Questões de Vestibular IFF 2018 para Vestibular - Segundo Semestre

Foram encontradas 5 questões

Shares in the music streaming firm Spotify will be publicly traded for the first time when the firm debuts on the New York market.

The flotation marks a turning point for the firm that after 12 years has not yet made a profit. Spotify's listing, which could value it at $20billion (£14 billion), is unconventional: it is not issuing any new shares. Instead, shares held by the firm's private investors will be made available.

What was once an small upstart Swedish music platform, has grown rapidly in recent years, adding millions of users to its free-to-use ad-funded service, and converting many of them to its more lucrative subscription service. It's used in 61 countries, has 159 million active users and a library of 35 million songs. They developed the platform in 2006 as a response to the growing piracy problem the music industry was facing. It is now the global leader among music streaming companies, boasting 71 million paying customers, twice as many as runner-up Apple.

What Spotify must do to survive? So far costs and fees to recording companies for the rights to play their music, have exceeded Spotify's revenues. And some analysts predict the listing will speed-up Spotify's race towards profitability. "When that's done we'll see a bit of a shift in strategy and direction." says Mark Mulligan at MIDia Research. The firm made a commitment to investors who backed it as the company was growing, that they would be given the chance to cash in their investment. The streaming giant has filed for paperwork to start trading its shares publicly on the New York Stock Exchange.

What will Spotify look like in the future? So what will change? "So far they've been treading a very fine line between being the dramatic new future of the music business but simultaneously being the biggest friend of the old music industry by giving record labels a platform to build out of decline," says Mr Mulligan.

"To go to the next phase [Spotify] will have to stop being so friendly to the record companies." More than half of Spotify's revenue goes directly to the record companies. Chris Hayes expects Spotify to evolve. "I think over time they're going to have to diversify their offering." he says, helping to set them apart from a sea of rival streaming services. They have already moved into podcasts and producing original music. They may well start to offer more original content like Taylor Swift's recent video which was only made available on the platform, says Chris Hayes.

So can Spotify make money? The firm's first operating profit (not including debt financing) is on the horizon for 2019 based on current trends, according to Mr Hayes. "The strategy has always been the free tier, but it is a funnel through which to persuade free users to upgrade to the subscription tier which is lucrative.

"As long as subscriptions continue to grow it should eventually become profitable. "Spotify's rivals are the biggest companies in the world with bottomless pockets," he says, and they are using music as a way to sell their core products, not as a business proposition in itself.

Apple, Amazon and Google are also in the streaming game and - unlike Spotify - all sell devices on which consumers can listen to music. And while Spotify has signed deals with all the "big three" record labels - Warner, Universal and Sony - it is the music executives that still hold the bargaining chips.

Adapted from: http://www.bbc.com/news/business-43613398. Acesso em: 03 abr. 2018.

Shares in the music streaming firm Spotify will be publicly traded for the first time when the firm debuts on the New York market.

The flotation marks a turning point for the firm that after 12 years has not yet made a profit. Spotify's listing, which could value it at $20billion (£14 billion), is unconventional: it is not issuing any new shares. Instead, shares held by the firm's private investors will be made available.

What was once an small upstart Swedish music platform, has grown rapidly in recent years, adding millions of users to its free-to-use ad-funded service, and converting many of them to its more lucrative subscription service. It's used in 61 countries, has 159 million active users and a library of 35 million songs. They developed the platform in 2006 as a response to the growing piracy problem the music industry was facing. It is now the global leader among music streaming companies, boasting 71 million paying customers, twice as many as runner-up Apple.

What Spotify must do to survive? So far costs and fees to recording companies for the rights to play their music, have exceeded Spotify's revenues. And some analysts predict the listing will speed-up Spotify's race towards profitability. "When that's done we'll see a bit of a shift in strategy and direction." says Mark Mulligan at MIDia Research. The firm made a commitment to investors who backed it as the company was growing, that they would be given the chance to cash in their investment. The streaming giant has filed for paperwork to start trading its shares publicly on the New York Stock Exchange.

What will Spotify look like in the future? So what will change? "So far they've been treading a very fine line between being the dramatic new future of the music business but simultaneously being the biggest friend of the old music industry by giving record labels a platform to build out of decline," says Mr Mulligan.

"To go to the next phase [Spotify] will have to stop being so friendly to the record companies." More than half of Spotify's revenue goes directly to the record companies. Chris Hayes expects Spotify to evolve. "I think over time they're going to have to diversify their offering." he says, helping to set them apart from a sea of rival streaming services. They have already moved into podcasts and producing original music. They may well start to offer more original content like Taylor Swift's recent video which was only made available on the platform, says Chris Hayes.

So can Spotify make money? The firm's first operating profit (not including debt financing) is on the horizon for 2019 based on current trends, according to Mr Hayes. "The strategy has always been the free tier, but it is a funnel through which to persuade free users to upgrade to the subscription tier which is lucrative.

"As long as subscriptions continue to grow it should eventually become profitable. "Spotify's rivals are the biggest companies in the world with bottomless pockets," he says, and they are using music as a way to sell their core products, not as a business proposition in itself.

Apple, Amazon and Google are also in the streaming game and - unlike Spotify - all sell devices on which consumers can listen to music. And while Spotify has signed deals with all the "big three" record labels - Warner, Universal and Sony - it is the music executives that still hold the bargaining chips.

Adapted from: http://www.bbc.com/news/business-43613398. Acesso em: 03 abr. 2018.

Shares in the music streaming firm Spotify will be publicly traded for the first time when the firm debuts on the New York market.

The flotation marks a turning point for the firm that after 12 years has not yet made a profit. Spotify's listing, which could value it at $20billion (£14 billion), is unconventional: it is not issuing any new shares. Instead, shares held by the firm's private investors will be made available.

What was once an small upstart Swedish music platform, has grown rapidly in recent years, adding millions of users to its free-to-use ad-funded service, and converting many of them to its more lucrative subscription service. It's used in 61 countries, has 159 million active users and a library of 35 million songs. They developed the platform in 2006 as a response to the growing piracy problem the music industry was facing. It is now the global leader among music streaming companies, boasting 71 million paying customers, twice as many as runner-up Apple.

What Spotify must do to survive? So far costs and fees to recording companies for the rights to play their music, have exceeded Spotify's revenues. And some analysts predict the listing will speed-up Spotify's race towards profitability. "When that's done we'll see a bit of a shift in strategy and direction." says Mark Mulligan at MIDia Research. The firm made a commitment to investors who backed it as the company was growing, that they would be given the chance to cash in their investment. The streaming giant has filed for paperwork to start trading its shares publicly on the New York Stock Exchange.

What will Spotify look like in the future? So what will change? "So far they've been treading a very fine line between being the dramatic new future of the music business but simultaneously being the biggest friend of the old music industry by giving record labels a platform to build out of decline," says Mr Mulligan.

"To go to the next phase [Spotify] will have to stop being so friendly to the record companies." More than half of Spotify's revenue goes directly to the record companies. Chris Hayes expects Spotify to evolve. "I think over time they're going to have to diversify their offering." he says, helping to set them apart from a sea of rival streaming services. They have already moved into podcasts and producing original music. They may well start to offer more original content like Taylor Swift's recent video which was only made available on the platform, says Chris Hayes.

So can Spotify make money? The firm's first operating profit (not including debt financing) is on the horizon for 2019 based on current trends, according to Mr Hayes. "The strategy has always been the free tier, but it is a funnel through which to persuade free users to upgrade to the subscription tier which is lucrative.

"As long as subscriptions continue to grow it should eventually become profitable. "Spotify's rivals are the biggest companies in the world with bottomless pockets," he says, and they are using music as a way to sell their core products, not as a business proposition in itself.

Apple, Amazon and Google are also in the streaming game and - unlike Spotify - all sell devices on which consumers can listen to music. And while Spotify has signed deals with all the "big three" record labels - Warner, Universal and Sony - it is the music executives that still hold the bargaining chips.

Adapted from: http://www.bbc.com/news/business-43613398. Acesso em: 03 abr. 2018.

Shares in the music streaming firm Spotify will be publicly traded for the first time when the firm debuts on the New York market.

The flotation marks a turning point for the firm that after 12 years has not yet made a profit. Spotify's listing, which could value it at $20billion (£14 billion), is unconventional: it is not issuing any new shares. Instead, shares held by the firm's private investors will be made available.

What was once an small upstart Swedish music platform, has grown rapidly in recent years, adding millions of users to its free-to-use ad-funded service, and converting many of them to its more lucrative subscription service. It's used in 61 countries, has 159 million active users and a library of 35 million songs. They developed the platform in 2006 as a response to the growing piracy problem the music industry was facing. It is now the global leader among music streaming companies, boasting 71 million paying customers, twice as many as runner-up Apple.

What Spotify must do to survive? So far costs and fees to recording companies for the rights to play their music, have exceeded Spotify's revenues. And some analysts predict the listing will speed-up Spotify's race towards profitability. "When that's done we'll see a bit of a shift in strategy and direction." says Mark Mulligan at MIDia Research. The firm made a commitment to investors who backed it as the company was growing, that they would be given the chance to cash in their investment. The streaming giant has filed for paperwork to start trading its shares publicly on the New York Stock Exchange.

What will Spotify look like in the future? So what will change? "So far they've been treading a very fine line between being the dramatic new future of the music business but simultaneously being the biggest friend of the old music industry by giving record labels a platform to build out of decline," says Mr Mulligan.

"To go to the next phase [Spotify] will have to stop being so friendly to the record companies." More than half of Spotify's revenue goes directly to the record companies. Chris Hayes expects Spotify to evolve. "I think over time they're going to have to diversify their offering." he says, helping to set them apart from a sea of rival streaming services. They have already moved into podcasts and producing original music. They may well start to offer more original content like Taylor Swift's recent video which was only made available on the platform, says Chris Hayes.

So can Spotify make money? The firm's first operating profit (not including debt financing) is on the horizon for 2019 based on current trends, according to Mr Hayes. "The strategy has always been the free tier, but it is a funnel through which to persuade free users to upgrade to the subscription tier which is lucrative.

"As long as subscriptions continue to grow it should eventually become profitable. "Spotify's rivals are the biggest companies in the world with bottomless pockets," he says, and they are using music as a way to sell their core products, not as a business proposition in itself.

Apple, Amazon and Google are also in the streaming game and - unlike Spotify - all sell devices on which consumers can listen to music. And while Spotify has signed deals with all the "big three" record labels - Warner, Universal and Sony - it is the music executives that still hold the bargaining chips.

Adapted from: http://www.bbc.com/news/business-43613398. Acesso em: 03 abr. 2018.

Shares in the music streaming firm Spotify will be publicly traded for the first time when the firm debuts on the New York market.

The flotation marks a turning point for the firm that after 12 years has not yet made a profit. Spotify's listing, which could value it at $20billion (£14 billion), is unconventional: it is not issuing any new shares. Instead, shares held by the firm's private investors will be made available.

What was once an small upstart Swedish music platform, has grown rapidly in recent years, adding millions of users to its free-to-use ad-funded service, and converting many of them to its more lucrative subscription service. It's used in 61 countries, has 159 million active users and a library of 35 million songs. They developed the platform in 2006 as a response to the growing piracy problem the music industry was facing. It is now the global leader among music streaming companies, boasting 71 million paying customers, twice as many as runner-up Apple.

What Spotify must do to survive? So far costs and fees to recording companies for the rights to play their music, have exceeded Spotify's revenues. And some analysts predict the listing will speed-up Spotify's race towards profitability. "When that's done we'll see a bit of a shift in strategy and direction." says Mark Mulligan at MIDia Research. The firm made a commitment to investors who backed it as the company was growing, that they would be given the chance to cash in their investment. The streaming giant has filed for paperwork to start trading its shares publicly on the New York Stock Exchange.

What will Spotify look like in the future? So what will change? "So far they've been treading a very fine line between being the dramatic new future of the music business but simultaneously being the biggest friend of the old music industry by giving record labels a platform to build out of decline," says Mr Mulligan.

"To go to the next phase [Spotify] will have to stop being so friendly to the record companies." More than half of Spotify's revenue goes directly to the record companies. Chris Hayes expects Spotify to evolve. "I think over time they're going to have to diversify their offering." he says, helping to set them apart from a sea of rival streaming services. They have already moved into podcasts and producing original music. They may well start to offer more original content like Taylor Swift's recent video which was only made available on the platform, says Chris Hayes.

So can Spotify make money? The firm's first operating profit (not including debt financing) is on the horizon for 2019 based on current trends, according to Mr Hayes. "The strategy has always been the free tier, but it is a funnel through which to persuade free users to upgrade to the subscription tier which is lucrative.

"As long as subscriptions continue to grow it should eventually become profitable. "Spotify's rivals are the biggest companies in the world with bottomless pockets," he says, and they are using music as a way to sell their core products, not as a business proposition in itself.

Apple, Amazon and Google are also in the streaming game and - unlike Spotify - all sell devices on which consumers can listen to music. And while Spotify has signed deals with all the "big three" record labels - Warner, Universal and Sony - it is the music executives that still hold the bargaining chips.

Adapted from: http://www.bbc.com/news/business-43613398. Acesso em: 03 abr. 2018.

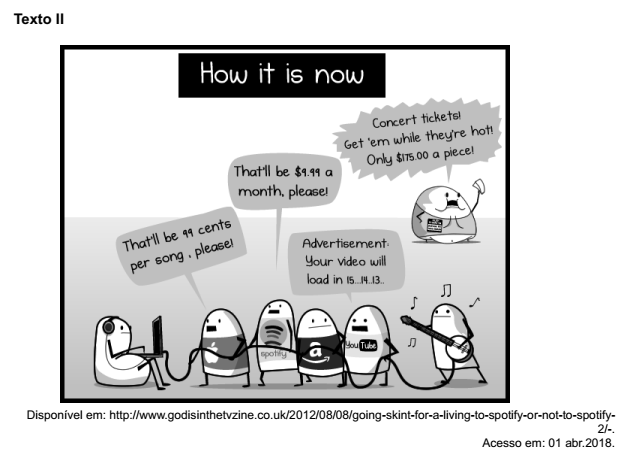

Após a leitura do texto I, “Spotify braces for $20billion US share market listing”, e da charge

acima, marque a alternativa INCORRETA: