR WILLPOWER BY

ELISA ROLAND

A good dose of willpower is often necessary to see any task through, whether it’s sticking to a spending plan or finishing that great American novel.

And if you want to increase that willpower, you just simply have to believe you have it, suggests a new study supported by the Swiss National Science Foundation.

“What matters most is what we think about our willpower,” leader study author Christopher Napolitano, educational psychology professor at the University of Illinois told the University of Illinois News Bureau. “When we view our willpower as limited, it’s similar to a muscle that gets tired and needs rest. If we believe it is a finite resource, we act that way, feeling exhausted and needing breaks between demanding mental tasks, while people who view their willpower as a limitless resource get energized instead.”

Napolitano and study co-author Veronika Job of the University of Zurich tested the validity of the Implicit Theory of Willpower for Strenuous Mental Activities Scale, a psychological assessment tool. They asked 1,100 Americans and 1,600 Europeans to weigh in on statements such as “After a strenuous mental activity, your energy is depleted, and you must rest to get it refueled again.”

Although there was little difference between men and women overall, Americans were more likely to admit to needing breaks after completing mentally challenging tasks, while European participants became more invigorated to keep going.

Based on the findings, Napolitano suggests that the key to amp up your willpower is to believe that you have an abundant supply of it.

“Your feelings about your willpower affect the way you behave—but these feelings are changeable,” he said. “Changing your beliefs about the nature of your self-control can have positive effects on development, leading to healthier behaviors and perceptions of others.”

Now that you have the drive, make sure you have the other winning attributes all successful people have in common.

Available at: <https://www.rd.com/advice/work-career/trick-boost-willpower/>.

Verifique se as sentenças abaixo são verdadeiras ou falsas de acordo com o texto:

( ) Um novo estudo sugere que a chave para aumentar sua força de vontade é acreditar que você tem uma oferta abundante dela.

( ) Pessoas que acreditam que sua força de vontade é finita não conseguem realizar tarefas mentais mais exigentes.

( ) O estudo revelou que os Americanos eram propensos a admitir a necessidade de pausas após a conclusão de tarefas mentalmente desafiadoras.

( ) Segundo Napolitano, os sentimentos sobre a força de vontade afetam a maneira como um indivíduo se comporta, porém esses sentimentos não são mutáveis.

Assinale a sequência correta:

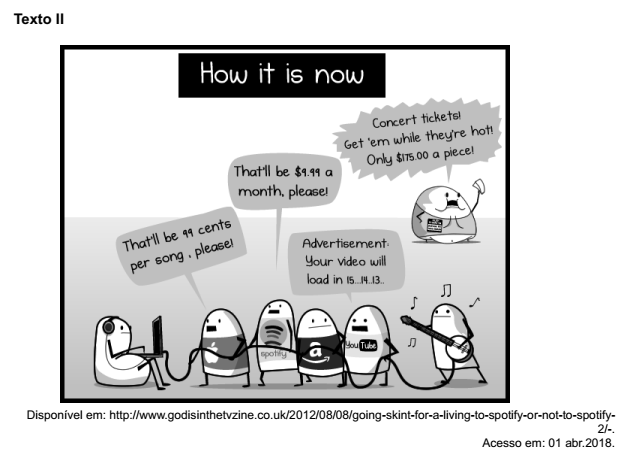

Shares in the music streaming firm Spotify will be publicly traded for the first time when the firm debuts on the New York market.

The flotation marks a turning point for the firm that after 12 years has not yet made a profit. Spotify's listing, which could value it at $20billion (£14 billion), is unconventional: it is not issuing any new shares. Instead, shares held by the firm's private investors will be made available.

What was once an small upstart Swedish music platform, has grown rapidly in recent years, adding millions of users to its free-to-use ad-funded service, and converting many of them to its more lucrative subscription service. It's used in 61 countries, has 159 million active users and a library of 35 million songs. They developed the platform in 2006 as a response to the growing piracy problem the music industry was facing. It is now the global leader among music streaming companies, boasting 71 million paying customers, twice as many as runner-up Apple.

What Spotify must do to survive? So far costs and fees to recording companies for the rights to play their music, have exceeded Spotify's revenues. And some analysts predict the listing will speed-up Spotify's race towards profitability. "When that's done we'll see a bit of a shift in strategy and direction." says Mark Mulligan at MIDia Research. The firm made a commitment to investors who backed it as the company was growing, that they would be given the chance to cash in their investment. The streaming giant has filed for paperwork to start trading its shares publicly on the New York Stock Exchange.

What will Spotify look like in the future? So what will change? "So far they've been treading a very fine line between being the dramatic new future of the music business but simultaneously being the biggest friend of the old music industry by giving record labels a platform to build out of decline," says Mr Mulligan.

"To go to the next phase [Spotify] will have to stop being so friendly to the record companies." More than half of Spotify's revenue goes directly to the record companies. Chris Hayes expects Spotify to evolve. "I think over time they're going to have to diversify their offering." he says, helping to set them apart from a sea of rival streaming services. They have already moved into podcasts and producing original music. They may well start to offer more original content like Taylor Swift's recent video which was only made available on the platform, says Chris Hayes.

So can Spotify make money? The firm's first operating profit (not including debt financing) is on the horizon for 2019 based on current trends, according to Mr Hayes. "The strategy has always been the free tier, but it is a funnel through which to persuade free users to upgrade to the subscription tier which is lucrative.

"As long as subscriptions continue to grow it should eventually become profitable. "Spotify's rivals are the biggest companies in the world with bottomless pockets," he says, and they are using music as a way to sell their core products, not as a business proposition in itself.

Apple, Amazon and Google are also in the streaming game and - unlike Spotify - all sell devices on which consumers can listen to music. And while Spotify has signed deals with all the "big three" record labels - Warner, Universal and Sony - it is the music executives that still hold the bargaining chips.

Adapted from: http://www.bbc.com/news/business-43613398. Acesso em: 03 abr. 2018.

Após a leitura do texto I, “Spotify braces for $20billion US share market listing”, e da charge

acima, marque a alternativa INCORRETA:

T E X T

EL TIGRE, Venezuela — Thousands of workers are fleeing Venezuela’s state-owned oil company, abandoning once-coveted jobs made worthless by the worst inflation in the world. And now the hemorrhaging is threatening the nation’s chances of overcoming its long economic collapse.

Desperate oil workers and criminals are also stripping the oil company of vital equipment, vehicles, pumps and copper wiring, carrying off whatever they can to make money. The double drain — of people and hardware — is further crippling a company that has been teetering for years yet remains the country’s most important source of income.

The timing could not be worse for Venezuela’s increasingly authoritarian president, Nicolás Maduro, who was re-elected last month in a vote that has been widely condemned by leaders across the hemisphere. Prominent opposition politicians were either barred from competing in the election, imprisoned or in exile.

But while Mr. Maduro has firm control over the country, Venezuela is on its knees economically, buckled by hyperinflation and a history of mismanagement. Widespread hunger, political strife, devastating shortages of medicine and an exodus of well over a million people in recent years have turned this country, once the economic envy of many of its neighbors, into a crisis that is spilling over international borders.

If Mr. Maduro is going to find a way out of the mess, the key will be oil: virtually the only source of hard currency for a nation with the world’s largest estimated petroleum reserves. But each month Venezuela produces less of it. Offices at the state oil company are emptying out, crews in the field are at half strength, pickup trucks are stolen and vital materials vanish. All of this is adding to the severe problems at the company that were already acute because of corruption, poor maintenance, crippling debts, the loss of professionals and even a lack of spare parts.

Now workers at all levels are walking away in large numbers, sometimes literally taking pieces of the company with them, union leaders, oil executives and workers say.

A job with Petróleos de Venezuela, known as Pdvsa, used to be a ticket to the Venezuelan Dream. No more.

Inflation in Venezuela is projected to reach an astounding 13,000 percent this year, according to the International Monetary Fund. When The New York Times interviewed Mr. Navas in May, the monthly salary for a worker like him was barely enough to buy a whole chicken or two pounds of beef. But with prices going up so quickly, it buys even less now.

Junior Martínez, 28, who has worked in the oil industry for eight years, is assembling papers, including his diploma as a chemical engineer. His wife and her daughter left three months ago to earn money in Brazil. “I get 1,400,000 bolívars a week and it isn’t even enough to buy a carton of eggs or a tube of toothpaste,”Mr. Martínez said of his salary in bolívars, Venezuela’s currency.

Mr. Martínez’s father, Ovidio Martínez, 55, recalled growing up here when the oil boom began. He cried as he spoke of his son’s determination to leave the country. “You watch your children leave and you can’t stop them,” the elder Mr. Martínez said, fighting back tears. “In this country, they don’t have a future.”

In El Tigre, hundreds of people stood in line one recent morning outside a supermarket, many waiting since the evening before to buy whatever food they could.

From: www.nytimes.com/June 14, 2018. Adapted.

T E X T

EL TIGRE, Venezuela — Thousands of workers are fleeing Venezuela’s state-owned oil company, abandoning once-coveted jobs made worthless by the worst inflation in the world. And now the hemorrhaging is threatening the nation’s chances of overcoming its long economic collapse.

Desperate oil workers and criminals are also stripping the oil company of vital equipment, vehicles, pumps and copper wiring, carrying off whatever they can to make money. The double drain — of people and hardware — is further crippling a company that has been teetering for years yet remains the country’s most important source of income.

The timing could not be worse for Venezuela’s increasingly authoritarian president, Nicolás Maduro, who was re-elected last month in a vote that has been widely condemned by leaders across the hemisphere. Prominent opposition politicians were either barred from competing in the election, imprisoned or in exile.

But while Mr. Maduro has firm control over the country, Venezuela is on its knees economically, buckled by hyperinflation and a history of mismanagement. Widespread hunger, political strife, devastating shortages of medicine and an exodus of well over a million people in recent years have turned this country, once the economic envy of many of its neighbors, into a crisis that is spilling over international borders.

If Mr. Maduro is going to find a way out of the mess, the key will be oil: virtually the only source of hard currency for a nation with the world’s largest estimated petroleum reserves. But each month Venezuela produces less of it. Offices at the state oil company are emptying out, crews in the field are at half strength, pickup trucks are stolen and vital materials vanish. All of this is adding to the severe problems at the company that were already acute because of corruption, poor maintenance, crippling debts, the loss of professionals and even a lack of spare parts.

Now workers at all levels are walking away in large numbers, sometimes literally taking pieces of the company with them, union leaders, oil executives and workers say.

A job with Petróleos de Venezuela, known as Pdvsa, used to be a ticket to the Venezuelan Dream. No more.

Inflation in Venezuela is projected to reach an astounding 13,000 percent this year, according to the International Monetary Fund. When The New York Times interviewed Mr. Navas in May, the monthly salary for a worker like him was barely enough to buy a whole chicken or two pounds of beef. But with prices going up so quickly, it buys even less now.

Junior Martínez, 28, who has worked in the oil industry for eight years, is assembling papers, including his diploma as a chemical engineer. His wife and her daughter left three months ago to earn money in Brazil. “I get 1,400,000 bolívars a week and it isn’t even enough to buy a carton of eggs or a tube of toothpaste,”Mr. Martínez said of his salary in bolívars, Venezuela’s currency.

Mr. Martínez’s father, Ovidio Martínez, 55, recalled growing up here when the oil boom began. He cried as he spoke of his son’s determination to leave the country. “You watch your children leave and you can’t stop them,” the elder Mr. Martínez said, fighting back tears. “In this country, they don’t have a future.”

In El Tigre, hundreds of people stood in line one recent morning outside a supermarket, many waiting since the evening before to buy whatever food they could.

From: www.nytimes.com/June 14, 2018. Adapted.

T E X T

EL TIGRE, Venezuela — Thousands of workers are fleeing Venezuela’s state-owned oil company, abandoning once-coveted jobs made worthless by the worst inflation in the world. And now the hemorrhaging is threatening the nation’s chances of overcoming its long economic collapse.

Desperate oil workers and criminals are also stripping the oil company of vital equipment, vehicles, pumps and copper wiring, carrying off whatever they can to make money. The double drain — of people and hardware — is further crippling a company that has been teetering for years yet remains the country’s most important source of income.

The timing could not be worse for Venezuela’s increasingly authoritarian president, Nicolás Maduro, who was re-elected last month in a vote that has been widely condemned by leaders across the hemisphere. Prominent opposition politicians were either barred from competing in the election, imprisoned or in exile.

But while Mr. Maduro has firm control over the country, Venezuela is on its knees economically, buckled by hyperinflation and a history of mismanagement. Widespread hunger, political strife, devastating shortages of medicine and an exodus of well over a million people in recent years have turned this country, once the economic envy of many of its neighbors, into a crisis that is spilling over international borders.

If Mr. Maduro is going to find a way out of the mess, the key will be oil: virtually the only source of hard currency for a nation with the world’s largest estimated petroleum reserves. But each month Venezuela produces less of it. Offices at the state oil company are emptying out, crews in the field are at half strength, pickup trucks are stolen and vital materials vanish. All of this is adding to the severe problems at the company that were already acute because of corruption, poor maintenance, crippling debts, the loss of professionals and even a lack of spare parts.

Now workers at all levels are walking away in large numbers, sometimes literally taking pieces of the company with them, union leaders, oil executives and workers say.

A job with Petróleos de Venezuela, known as Pdvsa, used to be a ticket to the Venezuelan Dream. No more.

Inflation in Venezuela is projected to reach an astounding 13,000 percent this year, according to the International Monetary Fund. When The New York Times interviewed Mr. Navas in May, the monthly salary for a worker like him was barely enough to buy a whole chicken or two pounds of beef. But with prices going up so quickly, it buys even less now.

Junior Martínez, 28, who has worked in the oil industry for eight years, is assembling papers, including his diploma as a chemical engineer. His wife and her daughter left three months ago to earn money in Brazil. “I get 1,400,000 bolívars a week and it isn’t even enough to buy a carton of eggs or a tube of toothpaste,”Mr. Martínez said of his salary in bolívars, Venezuela’s currency.

Mr. Martínez’s father, Ovidio Martínez, 55, recalled growing up here when the oil boom began. He cried as he spoke of his son’s determination to leave the country. “You watch your children leave and you can’t stop them,” the elder Mr. Martínez said, fighting back tears. “In this country, they don’t have a future.”

In El Tigre, hundreds of people stood in line one recent morning outside a supermarket, many waiting since the evening before to buy whatever food they could.

From: www.nytimes.com/June 14, 2018. Adapted.

T E X T

EL TIGRE, Venezuela — Thousands of workers are fleeing Venezuela’s state-owned oil company, abandoning once-coveted jobs made worthless by the worst inflation in the world. And now the hemorrhaging is threatening the nation’s chances of overcoming its long economic collapse.

Desperate oil workers and criminals are also stripping the oil company of vital equipment, vehicles, pumps and copper wiring, carrying off whatever they can to make money. The double drain — of people and hardware — is further crippling a company that has been teetering for years yet remains the country’s most important source of income.

The timing could not be worse for Venezuela’s increasingly authoritarian president, Nicolás Maduro, who was re-elected last month in a vote that has been widely condemned by leaders across the hemisphere. Prominent opposition politicians were either barred from competing in the election, imprisoned or in exile.

But while Mr. Maduro has firm control over the country, Venezuela is on its knees economically, buckled by hyperinflation and a history of mismanagement. Widespread hunger, political strife, devastating shortages of medicine and an exodus of well over a million people in recent years have turned this country, once the economic envy of many of its neighbors, into a crisis that is spilling over international borders.

If Mr. Maduro is going to find a way out of the mess, the key will be oil: virtually the only source of hard currency for a nation with the world’s largest estimated petroleum reserves. But each month Venezuela produces less of it. Offices at the state oil company are emptying out, crews in the field are at half strength, pickup trucks are stolen and vital materials vanish. All of this is adding to the severe problems at the company that were already acute because of corruption, poor maintenance, crippling debts, the loss of professionals and even a lack of spare parts.

Now workers at all levels are walking away in large numbers, sometimes literally taking pieces of the company with them, union leaders, oil executives and workers say.

A job with Petróleos de Venezuela, known as Pdvsa, used to be a ticket to the Venezuelan Dream. No more.

Inflation in Venezuela is projected to reach an astounding 13,000 percent this year, according to the International Monetary Fund. When The New York Times interviewed Mr. Navas in May, the monthly salary for a worker like him was barely enough to buy a whole chicken or two pounds of beef. But with prices going up so quickly, it buys even less now.

Junior Martínez, 28, who has worked in the oil industry for eight years, is assembling papers, including his diploma as a chemical engineer. His wife and her daughter left three months ago to earn money in Brazil. “I get 1,400,000 bolívars a week and it isn’t even enough to buy a carton of eggs or a tube of toothpaste,”Mr. Martínez said of his salary in bolívars, Venezuela’s currency.

Mr. Martínez’s father, Ovidio Martínez, 55, recalled growing up here when the oil boom began. He cried as he spoke of his son’s determination to leave the country. “You watch your children leave and you can’t stop them,” the elder Mr. Martínez said, fighting back tears. “In this country, they don’t have a future.”

In El Tigre, hundreds of people stood in line one recent morning outside a supermarket, many waiting since the evening before to buy whatever food they could.

From: www.nytimes.com/June 14, 2018. Adapted.

T E X T

EL TIGRE, Venezuela — Thousands of workers are fleeing Venezuela’s state-owned oil company, abandoning once-coveted jobs made worthless by the worst inflation in the world. And now the hemorrhaging is threatening the nation’s chances of overcoming its long economic collapse.

Desperate oil workers and criminals are also stripping the oil company of vital equipment, vehicles, pumps and copper wiring, carrying off whatever they can to make money. The double drain — of people and hardware — is further crippling a company that has been teetering for years yet remains the country’s most important source of income.

The timing could not be worse for Venezuela’s increasingly authoritarian president, Nicolás Maduro, who was re-elected last month in a vote that has been widely condemned by leaders across the hemisphere. Prominent opposition politicians were either barred from competing in the election, imprisoned or in exile.

But while Mr. Maduro has firm control over the country, Venezuela is on its knees economically, buckled by hyperinflation and a history of mismanagement. Widespread hunger, political strife, devastating shortages of medicine and an exodus of well over a million people in recent years have turned this country, once the economic envy of many of its neighbors, into a crisis that is spilling over international borders.

If Mr. Maduro is going to find a way out of the mess, the key will be oil: virtually the only source of hard currency for a nation with the world’s largest estimated petroleum reserves. But each month Venezuela produces less of it. Offices at the state oil company are emptying out, crews in the field are at half strength, pickup trucks are stolen and vital materials vanish. All of this is adding to the severe problems at the company that were already acute because of corruption, poor maintenance, crippling debts, the loss of professionals and even a lack of spare parts.

Now workers at all levels are walking away in large numbers, sometimes literally taking pieces of the company with them, union leaders, oil executives and workers say.

A job with Petróleos de Venezuela, known as Pdvsa, used to be a ticket to the Venezuelan Dream. No more.

Inflation in Venezuela is projected to reach an astounding 13,000 percent this year, according to the International Monetary Fund. When The New York Times interviewed Mr. Navas in May, the monthly salary for a worker like him was barely enough to buy a whole chicken or two pounds of beef. But with prices going up so quickly, it buys even less now.

Junior Martínez, 28, who has worked in the oil industry for eight years, is assembling papers, including his diploma as a chemical engineer. His wife and her daughter left three months ago to earn money in Brazil. “I get 1,400,000 bolívars a week and it isn’t even enough to buy a carton of eggs or a tube of toothpaste,”Mr. Martínez said of his salary in bolívars, Venezuela’s currency.

Mr. Martínez’s father, Ovidio Martínez, 55, recalled growing up here when the oil boom began. He cried as he spoke of his son’s determination to leave the country. “You watch your children leave and you can’t stop them,” the elder Mr. Martínez said, fighting back tears. “In this country, they don’t have a future.”

In El Tigre, hundreds of people stood in line one recent morning outside a supermarket, many waiting since the evening before to buy whatever food they could.

From: www.nytimes.com/June 14, 2018. Adapted.

T E X T

EL TIGRE, Venezuela — Thousands of workers are fleeing Venezuela’s state-owned oil company, abandoning once-coveted jobs made worthless by the worst inflation in the world. And now the hemorrhaging is threatening the nation’s chances of overcoming its long economic collapse.

Desperate oil workers and criminals are also stripping the oil company of vital equipment, vehicles, pumps and copper wiring, carrying off whatever they can to make money. The double drain — of people and hardware — is further crippling a company that has been teetering for years yet remains the country’s most important source of income.

The timing could not be worse for Venezuela’s increasingly authoritarian president, Nicolás Maduro, who was re-elected last month in a vote that has been widely condemned by leaders across the hemisphere. Prominent opposition politicians were either barred from competing in the election, imprisoned or in exile.

But while Mr. Maduro has firm control over the country, Venezuela is on its knees economically, buckled by hyperinflation and a history of mismanagement. Widespread hunger, political strife, devastating shortages of medicine and an exodus of well over a million people in recent years have turned this country, once the economic envy of many of its neighbors, into a crisis that is spilling over international borders.

If Mr. Maduro is going to find a way out of the mess, the key will be oil: virtually the only source of hard currency for a nation with the world’s largest estimated petroleum reserves. But each month Venezuela produces less of it. Offices at the state oil company are emptying out, crews in the field are at half strength, pickup trucks are stolen and vital materials vanish. All of this is adding to the severe problems at the company that were already acute because of corruption, poor maintenance, crippling debts, the loss of professionals and even a lack of spare parts.

Now workers at all levels are walking away in large numbers, sometimes literally taking pieces of the company with them, union leaders, oil executives and workers say.

A job with Petróleos de Venezuela, known as Pdvsa, used to be a ticket to the Venezuelan Dream. No more.

Inflation in Venezuela is projected to reach an astounding 13,000 percent this year, according to the International Monetary Fund. When The New York Times interviewed Mr. Navas in May, the monthly salary for a worker like him was barely enough to buy a whole chicken or two pounds of beef. But with prices going up so quickly, it buys even less now.

Junior Martínez, 28, who has worked in the oil industry for eight years, is assembling papers, including his diploma as a chemical engineer. His wife and her daughter left three months ago to earn money in Brazil. “I get 1,400,000 bolívars a week and it isn’t even enough to buy a carton of eggs or a tube of toothpaste,”Mr. Martínez said of his salary in bolívars, Venezuela’s currency.

Mr. Martínez’s father, Ovidio Martínez, 55, recalled growing up here when the oil boom began. He cried as he spoke of his son’s determination to leave the country. “You watch your children leave and you can’t stop them,” the elder Mr. Martínez said, fighting back tears. “In this country, they don’t have a future.”

In El Tigre, hundreds of people stood in line one recent morning outside a supermarket, many waiting since the evening before to buy whatever food they could.

From: www.nytimes.com/June 14, 2018. Adapted.

T E X T

EL TIGRE, Venezuela — Thousands of workers are fleeing Venezuela’s state-owned oil company, abandoning once-coveted jobs made worthless by the worst inflation in the world. And now the hemorrhaging is threatening the nation’s chances of overcoming its long economic collapse.

Desperate oil workers and criminals are also stripping the oil company of vital equipment, vehicles, pumps and copper wiring, carrying off whatever they can to make money. The double drain — of people and hardware — is further crippling a company that has been teetering for years yet remains the country’s most important source of income.

The timing could not be worse for Venezuela’s increasingly authoritarian president, Nicolás Maduro, who was re-elected last month in a vote that has been widely condemned by leaders across the hemisphere. Prominent opposition politicians were either barred from competing in the election, imprisoned or in exile.

But while Mr. Maduro has firm control over the country, Venezuela is on its knees economically, buckled by hyperinflation and a history of mismanagement. Widespread hunger, political strife, devastating shortages of medicine and an exodus of well over a million people in recent years have turned this country, once the economic envy of many of its neighbors, into a crisis that is spilling over international borders.

If Mr. Maduro is going to find a way out of the mess, the key will be oil: virtually the only source of hard currency for a nation with the world’s largest estimated petroleum reserves. But each month Venezuela produces less of it. Offices at the state oil company are emptying out, crews in the field are at half strength, pickup trucks are stolen and vital materials vanish. All of this is adding to the severe problems at the company that were already acute because of corruption, poor maintenance, crippling debts, the loss of professionals and even a lack of spare parts.

Now workers at all levels are walking away in large numbers, sometimes literally taking pieces of the company with them, union leaders, oil executives and workers say.

A job with Petróleos de Venezuela, known as Pdvsa, used to be a ticket to the Venezuelan Dream. No more.

Inflation in Venezuela is projected to reach an astounding 13,000 percent this year, according to the International Monetary Fund. When The New York Times interviewed Mr. Navas in May, the monthly salary for a worker like him was barely enough to buy a whole chicken or two pounds of beef. But with prices going up so quickly, it buys even less now.

Junior Martínez, 28, who has worked in the oil industry for eight years, is assembling papers, including his diploma as a chemical engineer. His wife and her daughter left three months ago to earn money in Brazil. “I get 1,400,000 bolívars a week and it isn’t even enough to buy a carton of eggs or a tube of toothpaste,”Mr. Martínez said of his salary in bolívars, Venezuela’s currency.

Mr. Martínez’s father, Ovidio Martínez, 55, recalled growing up here when the oil boom began. He cried as he spoke of his son’s determination to leave the country. “You watch your children leave and you can’t stop them,” the elder Mr. Martínez said, fighting back tears. “In this country, they don’t have a future.”

In El Tigre, hundreds of people stood in line one recent morning outside a supermarket, many waiting since the evening before to buy whatever food they could.

From: www.nytimes.com/June 14, 2018. Adapted.

T E X T

EL TIGRE, Venezuela — Thousands of workers are fleeing Venezuela’s state-owned oil company, abandoning once-coveted jobs made worthless by the worst inflation in the world. And now the hemorrhaging is threatening the nation’s chances of overcoming its long economic collapse.

Desperate oil workers and criminals are also stripping the oil company of vital equipment, vehicles, pumps and copper wiring, carrying off whatever they can to make money. The double drain — of people and hardware — is further crippling a company that has been teetering for years yet remains the country’s most important source of income.

The timing could not be worse for Venezuela’s increasingly authoritarian president, Nicolás Maduro, who was re-elected last month in a vote that has been widely condemned by leaders across the hemisphere. Prominent opposition politicians were either barred from competing in the election, imprisoned or in exile.

But while Mr. Maduro has firm control over the country, Venezuela is on its knees economically, buckled by hyperinflation and a history of mismanagement. Widespread hunger, political strife, devastating shortages of medicine and an exodus of well over a million people in recent years have turned this country, once the economic envy of many of its neighbors, into a crisis that is spilling over international borders.

If Mr. Maduro is going to find a way out of the mess, the key will be oil: virtually the only source of hard currency for a nation with the world’s largest estimated petroleum reserves. But each month Venezuela produces less of it. Offices at the state oil company are emptying out, crews in the field are at half strength, pickup trucks are stolen and vital materials vanish. All of this is adding to the severe problems at the company that were already acute because of corruption, poor maintenance, crippling debts, the loss of professionals and even a lack of spare parts.

Now workers at all levels are walking away in large numbers, sometimes literally taking pieces of the company with them, union leaders, oil executives and workers say.

A job with Petróleos de Venezuela, known as Pdvsa, used to be a ticket to the Venezuelan Dream. No more.

Inflation in Venezuela is projected to reach an astounding 13,000 percent this year, according to the International Monetary Fund. When The New York Times interviewed Mr. Navas in May, the monthly salary for a worker like him was barely enough to buy a whole chicken or two pounds of beef. But with prices going up so quickly, it buys even less now.

Junior Martínez, 28, who has worked in the oil industry for eight years, is assembling papers, including his diploma as a chemical engineer. His wife and her daughter left three months ago to earn money in Brazil. “I get 1,400,000 bolívars a week and it isn’t even enough to buy a carton of eggs or a tube of toothpaste,”Mr. Martínez said of his salary in bolívars, Venezuela’s currency.

Mr. Martínez’s father, Ovidio Martínez, 55, recalled growing up here when the oil boom began. He cried as he spoke of his son’s determination to leave the country. “You watch your children leave and you can’t stop them,” the elder Mr. Martínez said, fighting back tears. “In this country, they don’t have a future.”

In El Tigre, hundreds of people stood in line one recent morning outside a supermarket, many waiting since the evening before to buy whatever food they could.

From: www.nytimes.com/June 14, 2018. Adapted.

T E X T

If all of the children who currently are sedentary started exercising every day, societies could save enormous amounts of money in the coming decades and have healthier citizens as a whole, according to a remarkable new study. In the United States alone, we could expect to save more than $120 billion every year in health care and associated expenses. The study is the first to use sophisticated computer simulations to arrive at a literal and sobering societal price tag for allowing our children to be sedentary.

Inactivity is, of course, widespread among young people today. Recent research shows that in the United States and Europe, physical activity tends to peak at about age 7 for both boys and girls and tail off continually throughout adolescence. More than two-thirds of children in the United States rarely exercise at all.

The immediate health consequences for inactive children and their families are worrisome. Childhood obesity, which is linked to lack of exercise, is common, as is the incidence of Type 2 diabetes and other health problems related to being overweight among children as young as 6.

But the long-term financial costs of inactivity in the young, both for them and society as a whole, have never been quantified. So for the new study, which was published this week in Health Affairs, researchers with the Global Obesity Prevention Center at Johns Hopkins University in Baltimore and other institutions decided to create a bogglingly complex computer model of what the future could look like if we do or do not get more of our children moving.

The researchers began by gathering as much public data as is currently available about the health, weight and physical activity patterns of all 31.7 million American children now aged 8 to 11, using large-scale databases from the Census Bureau, the Centers for Disease Control and Prevention, and other groups.

The researchers fed this information into a computerized modeling program that created an electronic avatar for every American child today. In line with reality, two-thirds of these children were programmed to rarely exercise and many were overweight or obese.

The scientists then had the simulated children grow up. Using estimations about how calorie intake and activity patterns affect body weight, the program changed each virtual child’s body day-by-day and year-by-year into adulthood. Most became increasingly overweight.

As the simulated children became adults, the scientists then modeled each one’s health, based on obesity-associated risks for heart disease, diabetes, stroke and cancer, and also the probable financial price of dealing with those diseases (adjusted for future inflation), both in terms of direct expenses for hospitalizations, drugs and so on, and lost productivity because of someone’s being ill.

The results were staggering. According to the computer model, the costs of today’s 8- to 11- year-olds being inactive and consequently overweight would be almost $3 trillion in medical expenses and lost productivity every year once the children reached adulthood and for decades until their deaths.

But when the researchers tweaked children’s activity levels within their model, the numbers began to look quite different. If they presumed that, in an imaginary America, half of all children exercised vigorously for about 25 minutes three times a week, such as during active recess or sports or, more ambitiously, ran around and moved for at least an hour every day, which is the amount of youth exercise recommended by the C.D.C., their virtual lives were transformed.

Most obviously, the incidence of childhood obesity fell by more than 4 percent, a change that resonated throughout the simulated children’s lives and society. There were about half a million fewer cases of adult-onset heart disease, diabetes, cancer and strokes in this simulation, and the society-wide costs associated with these illnesses dropped by about $32 billion every year if the children romped about for 25 minutes three times per week and by almost $37 billion if they moved for an hour every day.

The impacts were even more substantial when the researchers assumed that 100 percent of the children who are now sedentary got regular exercise. In this scenario, the annual total costs during adulthood from obesity-associated medical expenses and lost productivity plummeted by about $62 billion when children were active three times a week and by more than $120 billion every year when all of the virtual children played and moved for at least an hour each day.

From: https://www.nytimes.com May 3, 2017

T E X T

If all of the children who currently are sedentary started exercising every day, societies could save enormous amounts of money in the coming decades and have healthier citizens as a whole, according to a remarkable new study. In the United States alone, we could expect to save more than $120 billion every year in health care and associated expenses. The study is the first to use sophisticated computer simulations to arrive at a literal and sobering societal price tag for allowing our children to be sedentary.

Inactivity is, of course, widespread among young people today. Recent research shows that in the United States and Europe, physical activity tends to peak at about age 7 for both boys and girls and tail off continually throughout adolescence. More than two-thirds of children in the United States rarely exercise at all.

The immediate health consequences for inactive children and their families are worrisome. Childhood obesity, which is linked to lack of exercise, is common, as is the incidence of Type 2 diabetes and other health problems related to being overweight among children as young as 6.

But the long-term financial costs of inactivity in the young, both for them and society as a whole, have never been quantified. So for the new study, which was published this week in Health Affairs, researchers with the Global Obesity Prevention Center at Johns Hopkins University in Baltimore and other institutions decided to create a bogglingly complex computer model of what the future could look like if we do or do not get more of our children moving.

The researchers began by gathering as much public data as is currently available about the health, weight and physical activity patterns of all 31.7 million American children now aged 8 to 11, using large-scale databases from the Census Bureau, the Centers for Disease Control and Prevention, and other groups.

The researchers fed this information into a computerized modeling program that created an electronic avatar for every American child today. In line with reality, two-thirds of these children were programmed to rarely exercise and many were overweight or obese.

The scientists then had the simulated children grow up. Using estimations about how calorie intake and activity patterns affect body weight, the program changed each virtual child’s body day-by-day and year-by-year into adulthood. Most became increasingly overweight.

As the simulated children became adults, the scientists then modeled each one’s health, based on obesity-associated risks for heart disease, diabetes, stroke and cancer, and also the probable financial price of dealing with those diseases (adjusted for future inflation), both in terms of direct expenses for hospitalizations, drugs and so on, and lost productivity because of someone’s being ill.

The results were staggering. According to the computer model, the costs of today’s 8- to 11- year-olds being inactive and consequently overweight would be almost $3 trillion in medical expenses and lost productivity every year once the children reached adulthood and for decades until their deaths.

But when the researchers tweaked children’s activity levels within their model, the numbers began to look quite different. If they presumed that, in an imaginary America, half of all children exercised vigorously for about 25 minutes three times a week, such as during active recess or sports or, more ambitiously, ran around and moved for at least an hour every day, which is the amount of youth exercise recommended by the C.D.C., their virtual lives were transformed.

Most obviously, the incidence of childhood obesity fell by more than 4 percent, a change that resonated throughout the simulated children’s lives and society. There were about half a million fewer cases of adult-onset heart disease, diabetes, cancer and strokes in this simulation, and the society-wide costs associated with these illnesses dropped by about $32 billion every year if the children romped about for 25 minutes three times per week and by almost $37 billion if they moved for an hour every day.

The impacts were even more substantial when the researchers assumed that 100 percent of the children who are now sedentary got regular exercise. In this scenario, the annual total costs during adulthood from obesity-associated medical expenses and lost productivity plummeted by about $62 billion when children were active three times a week and by more than $120 billion every year when all of the virtual children played and moved for at least an hour each day.

From: https://www.nytimes.com May 3, 2017

T E X T

If all of the children who currently are sedentary started exercising every day, societies could save enormous amounts of money in the coming decades and have healthier citizens as a whole, according to a remarkable new study. In the United States alone, we could expect to save more than $120 billion every year in health care and associated expenses. The study is the first to use sophisticated computer simulations to arrive at a literal and sobering societal price tag for allowing our children to be sedentary.

Inactivity is, of course, widespread among young people today. Recent research shows that in the United States and Europe, physical activity tends to peak at about age 7 for both boys and girls and tail off continually throughout adolescence. More than two-thirds of children in the United States rarely exercise at all.

The immediate health consequences for inactive children and their families are worrisome. Childhood obesity, which is linked to lack of exercise, is common, as is the incidence of Type 2 diabetes and other health problems related to being overweight among children as young as 6.

But the long-term financial costs of inactivity in the young, both for them and society as a whole, have never been quantified. So for the new study, which was published this week in Health Affairs, researchers with the Global Obesity Prevention Center at Johns Hopkins University in Baltimore and other institutions decided to create a bogglingly complex computer model of what the future could look like if we do or do not get more of our children moving.

The researchers began by gathering as much public data as is currently available about the health, weight and physical activity patterns of all 31.7 million American children now aged 8 to 11, using large-scale databases from the Census Bureau, the Centers for Disease Control and Prevention, and other groups.

The researchers fed this information into a computerized modeling program that created an electronic avatar for every American child today. In line with reality, two-thirds of these children were programmed to rarely exercise and many were overweight or obese.

The scientists then had the simulated children grow up. Using estimations about how calorie intake and activity patterns affect body weight, the program changed each virtual child’s body day-by-day and year-by-year into adulthood. Most became increasingly overweight.

As the simulated children became adults, the scientists then modeled each one’s health, based on obesity-associated risks for heart disease, diabetes, stroke and cancer, and also the probable financial price of dealing with those diseases (adjusted for future inflation), both in terms of direct expenses for hospitalizations, drugs and so on, and lost productivity because of someone’s being ill.

The results were staggering. According to the computer model, the costs of today’s 8- to 11- year-olds being inactive and consequently overweight would be almost $3 trillion in medical expenses and lost productivity every year once the children reached adulthood and for decades until their deaths.

But when the researchers tweaked children’s activity levels within their model, the numbers began to look quite different. If they presumed that, in an imaginary America, half of all children exercised vigorously for about 25 minutes three times a week, such as during active recess or sports or, more ambitiously, ran around and moved for at least an hour every day, which is the amount of youth exercise recommended by the C.D.C., their virtual lives were transformed.

Most obviously, the incidence of childhood obesity fell by more than 4 percent, a change that resonated throughout the simulated children’s lives and society. There were about half a million fewer cases of adult-onset heart disease, diabetes, cancer and strokes in this simulation, and the society-wide costs associated with these illnesses dropped by about $32 billion every year if the children romped about for 25 minutes three times per week and by almost $37 billion if they moved for an hour every day.

The impacts were even more substantial when the researchers assumed that 100 percent of the children who are now sedentary got regular exercise. In this scenario, the annual total costs during adulthood from obesity-associated medical expenses and lost productivity plummeted by about $62 billion when children were active three times a week and by more than $120 billion every year when all of the virtual children played and moved for at least an hour each day.

From: https://www.nytimes.com May 3, 2017

T E X T

If all of the children who currently are sedentary started exercising every day, societies could save enormous amounts of money in the coming decades and have healthier citizens as a whole, according to a remarkable new study. In the United States alone, we could expect to save more than $120 billion every year in health care and associated expenses. The study is the first to use sophisticated computer simulations to arrive at a literal and sobering societal price tag for allowing our children to be sedentary.

Inactivity is, of course, widespread among young people today. Recent research shows that in the United States and Europe, physical activity tends to peak at about age 7 for both boys and girls and tail off continually throughout adolescence. More than two-thirds of children in the United States rarely exercise at all.

The immediate health consequences for inactive children and their families are worrisome. Childhood obesity, which is linked to lack of exercise, is common, as is the incidence of Type 2 diabetes and other health problems related to being overweight among children as young as 6.

But the long-term financial costs of inactivity in the young, both for them and society as a whole, have never been quantified. So for the new study, which was published this week in Health Affairs, researchers with the Global Obesity Prevention Center at Johns Hopkins University in Baltimore and other institutions decided to create a bogglingly complex computer model of what the future could look like if we do or do not get more of our children moving.

The researchers began by gathering as much public data as is currently available about the health, weight and physical activity patterns of all 31.7 million American children now aged 8 to 11, using large-scale databases from the Census Bureau, the Centers for Disease Control and Prevention, and other groups.

The researchers fed this information into a computerized modeling program that created an electronic avatar for every American child today. In line with reality, two-thirds of these children were programmed to rarely exercise and many were overweight or obese.

The scientists then had the simulated children grow up. Using estimations about how calorie intake and activity patterns affect body weight, the program changed each virtual child’s body day-by-day and year-by-year into adulthood. Most became increasingly overweight.

As the simulated children became adults, the scientists then modeled each one’s health, based on obesity-associated risks for heart disease, diabetes, stroke and cancer, and also the probable financial price of dealing with those diseases (adjusted for future inflation), both in terms of direct expenses for hospitalizations, drugs and so on, and lost productivity because of someone’s being ill.

The results were staggering. According to the computer model, the costs of today’s 8- to 11- year-olds being inactive and consequently overweight would be almost $3 trillion in medical expenses and lost productivity every year once the children reached adulthood and for decades until their deaths.

But when the researchers tweaked children’s activity levels within their model, the numbers began to look quite different. If they presumed that, in an imaginary America, half of all children exercised vigorously for about 25 minutes three times a week, such as during active recess or sports or, more ambitiously, ran around and moved for at least an hour every day, which is the amount of youth exercise recommended by the C.D.C., their virtual lives were transformed.

Most obviously, the incidence of childhood obesity fell by more than 4 percent, a change that resonated throughout the simulated children’s lives and society. There were about half a million fewer cases of adult-onset heart disease, diabetes, cancer and strokes in this simulation, and the society-wide costs associated with these illnesses dropped by about $32 billion every year if the children romped about for 25 minutes three times per week and by almost $37 billion if they moved for an hour every day.

The impacts were even more substantial when the researchers assumed that 100 percent of the children who are now sedentary got regular exercise. In this scenario, the annual total costs during adulthood from obesity-associated medical expenses and lost productivity plummeted by about $62 billion when children were active three times a week and by more than $120 billion every year when all of the virtual children played and moved for at least an hour each day.

From: https://www.nytimes.com May 3, 2017

T E X T

If all of the children who currently are sedentary started exercising every day, societies could save enormous amounts of money in the coming decades and have healthier citizens as a whole, according to a remarkable new study. In the United States alone, we could expect to save more than $120 billion every year in health care and associated expenses. The study is the first to use sophisticated computer simulations to arrive at a literal and sobering societal price tag for allowing our children to be sedentary.

Inactivity is, of course, widespread among young people today. Recent research shows that in the United States and Europe, physical activity tends to peak at about age 7 for both boys and girls and tail off continually throughout adolescence. More than two-thirds of children in the United States rarely exercise at all.

The immediate health consequences for inactive children and their families are worrisome. Childhood obesity, which is linked to lack of exercise, is common, as is the incidence of Type 2 diabetes and other health problems related to being overweight among children as young as 6.

But the long-term financial costs of inactivity in the young, both for them and society as a whole, have never been quantified. So for the new study, which was published this week in Health Affairs, researchers with the Global Obesity Prevention Center at Johns Hopkins University in Baltimore and other institutions decided to create a bogglingly complex computer model of what the future could look like if we do or do not get more of our children moving.

The researchers began by gathering as much public data as is currently available about the health, weight and physical activity patterns of all 31.7 million American children now aged 8 to 11, using large-scale databases from the Census Bureau, the Centers for Disease Control and Prevention, and other groups.

The researchers fed this information into a computerized modeling program that created an electronic avatar for every American child today. In line with reality, two-thirds of these children were programmed to rarely exercise and many were overweight or obese.

The scientists then had the simulated children grow up. Using estimations about how calorie intake and activity patterns affect body weight, the program changed each virtual child’s body day-by-day and year-by-year into adulthood. Most became increasingly overweight.

As the simulated children became adults, the scientists then modeled each one’s health, based on obesity-associated risks for heart disease, diabetes, stroke and cancer, and also the probable financial price of dealing with those diseases (adjusted for future inflation), both in terms of direct expenses for hospitalizations, drugs and so on, and lost productivity because of someone’s being ill.

The results were staggering. According to the computer model, the costs of today’s 8- to 11- year-olds being inactive and consequently overweight would be almost $3 trillion in medical expenses and lost productivity every year once the children reached adulthood and for decades until their deaths.

But when the researchers tweaked children’s activity levels within their model, the numbers began to look quite different. If they presumed that, in an imaginary America, half of all children exercised vigorously for about 25 minutes three times a week, such as during active recess or sports or, more ambitiously, ran around and moved for at least an hour every day, which is the amount of youth exercise recommended by the C.D.C., their virtual lives were transformed.

Most obviously, the incidence of childhood obesity fell by more than 4 percent, a change that resonated throughout the simulated children’s lives and society. There were about half a million fewer cases of adult-onset heart disease, diabetes, cancer and strokes in this simulation, and the society-wide costs associated with these illnesses dropped by about $32 billion every year if the children romped about for 25 minutes three times per week and by almost $37 billion if they moved for an hour every day.

The impacts were even more substantial when the researchers assumed that 100 percent of the children who are now sedentary got regular exercise. In this scenario, the annual total costs during adulthood from obesity-associated medical expenses and lost productivity plummeted by about $62 billion when children were active three times a week and by more than $120 billion every year when all of the virtual children played and moved for at least an hour each day.

From: https://www.nytimes.com May 3, 2017

T E X T

If all of the children who currently are sedentary started exercising every day, societies could save enormous amounts of money in the coming decades and have healthier citizens as a whole, according to a remarkable new study. In the United States alone, we could expect to save more than $120 billion every year in health care and associated expenses. The study is the first to use sophisticated computer simulations to arrive at a literal and sobering societal price tag for allowing our children to be sedentary.

Inactivity is, of course, widespread among young people today. Recent research shows that in the United States and Europe, physical activity tends to peak at about age 7 for both boys and girls and tail off continually throughout adolescence. More than two-thirds of children in the United States rarely exercise at all.

The immediate health consequences for inactive children and their families are worrisome. Childhood obesity, which is linked to lack of exercise, is common, as is the incidence of Type 2 diabetes and other health problems related to being overweight among children as young as 6.

But the long-term financial costs of inactivity in the young, both for them and society as a whole, have never been quantified. So for the new study, which was published this week in Health Affairs, researchers with the Global Obesity Prevention Center at Johns Hopkins University in Baltimore and other institutions decided to create a bogglingly complex computer model of what the future could look like if we do or do not get more of our children moving.

The researchers began by gathering as much public data as is currently available about the health, weight and physical activity patterns of all 31.7 million American children now aged 8 to 11, using large-scale databases from the Census Bureau, the Centers for Disease Control and Prevention, and other groups.

The researchers fed this information into a computerized modeling program that created an electronic avatar for every American child today. In line with reality, two-thirds of these children were programmed to rarely exercise and many were overweight or obese.

The scientists then had the simulated children grow up. Using estimations about how calorie intake and activity patterns affect body weight, the program changed each virtual child’s body day-by-day and year-by-year into adulthood. Most became increasingly overweight.

As the simulated children became adults, the scientists then modeled each one’s health, based on obesity-associated risks for heart disease, diabetes, stroke and cancer, and also the probable financial price of dealing with those diseases (adjusted for future inflation), both in terms of direct expenses for hospitalizations, drugs and so on, and lost productivity because of someone’s being ill.

The results were staggering. According to the computer model, the costs of today’s 8- to 11- year-olds being inactive and consequently overweight would be almost $3 trillion in medical expenses and lost productivity every year once the children reached adulthood and for decades until their deaths.

But when the researchers tweaked children’s activity levels within their model, the numbers began to look quite different. If they presumed that, in an imaginary America, half of all children exercised vigorously for about 25 minutes three times a week, such as during active recess or sports or, more ambitiously, ran around and moved for at least an hour every day, which is the amount of youth exercise recommended by the C.D.C., their virtual lives were transformed.

Most obviously, the incidence of childhood obesity fell by more than 4 percent, a change that resonated throughout the simulated children’s lives and society. There were about half a million fewer cases of adult-onset heart disease, diabetes, cancer and strokes in this simulation, and the society-wide costs associated with these illnesses dropped by about $32 billion every year if the children romped about for 25 minutes three times per week and by almost $37 billion if they moved for an hour every day.

The impacts were even more substantial when the researchers assumed that 100 percent of the children who are now sedentary got regular exercise. In this scenario, the annual total costs during adulthood from obesity-associated medical expenses and lost productivity plummeted by about $62 billion when children were active three times a week and by more than $120 billion every year when all of the virtual children played and moved for at least an hour each day.

From: https://www.nytimes.com May 3, 2017

T E X T

If all of the children who currently are sedentary started exercising every day, societies could save enormous amounts of money in the coming decades and have healthier citizens as a whole, according to a remarkable new study. In the United States alone, we could expect to save more than $120 billion every year in health care and associated expenses. The study is the first to use sophisticated computer simulations to arrive at a literal and sobering societal price tag for allowing our children to be sedentary.

Inactivity is, of course, widespread among young people today. Recent research shows that in the United States and Europe, physical activity tends to peak at about age 7 for both boys and girls and tail off continually throughout adolescence. More than two-thirds of children in the United States rarely exercise at all.

The immediate health consequences for inactive children and their families are worrisome. Childhood obesity, which is linked to lack of exercise, is common, as is the incidence of Type 2 diabetes and other health problems related to being overweight among children as young as 6.

But the long-term financial costs of inactivity in the young, both for them and society as a whole, have never been quantified. So for the new study, which was published this week in Health Affairs, researchers with the Global Obesity Prevention Center at Johns Hopkins University in Baltimore and other institutions decided to create a bogglingly complex computer model of what the future could look like if we do or do not get more of our children moving.

The researchers began by gathering as much public data as is currently available about the health, weight and physical activity patterns of all 31.7 million American children now aged 8 to 11, using large-scale databases from the Census Bureau, the Centers for Disease Control and Prevention, and other groups.

The researchers fed this information into a computerized modeling program that created an electronic avatar for every American child today. In line with reality, two-thirds of these children were programmed to rarely exercise and many were overweight or obese.

The scientists then had the simulated children grow up. Using estimations about how calorie intake and activity patterns affect body weight, the program changed each virtual child’s body day-by-day and year-by-year into adulthood. Most became increasingly overweight.

As the simulated children became adults, the scientists then modeled each one’s health, based on obesity-associated risks for heart disease, diabetes, stroke and cancer, and also the probable financial price of dealing with those diseases (adjusted for future inflation), both in terms of direct expenses for hospitalizations, drugs and so on, and lost productivity because of someone’s being ill.

The results were staggering. According to the computer model, the costs of today’s 8- to 11- year-olds being inactive and consequently overweight would be almost $3 trillion in medical expenses and lost productivity every year once the children reached adulthood and for decades until their deaths.

But when the researchers tweaked children’s activity levels within their model, the numbers began to look quite different. If they presumed that, in an imaginary America, half of all children exercised vigorously for about 25 minutes three times a week, such as during active recess or sports or, more ambitiously, ran around and moved for at least an hour every day, which is the amount of youth exercise recommended by the C.D.C., their virtual lives were transformed.

Most obviously, the incidence of childhood obesity fell by more than 4 percent, a change that resonated throughout the simulated children’s lives and society. There were about half a million fewer cases of adult-onset heart disease, diabetes, cancer and strokes in this simulation, and the society-wide costs associated with these illnesses dropped by about $32 billion every year if the children romped about for 25 minutes three times per week and by almost $37 billion if they moved for an hour every day.

The impacts were even more substantial when the researchers assumed that 100 percent of the children who are now sedentary got regular exercise. In this scenario, the annual total costs during adulthood from obesity-associated medical expenses and lost productivity plummeted by about $62 billion when children were active three times a week and by more than $120 billion every year when all of the virtual children played and moved for at least an hour each day.

From: https://www.nytimes.com May 3, 2017

T E X T

If all of the children who currently are sedentary started exercising every day, societies could save enormous amounts of money in the coming decades and have healthier citizens as a whole, according to a remarkable new study. In the United States alone, we could expect to save more than $120 billion every year in health care and associated expenses. The study is the first to use sophisticated computer simulations to arrive at a literal and sobering societal price tag for allowing our children to be sedentary.

Inactivity is, of course, widespread among young people today. Recent research shows that in the United States and Europe, physical activity tends to peak at about age 7 for both boys and girls and tail off continually throughout adolescence. More than two-thirds of children in the United States rarely exercise at all.

The immediate health consequences for inactive children and their families are worrisome. Childhood obesity, which is linked to lack of exercise, is common, as is the incidence of Type 2 diabetes and other health problems related to being overweight among children as young as 6.

But the long-term financial costs of inactivity in the young, both for them and society as a whole, have never been quantified. So for the new study, which was published this week in Health Affairs, researchers with the Global Obesity Prevention Center at Johns Hopkins University in Baltimore and other institutions decided to create a bogglingly complex computer model of what the future could look like if we do or do not get more of our children moving.

The researchers began by gathering as much public data as is currently available about the health, weight and physical activity patterns of all 31.7 million American children now aged 8 to 11, using large-scale databases from the Census Bureau, the Centers for Disease Control and Prevention, and other groups.

The researchers fed this information into a computerized modeling program that created an electronic avatar for every American child today. In line with reality, two-thirds of these children were programmed to rarely exercise and many were overweight or obese.

The scientists then had the simulated children grow up. Using estimations about how calorie intake and activity patterns affect body weight, the program changed each virtual child’s body day-by-day and year-by-year into adulthood. Most became increasingly overweight.

As the simulated children became adults, the scientists then modeled each one’s health, based on obesity-associated risks for heart disease, diabetes, stroke and cancer, and also the probable financial price of dealing with those diseases (adjusted for future inflation), both in terms of direct expenses for hospitalizations, drugs and so on, and lost productivity because of someone’s being ill.

The results were staggering. According to the computer model, the costs of today’s 8- to 11- year-olds being inactive and consequently overweight would be almost $3 trillion in medical expenses and lost productivity every year once the children reached adulthood and for decades until their deaths.

But when the researchers tweaked children’s activity levels within their model, the numbers began to look quite different. If they presumed that, in an imaginary America, half of all children exercised vigorously for about 25 minutes three times a week, such as during active recess or sports or, more ambitiously, ran around and moved for at least an hour every day, which is the amount of youth exercise recommended by the C.D.C., their virtual lives were transformed.

Most obviously, the incidence of childhood obesity fell by more than 4 percent, a change that resonated throughout the simulated children’s lives and society. There were about half a million fewer cases of adult-onset heart disease, diabetes, cancer and strokes in this simulation, and the society-wide costs associated with these illnesses dropped by about $32 billion every year if the children romped about for 25 minutes three times per week and by almost $37 billion if they moved for an hour every day.

The impacts were even more substantial when the researchers assumed that 100 percent of the children who are now sedentary got regular exercise. In this scenario, the annual total costs during adulthood from obesity-associated medical expenses and lost productivity plummeted by about $62 billion when children were active three times a week and by more than $120 billion every year when all of the virtual children played and moved for at least an hour each day.

From: https://www.nytimes.com May 3, 2017