Questões de Vestibular UECE 2015 para Vestibular - Primeiro Semestre

Foram encontradas 60 questões

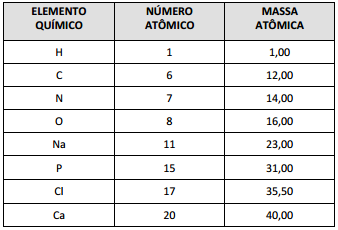

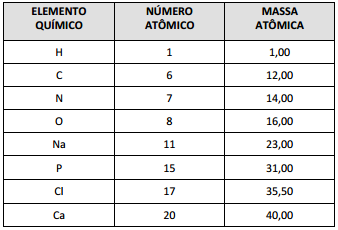

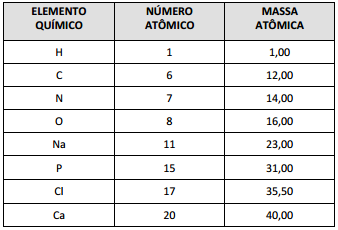

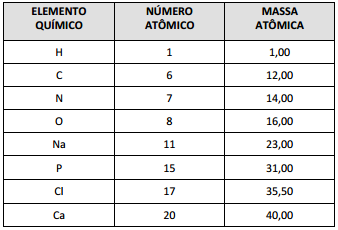

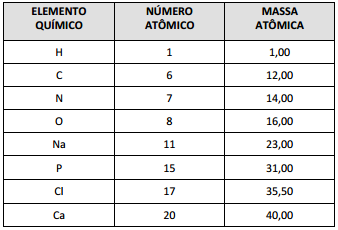

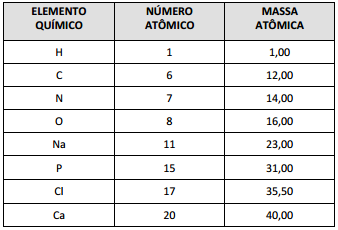

DADOS QUE PODEM SER USADOS NESTA PROVA

DADOS QUE PODEM SER USADOS NESTA PROVA

DADOS QUE PODEM SER USADOS NESTA PROVA

DADOS QUE PODEM SER USADOS NESTA PROVA

DADOS QUE PODEM SER USADOS NESTA PROVA

Um carro estacionado na sombra durante um dia, com as janelas fechadas, pode conter de 400 a 800 mg de benzeno. Se está ao sol, o nível de benzeno subirá de 2000 a 4000 mg. A pessoa que entra no carro e mantém as janelas fechadas, inevitavelmente aspirará, em rápida sucessão, excessivas quantidades dessa toxina. O benzeno é uma toxina que afeta os rins e o fígado, e o que é pior, é extremamente difícil para o organismo expulsar esta substância tóxica. Por essa razão, os manuais de instruções de uso dos carros indicam que antes de ligar o ar condicionado, deve-se primeiramente abrir as janelas e deixá-las abertas por um tempo de dois minutos.

Com relação ao benzeno, assinale a afirmação

correta.

DADOS QUE PODEM SER USADOS NESTA PROVA

O fermento é responsável pelo aumento do volume de um bolo, que acontece assim: a temperatura alta faz com que o fermento libere gás carbônico; esse gás se expande e faz o bolo crescer. Quando adicionado na massa, o fermento sofre uma transformação química a partir da reação entre bicarbonato de sódio e fosfato dihidrogenado de cálcio:

NaHCO3 + Ca(H2 PO4)2 —–>

Assinale a opção que apresenta corretamente os

produtos ajustados dessa reação química.

As doenças ligadas à genética são muitas e variadas, e algumas dessas patologias aparentam não ter muita importância, uma vez que não são quantitativamente significantes, como é o caso da polidactilia. Há uma variação muito grande em sua expressão, desde a presença de um dedo extra, completamente desenvolvido, até a de uma simples saliência carnosa. Distinguem-se dois tipos de polidactilia: a pós–axial, do lado cubital da mão ou do lado peroneal do pé, e a pré–axial, do lado radial da mão ou tibial do pé.

(http://fisiounec2015.blogspot.com.br/2011/05/polidactilia.h tml).

No que concerne à polidactilia, é correto afirmar que

Em seu artigo “Mecanismos Redox de Compostos Aromáticos, Aminoácidos e Proteínas, em Eléctrodos de Carbono”, Teodor Adrian Enache, pesquisador da Faculdade de Ciências e Tecnologia, da Universidade de Coimbra, Portugal, discute a reação entre oxidação e aminoácidos.

Assinale a afirmação verdadeira a respeito dessa

reação.

TEXT

Five years ago, the book world was seized by collective panic over the uncertain future of print.

As readers migrated to new digital devices, ebook sales soared, up 1,260 percent between 2008 and 2010, alarming booksellers that watched consumers use their stores to find titles they would later buy online. Print sales dwindled, bookstores struggled to stay open, and publishers and authors feared that cheaper e-books would cannibalize their business.

Then in 2011, the industry’s fears were realized when Borders declared bankruptcy.

“E-books were this rocket ship going straight up,” said Len Vlahos, a former executive director of the Book Industry Study Group, a nonprofit research group that tracks the publishing industry. “Just about everybody you talked to thought we were going the way of digital music.”

But the digital apocalypse never arrived, or at least not on schedule. While analysts once predicted that e-books would overtake print by 2015, digital sales have instead slowed sharply.

Now, there are signs that some e-book adopters are returning to print, or becoming hybrid readers, who juggle devices and paper. E-book sales fell by 10 percent in the first five months of this year, according to the Association of American Publishers, which collects data from nearly 1,200 publishers. Digital books accounted last year for around 20 percent of the market, roughly the same as they did a few years ago.

E-books’ declining popularity may signal that publishing, while not immune to technological upheaval, will weather the tidal wave of digital technology better than other forms of media, like music and television.

E-book subscription services, modeled on companies like Netflix and Pandora, have struggled to convert book lovers into digital binge readers, and some have shut down. Sales of dedicated e-reading devices have plunged as consumers migrated to tablets and smartphones. And according to some surveys, young readers who are digital natives still prefer reading on paper.

The surprising resilience of print has provided a lift to many booksellers. Independent bookstores, which were battered by the recession and competition from Amazon, are showing strong signs of resurgence. The American Booksellers Association counted 1,712 member stores in 2,227 locations in 2015, up from 1,410 in 1,660 locations five years ago.

Publishers, seeking to capitalize on the shift, are pouring money into their print infrastructures and distribution. Penguin Random House has invested nearly $100 million in expanding and updating its warehouses and speeding up distribution of its books. It added 365,000 square feet last year to its warehouse in Crawfordsville, Ind., more than doubling the size of the warehouse.

“People talked about the demise of physical books as if it was only a matter of time, but even 50 to 100 years from now, print will be a big chunk of our business,” said Markus Dohle, the chief executive of Penguin Random House, which has nearly 250 imprints globally. Print books account for more than 70 percent of the company’s sales in the United States.

Some 12 million e-readers were sold last year, a steep drop from the nearly 20 million sold in 2011, according to Forrester Research. The portion of people who read books primarily on e-readers fell to 32 percent in the first quarter of 2015, from 50 percent in 2012, a Nielsen survey showed.

The tug of war between pixels and print almost certainly isn’t over. Industry analysts and publishing executives say it is too soon to declare the death of the digital publishing revolution. An appealing new device might come along. Already, a growing number of people are reading e-books on their cellphones. Amazon recently unveiled a new tablet for $50, which could draw a new wave of customers to e-books (the first-generation Kindle cost $400)

At Amazon, digital book sales have maintained their upward trajectory, according to Russell Grandinetti, senior vice president of Kindle. Last year, Amazon, which controls some 65 percent of the e-book market, introduced an e-book subscription service that allows readers to pay a flat monthly fee of $10 for unlimited digital reading. It offers more than a million titles, many of them from selfpublished authors.

Some publishing executives say the world is changing too quickly to declare that the digital tide is waning.

“Maybe it’s just a pause here,” said Carolyn Reidy, the president and chief executive of Simon & Schuster. “Will the next generation want to read books on their smartphones, and will we see another burst come?”

www.nytimes.com/2015/09/23

TEXT

Five years ago, the book world was seized by collective panic over the uncertain future of print.

As readers migrated to new digital devices, ebook sales soared, up 1,260 percent between 2008 and 2010, alarming booksellers that watched consumers use their stores to find titles they would later buy online. Print sales dwindled, bookstores struggled to stay open, and publishers and authors feared that cheaper e-books would cannibalize their business.

Then in 2011, the industry’s fears were realized when Borders declared bankruptcy.

“E-books were this rocket ship going straight up,” said Len Vlahos, a former executive director of the Book Industry Study Group, a nonprofit research group that tracks the publishing industry. “Just about everybody you talked to thought we were going the way of digital music.”

But the digital apocalypse never arrived, or at least not on schedule. While analysts once predicted that e-books would overtake print by 2015, digital sales have instead slowed sharply.

Now, there are signs that some e-book adopters are returning to print, or becoming hybrid readers, who juggle devices and paper. E-book sales fell by 10 percent in the first five months of this year, according to the Association of American Publishers, which collects data from nearly 1,200 publishers. Digital books accounted last year for around 20 percent of the market, roughly the same as they did a few years ago.

E-books’ declining popularity may signal that publishing, while not immune to technological upheaval, will weather the tidal wave of digital technology better than other forms of media, like music and television.

E-book subscription services, modeled on companies like Netflix and Pandora, have struggled to convert book lovers into digital binge readers, and some have shut down. Sales of dedicated e-reading devices have plunged as consumers migrated to tablets and smartphones. And according to some surveys, young readers who are digital natives still prefer reading on paper.

The surprising resilience of print has provided a lift to many booksellers. Independent bookstores, which were battered by the recession and competition from Amazon, are showing strong signs of resurgence. The American Booksellers Association counted 1,712 member stores in 2,227 locations in 2015, up from 1,410 in 1,660 locations five years ago.

Publishers, seeking to capitalize on the shift, are pouring money into their print infrastructures and distribution. Penguin Random House has invested nearly $100 million in expanding and updating its warehouses and speeding up distribution of its books. It added 365,000 square feet last year to its warehouse in Crawfordsville, Ind., more than doubling the size of the warehouse.

“People talked about the demise of physical books as if it was only a matter of time, but even 50 to 100 years from now, print will be a big chunk of our business,” said Markus Dohle, the chief executive of Penguin Random House, which has nearly 250 imprints globally. Print books account for more than 70 percent of the company’s sales in the United States.

Some 12 million e-readers were sold last year, a steep drop from the nearly 20 million sold in 2011, according to Forrester Research. The portion of people who read books primarily on e-readers fell to 32 percent in the first quarter of 2015, from 50 percent in 2012, a Nielsen survey showed.

The tug of war between pixels and print almost certainly isn’t over. Industry analysts and publishing executives say it is too soon to declare the death of the digital publishing revolution. An appealing new device might come along. Already, a growing number of people are reading e-books on their cellphones. Amazon recently unveiled a new tablet for $50, which could draw a new wave of customers to e-books (the first-generation Kindle cost $400)

At Amazon, digital book sales have maintained their upward trajectory, according to Russell Grandinetti, senior vice president of Kindle. Last year, Amazon, which controls some 65 percent of the e-book market, introduced an e-book subscription service that allows readers to pay a flat monthly fee of $10 for unlimited digital reading. It offers more than a million titles, many of them from selfpublished authors.

Some publishing executives say the world is changing too quickly to declare that the digital tide is waning.

“Maybe it’s just a pause here,” said Carolyn Reidy, the president and chief executive of Simon & Schuster. “Will the next generation want to read books on their smartphones, and will we see another burst come?”

www.nytimes.com/2015/09/23

TEXT

Five years ago, the book world was seized by collective panic over the uncertain future of print.

As readers migrated to new digital devices, ebook sales soared, up 1,260 percent between 2008 and 2010, alarming booksellers that watched consumers use their stores to find titles they would later buy online. Print sales dwindled, bookstores struggled to stay open, and publishers and authors feared that cheaper e-books would cannibalize their business.

Then in 2011, the industry’s fears were realized when Borders declared bankruptcy.

“E-books were this rocket ship going straight up,” said Len Vlahos, a former executive director of the Book Industry Study Group, a nonprofit research group that tracks the publishing industry. “Just about everybody you talked to thought we were going the way of digital music.”

But the digital apocalypse never arrived, or at least not on schedule. While analysts once predicted that e-books would overtake print by 2015, digital sales have instead slowed sharply.

Now, there are signs that some e-book adopters are returning to print, or becoming hybrid readers, who juggle devices and paper. E-book sales fell by 10 percent in the first five months of this year, according to the Association of American Publishers, which collects data from nearly 1,200 publishers. Digital books accounted last year for around 20 percent of the market, roughly the same as they did a few years ago.

E-books’ declining popularity may signal that publishing, while not immune to technological upheaval, will weather the tidal wave of digital technology better than other forms of media, like music and television.

E-book subscription services, modeled on companies like Netflix and Pandora, have struggled to convert book lovers into digital binge readers, and some have shut down. Sales of dedicated e-reading devices have plunged as consumers migrated to tablets and smartphones. And according to some surveys, young readers who are digital natives still prefer reading on paper.

The surprising resilience of print has provided a lift to many booksellers. Independent bookstores, which were battered by the recession and competition from Amazon, are showing strong signs of resurgence. The American Booksellers Association counted 1,712 member stores in 2,227 locations in 2015, up from 1,410 in 1,660 locations five years ago.

Publishers, seeking to capitalize on the shift, are pouring money into their print infrastructures and distribution. Penguin Random House has invested nearly $100 million in expanding and updating its warehouses and speeding up distribution of its books. It added 365,000 square feet last year to its warehouse in Crawfordsville, Ind., more than doubling the size of the warehouse.

“People talked about the demise of physical books as if it was only a matter of time, but even 50 to 100 years from now, print will be a big chunk of our business,” said Markus Dohle, the chief executive of Penguin Random House, which has nearly 250 imprints globally. Print books account for more than 70 percent of the company’s sales in the United States.

Some 12 million e-readers were sold last year, a steep drop from the nearly 20 million sold in 2011, according to Forrester Research. The portion of people who read books primarily on e-readers fell to 32 percent in the first quarter of 2015, from 50 percent in 2012, a Nielsen survey showed.

The tug of war between pixels and print almost certainly isn’t over. Industry analysts and publishing executives say it is too soon to declare the death of the digital publishing revolution. An appealing new device might come along. Already, a growing number of people are reading e-books on their cellphones. Amazon recently unveiled a new tablet for $50, which could draw a new wave of customers to e-books (the first-generation Kindle cost $400)

At Amazon, digital book sales have maintained their upward trajectory, according to Russell Grandinetti, senior vice president of Kindle. Last year, Amazon, which controls some 65 percent of the e-book market, introduced an e-book subscription service that allows readers to pay a flat monthly fee of $10 for unlimited digital reading. It offers more than a million titles, many of them from selfpublished authors.

Some publishing executives say the world is changing too quickly to declare that the digital tide is waning.

“Maybe it’s just a pause here,” said Carolyn Reidy, the president and chief executive of Simon & Schuster. “Will the next generation want to read books on their smartphones, and will we see another burst come?”

www.nytimes.com/2015/09/23

TEXT

Five years ago, the book world was seized by collective panic over the uncertain future of print.

As readers migrated to new digital devices, ebook sales soared, up 1,260 percent between 2008 and 2010, alarming booksellers that watched consumers use their stores to find titles they would later buy online. Print sales dwindled, bookstores struggled to stay open, and publishers and authors feared that cheaper e-books would cannibalize their business.

Then in 2011, the industry’s fears were realized when Borders declared bankruptcy.

“E-books were this rocket ship going straight up,” said Len Vlahos, a former executive director of the Book Industry Study Group, a nonprofit research group that tracks the publishing industry. “Just about everybody you talked to thought we were going the way of digital music.”

But the digital apocalypse never arrived, or at least not on schedule. While analysts once predicted that e-books would overtake print by 2015, digital sales have instead slowed sharply.

Now, there are signs that some e-book adopters are returning to print, or becoming hybrid readers, who juggle devices and paper. E-book sales fell by 10 percent in the first five months of this year, according to the Association of American Publishers, which collects data from nearly 1,200 publishers. Digital books accounted last year for around 20 percent of the market, roughly the same as they did a few years ago.

E-books’ declining popularity may signal that publishing, while not immune to technological upheaval, will weather the tidal wave of digital technology better than other forms of media, like music and television.

E-book subscription services, modeled on companies like Netflix and Pandora, have struggled to convert book lovers into digital binge readers, and some have shut down. Sales of dedicated e-reading devices have plunged as consumers migrated to tablets and smartphones. And according to some surveys, young readers who are digital natives still prefer reading on paper.

The surprising resilience of print has provided a lift to many booksellers. Independent bookstores, which were battered by the recession and competition from Amazon, are showing strong signs of resurgence. The American Booksellers Association counted 1,712 member stores in 2,227 locations in 2015, up from 1,410 in 1,660 locations five years ago.

Publishers, seeking to capitalize on the shift, are pouring money into their print infrastructures and distribution. Penguin Random House has invested nearly $100 million in expanding and updating its warehouses and speeding up distribution of its books. It added 365,000 square feet last year to its warehouse in Crawfordsville, Ind., more than doubling the size of the warehouse.

“People talked about the demise of physical books as if it was only a matter of time, but even 50 to 100 years from now, print will be a big chunk of our business,” said Markus Dohle, the chief executive of Penguin Random House, which has nearly 250 imprints globally. Print books account for more than 70 percent of the company’s sales in the United States.

Some 12 million e-readers were sold last year, a steep drop from the nearly 20 million sold in 2011, according to Forrester Research. The portion of people who read books primarily on e-readers fell to 32 percent in the first quarter of 2015, from 50 percent in 2012, a Nielsen survey showed.

The tug of war between pixels and print almost certainly isn’t over. Industry analysts and publishing executives say it is too soon to declare the death of the digital publishing revolution. An appealing new device might come along. Already, a growing number of people are reading e-books on their cellphones. Amazon recently unveiled a new tablet for $50, which could draw a new wave of customers to e-books (the first-generation Kindle cost $400)

At Amazon, digital book sales have maintained their upward trajectory, according to Russell Grandinetti, senior vice president of Kindle. Last year, Amazon, which controls some 65 percent of the e-book market, introduced an e-book subscription service that allows readers to pay a flat monthly fee of $10 for unlimited digital reading. It offers more than a million titles, many of them from selfpublished authors.

Some publishing executives say the world is changing too quickly to declare that the digital tide is waning.

“Maybe it’s just a pause here,” said Carolyn Reidy, the president and chief executive of Simon & Schuster. “Will the next generation want to read books on their smartphones, and will we see another burst come?”

www.nytimes.com/2015/09/23

TEXT

Five years ago, the book world was seized by collective panic over the uncertain future of print.

As readers migrated to new digital devices, ebook sales soared, up 1,260 percent between 2008 and 2010, alarming booksellers that watched consumers use their stores to find titles they would later buy online. Print sales dwindled, bookstores struggled to stay open, and publishers and authors feared that cheaper e-books would cannibalize their business.

Then in 2011, the industry’s fears were realized when Borders declared bankruptcy.

“E-books were this rocket ship going straight up,” said Len Vlahos, a former executive director of the Book Industry Study Group, a nonprofit research group that tracks the publishing industry. “Just about everybody you talked to thought we were going the way of digital music.”

But the digital apocalypse never arrived, or at least not on schedule. While analysts once predicted that e-books would overtake print by 2015, digital sales have instead slowed sharply.

Now, there are signs that some e-book adopters are returning to print, or becoming hybrid readers, who juggle devices and paper. E-book sales fell by 10 percent in the first five months of this year, according to the Association of American Publishers, which collects data from nearly 1,200 publishers. Digital books accounted last year for around 20 percent of the market, roughly the same as they did a few years ago.

E-books’ declining popularity may signal that publishing, while not immune to technological upheaval, will weather the tidal wave of digital technology better than other forms of media, like music and television.

E-book subscription services, modeled on companies like Netflix and Pandora, have struggled to convert book lovers into digital binge readers, and some have shut down. Sales of dedicated e-reading devices have plunged as consumers migrated to tablets and smartphones. And according to some surveys, young readers who are digital natives still prefer reading on paper.

The surprising resilience of print has provided a lift to many booksellers. Independent bookstores, which were battered by the recession and competition from Amazon, are showing strong signs of resurgence. The American Booksellers Association counted 1,712 member stores in 2,227 locations in 2015, up from 1,410 in 1,660 locations five years ago.

Publishers, seeking to capitalize on the shift, are pouring money into their print infrastructures and distribution. Penguin Random House has invested nearly $100 million in expanding and updating its warehouses and speeding up distribution of its books. It added 365,000 square feet last year to its warehouse in Crawfordsville, Ind., more than doubling the size of the warehouse.

“People talked about the demise of physical books as if it was only a matter of time, but even 50 to 100 years from now, print will be a big chunk of our business,” said Markus Dohle, the chief executive of Penguin Random House, which has nearly 250 imprints globally. Print books account for more than 70 percent of the company’s sales in the United States.

Some 12 million e-readers were sold last year, a steep drop from the nearly 20 million sold in 2011, according to Forrester Research. The portion of people who read books primarily on e-readers fell to 32 percent in the first quarter of 2015, from 50 percent in 2012, a Nielsen survey showed.

The tug of war between pixels and print almost certainly isn’t over. Industry analysts and publishing executives say it is too soon to declare the death of the digital publishing revolution. An appealing new device might come along. Already, a growing number of people are reading e-books on their cellphones. Amazon recently unveiled a new tablet for $50, which could draw a new wave of customers to e-books (the first-generation Kindle cost $400)

At Amazon, digital book sales have maintained their upward trajectory, according to Russell Grandinetti, senior vice president of Kindle. Last year, Amazon, which controls some 65 percent of the e-book market, introduced an e-book subscription service that allows readers to pay a flat monthly fee of $10 for unlimited digital reading. It offers more than a million titles, many of them from selfpublished authors.

Some publishing executives say the world is changing too quickly to declare that the digital tide is waning.

“Maybe it’s just a pause here,” said Carolyn Reidy, the president and chief executive of Simon & Schuster. “Will the next generation want to read books on their smartphones, and will we see another burst come?”

www.nytimes.com/2015/09/23

TEXT

Five years ago, the book world was seized by collective panic over the uncertain future of print.

As readers migrated to new digital devices, ebook sales soared, up 1,260 percent between 2008 and 2010, alarming booksellers that watched consumers use their stores to find titles they would later buy online. Print sales dwindled, bookstores struggled to stay open, and publishers and authors feared that cheaper e-books would cannibalize their business.

Then in 2011, the industry’s fears were realized when Borders declared bankruptcy.

“E-books were this rocket ship going straight up,” said Len Vlahos, a former executive director of the Book Industry Study Group, a nonprofit research group that tracks the publishing industry. “Just about everybody you talked to thought we were going the way of digital music.”

But the digital apocalypse never arrived, or at least not on schedule. While analysts once predicted that e-books would overtake print by 2015, digital sales have instead slowed sharply.

Now, there are signs that some e-book adopters are returning to print, or becoming hybrid readers, who juggle devices and paper. E-book sales fell by 10 percent in the first five months of this year, according to the Association of American Publishers, which collects data from nearly 1,200 publishers. Digital books accounted last year for around 20 percent of the market, roughly the same as they did a few years ago.

E-books’ declining popularity may signal that publishing, while not immune to technological upheaval, will weather the tidal wave of digital technology better than other forms of media, like music and television.

E-book subscription services, modeled on companies like Netflix and Pandora, have struggled to convert book lovers into digital binge readers, and some have shut down. Sales of dedicated e-reading devices have plunged as consumers migrated to tablets and smartphones. And according to some surveys, young readers who are digital natives still prefer reading on paper.

The surprising resilience of print has provided a lift to many booksellers. Independent bookstores, which were battered by the recession and competition from Amazon, are showing strong signs of resurgence. The American Booksellers Association counted 1,712 member stores in 2,227 locations in 2015, up from 1,410 in 1,660 locations five years ago.

Publishers, seeking to capitalize on the shift, are pouring money into their print infrastructures and distribution. Penguin Random House has invested nearly $100 million in expanding and updating its warehouses and speeding up distribution of its books. It added 365,000 square feet last year to its warehouse in Crawfordsville, Ind., more than doubling the size of the warehouse.

“People talked about the demise of physical books as if it was only a matter of time, but even 50 to 100 years from now, print will be a big chunk of our business,” said Markus Dohle, the chief executive of Penguin Random House, which has nearly 250 imprints globally. Print books account for more than 70 percent of the company’s sales in the United States.

Some 12 million e-readers were sold last year, a steep drop from the nearly 20 million sold in 2011, according to Forrester Research. The portion of people who read books primarily on e-readers fell to 32 percent in the first quarter of 2015, from 50 percent in 2012, a Nielsen survey showed.

The tug of war between pixels and print almost certainly isn’t over. Industry analysts and publishing executives say it is too soon to declare the death of the digital publishing revolution. An appealing new device might come along. Already, a growing number of people are reading e-books on their cellphones. Amazon recently unveiled a new tablet for $50, which could draw a new wave of customers to e-books (the first-generation Kindle cost $400)

At Amazon, digital book sales have maintained their upward trajectory, according to Russell Grandinetti, senior vice president of Kindle. Last year, Amazon, which controls some 65 percent of the e-book market, introduced an e-book subscription service that allows readers to pay a flat monthly fee of $10 for unlimited digital reading. It offers more than a million titles, many of them from selfpublished authors.

Some publishing executives say the world is changing too quickly to declare that the digital tide is waning.

“Maybe it’s just a pause here,” said Carolyn Reidy, the president and chief executive of Simon & Schuster. “Will the next generation want to read books on their smartphones, and will we see another burst come?”

www.nytimes.com/2015/09/23