Questões de Concurso

Comentadas para esaf

Foram encontradas 4.346 questões

Resolva questões gratuitamente!

Junte-se a mais de 4 milhões de concurseiros!

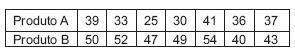

Em uma determinada semana uma empresa recebeu as seguintes quantidades de pedidos para os produtos A e B:

Assinale a opção que apresente os coeficientes de variação dos dois produtos:

the text below entitled "The real medicine":

The real medicine

Source: Newsweek (adapted)

Oct 17th 2005

People who survive a heart attack often

describe it as a wake-up call. But for a 61-year old

executive I met recently, it was more than that. This

man was in the midst of a divorce when he was

stricken last spring, and he had fallen out of touch

with friends and family members. The executive´s

doctor, unaware of the strife in his life, counseled him

to change his diet, start exercising and quit smoking.

He also prescribed drugs to lower cholesterol and

blood pressure. It was sound advice, but in combing

the medical literature, the patient discovered that he

needed to do more. Studies suggested that his risk of

dying within six months would be four times greater

if he remained depressed and lonely. So he joined

a support group and reordered his priorities, placing

relationships at the top of the list instead of the bottom.

His health has improved steadily since then, and so

has his outlook on life. In fact he now describes his

heart attack as the best thing that ever happened to

him. "Yes, my arteries are more open," he says. "But

even more important, I´m more open."

the text below entitled "The real medicine":

The real medicine

Source: Newsweek (adapted)

Oct 17th 2005

People who survive a heart attack often

describe it as a wake-up call. But for a 61-year old

executive I met recently, it was more than that. This

man was in the midst of a divorce when he was

stricken last spring, and he had fallen out of touch

with friends and family members. The executive´s

doctor, unaware of the strife in his life, counseled him

to change his diet, start exercising and quit smoking.

He also prescribed drugs to lower cholesterol and

blood pressure. It was sound advice, but in combing

the medical literature, the patient discovered that he

needed to do more. Studies suggested that his risk of

dying within six months would be four times greater

if he remained depressed and lonely. So he joined

a support group and reordered his priorities, placing

relationships at the top of the list instead of the bottom.

His health has improved steadily since then, and so

has his outlook on life. In fact he now describes his

heart attack as the best thing that ever happened to

him. "Yes, my arteries are more open," he says. "But

even more important, I´m more open."

text below entitled "Flight of the French":

Flight of the French

Source: Newsweek (adapted)

Sept 26th/Oct 3rd 2005

The Belgians call them "fiscal refugees", but these

refugees wear Chanel. They are runaways from high

taxes in France. Officially, France has lost, on average,

one millionaire or billionaire tax payer per day for tax

reasons since 1997, when the government started trying

to track capital flight. Privately, economists say the

number is much higher. "The statistic is stupid," holds

French economist Nicolas Baverez. "It's as if, to count

contraband, you only counted what people declared at

the border."

While much of Europe has revised its tax codes, France's

fiscal inertia is virtually begging its rich to leave. Holding dear

its commitment to égalité and fraternité, France has bucked

the trend in the European Union, where most member states

have dropped the wealth tax since the mid-1990s. France

went the opposite way in 1997 by abolishing a cap that limited

the wealth-tax bill, which kicks in at incomes over 720,000

euros to 85% of a taxpayer's income. The result: some pay

more taxes than they earn in income.

text below entitled "Flight of the French":

Flight of the French

Source: Newsweek (adapted)

Sept 26th/Oct 3rd 2005

The Belgians call them "fiscal refugees", but these

refugees wear Chanel. They are runaways from high

taxes in France. Officially, France has lost, on average,

one millionaire or billionaire tax payer per day for tax

reasons since 1997, when the government started trying

to track capital flight. Privately, economists say the

number is much higher. "The statistic is stupid," holds

French economist Nicolas Baverez. "It's as if, to count

contraband, you only counted what people declared at

the border."

While much of Europe has revised its tax codes, France's

fiscal inertia is virtually begging its rich to leave. Holding dear

its commitment to égalité and fraternité, France has bucked

the trend in the European Union, where most member states

have dropped the wealth tax since the mid-1990s. France

went the opposite way in 1997 by abolishing a cap that limited

the wealth-tax bill, which kicks in at incomes over 720,000

euros to 85% of a taxpayer's income. The result: some pay

more taxes than they earn in income.

text below entitled "Flight of the French":

Flight of the French

Source: Newsweek (adapted)

Sept 26th/Oct 3rd 2005

The Belgians call them "fiscal refugees", but these

refugees wear Chanel. They are runaways from high

taxes in France. Officially, France has lost, on average,

one millionaire or billionaire tax payer per day for tax

reasons since 1997, when the government started trying

to track capital flight. Privately, economists say the

number is much higher. "The statistic is stupid," holds

French economist Nicolas Baverez. "It's as if, to count

contraband, you only counted what people declared at

the border."

While much of Europe has revised its tax codes, France's

fiscal inertia is virtually begging its rich to leave. Holding dear

its commitment to égalité and fraternité, France has bucked

the trend in the European Union, where most member states

have dropped the wealth tax since the mid-1990s. France

went the opposite way in 1997 by abolishing a cap that limited

the wealth-tax bill, which kicks in at incomes over 720,000

euros to 85% of a taxpayer's income. The result: some pay

more taxes than they earn in income.

text below entitled "A dip in the middle":

A dip in the middle

Source: The Economist (adapted)

Sep 8th 2005

Income tax has been paid in Britain for more

than two centuries. First introduced by William Pitt the

Younger to finance the war against Napoleonic France,

it is the Treasury´s biggest source of revenue, raising

30% of tax receipts. It arouses strong political emotions,

regarded as fair by some because it makes the rich pay a

bigger share of their income than the poor, but unfair by

others because it penalizes enterprise and hard work.

During the past 30 years, income tax has been

subject to sweeping changes, notably the cut in the top

rate from 98% to 40% under Margaret Thatcher between

1979 and 1988. Now another Conservative politician,

George Osborne, is floating a radical reform to match

that earlier exploit. The shadow chancellor announced

on September 7th that he was setting up a commission

to explore the possible introduction of a flat income tax

in Britain.

Introducing a flat income tax into Britain would

involve two main changes. At present, there are three

marginal tax rates. These three rates would be replaced

by a single rate, which would be considerably lower than

the current top rate. At the same time there would be an

increase in the tax-free personal allowance, currently

worth 4,895 pounds.

text below entitled "A dip in the middle":

A dip in the middle

Source: The Economist (adapted)

Sep 8th 2005

Income tax has been paid in Britain for more

than two centuries. First introduced by William Pitt the

Younger to finance the war against Napoleonic France,

it is the Treasury´s biggest source of revenue, raising

30% of tax receipts. It arouses strong political emotions,

regarded as fair by some because it makes the rich pay a

bigger share of their income than the poor, but unfair by

others because it penalizes enterprise and hard work.

During the past 30 years, income tax has been

subject to sweeping changes, notably the cut in the top

rate from 98% to 40% under Margaret Thatcher between

1979 and 1988. Now another Conservative politician,

George Osborne, is floating a radical reform to match

that earlier exploit. The shadow chancellor announced

on September 7th that he was setting up a commission

to explore the possible introduction of a flat income tax

in Britain.

Introducing a flat income tax into Britain would

involve two main changes. At present, there are three

marginal tax rates. These three rates would be replaced

by a single rate, which would be considerably lower than

the current top rate. At the same time there would be an

increase in the tax-free personal allowance, currently

worth 4,895 pounds.

text below entitled "A dip in the middle":

A dip in the middle

Source: The Economist (adapted)

Sep 8th 2005

Income tax has been paid in Britain for more

than two centuries. First introduced by William Pitt the

Younger to finance the war against Napoleonic France,

it is the Treasury´s biggest source of revenue, raising

30% of tax receipts. It arouses strong political emotions,

regarded as fair by some because it makes the rich pay a

bigger share of their income than the poor, but unfair by

others because it penalizes enterprise and hard work.

During the past 30 years, income tax has been

subject to sweeping changes, notably the cut in the top

rate from 98% to 40% under Margaret Thatcher between

1979 and 1988. Now another Conservative politician,

George Osborne, is floating a radical reform to match

that earlier exploit. The shadow chancellor announced

on September 7th that he was setting up a commission

to explore the possible introduction of a flat income tax

in Britain.

Introducing a flat income tax into Britain would

involve two main changes. At present, there are three

marginal tax rates. These three rates would be replaced

by a single rate, which would be considerably lower than

the current top rate. At the same time there would be an

increase in the tax-free personal allowance, currently

worth 4,895 pounds.

text below entitled "A dip in the middle":

A dip in the middle

Source: The Economist (adapted)

Sep 8th 2005

Income tax has been paid in Britain for more

than two centuries. First introduced by William Pitt the

Younger to finance the war against Napoleonic France,

it is the Treasury´s biggest source of revenue, raising

30% of tax receipts. It arouses strong political emotions,

regarded as fair by some because it makes the rich pay a

bigger share of their income than the poor, but unfair by

others because it penalizes enterprise and hard work.

During the past 30 years, income tax has been

subject to sweeping changes, notably the cut in the top

rate from 98% to 40% under Margaret Thatcher between

1979 and 1988. Now another Conservative politician,

George Osborne, is floating a radical reform to match

that earlier exploit. The shadow chancellor announced

on September 7th that he was setting up a commission

to explore the possible introduction of a flat income tax

in Britain.

Introducing a flat income tax into Britain would

involve two main changes. At present, there are three

marginal tax rates. These three rates would be replaced

by a single rate, which would be considerably lower than

the current top rate. At the same time there would be an

increase in the tax-free personal allowance, currently

worth 4,895 pounds.

No texto abaixo foram substituídos sinais de pontuação por

números. Assinale a seqüência de sinais de pontuação que

devem ser inseridos nos espaços indicados para que o texto

se torne coerente e gramaticalmente correto.

Desconsidere a necessidade de transformar letras

minúsculas em maiúsculas.

Os seres humanos sofrem sempre confl itos de interesse

com os ressentimentos, facções, coalizões e instáveis

alianças que os acompanham(1) no entanto, o que

mais interessa nesses fenômenos confl ituosos não é

o quanto eles nos separam, mas quão freqüentemente

eles são neutralizados, perdoados e desculpados. Nos

seres humanos(2) com seu extraordinário dom narrativo,

uma das principais formas de manutenção da paz é o

dom humano de apresentar(3) dramatizar e explicar as

circunstâncias atenuantes em torno de violações que

ameaçam introduzir confl ito na habitualidade da vida(4) o

objetivo de tal narrativa não é reconciliar, não é legitimar,

nem mesmo desculpar, mas antes(5) explicar.

(Jerome Bruner. Atos de signifi cação, com adaptações)

Os fragmentos abaixo foram adaptados do texto O

sentido do som, de Leonardo Sá, para compor três

itens. Julgue-os quanto ao respeito às regras gramaticais

do padrão culto da língua portuguesa para assinalar a

opção correta a seguir.

I. A ausência de discurso é silêncio. O silêncio enquanto

formador do discurso expressivo e entendido em

sua forma dinâmica, em contraposição aquele que

corresponde à ausência de discurso, ganha amplitude a

gravidade quando passa a ser o perfi l de comportamento,

isto é, quando passa a ser uma atitude assumida por (e

imposta a) segmentos sociais que não “discursam”, mas

que apenas silenciam, que exercem a expressão em

dimensão mínima e deixam projetarem-se no discurso

de outrem como sendo o seu discurso.

II. Em um contexto como o do Brasil, no qual há uma

perversa concentração de privilégios, e no qual o acesso

aos meios disponíveis é restrito, outra vez coloca-se a

questão que abordamos ao falar dos silêncios: apenas

alguns segmentos sociais “emitem”, enquanto amplas

maiorias tornam-se “silenciosas”, resultando daí que as

imagens acústicas encontram suporte em meios que,

por razões tecnológicas e culturais, são inacessíveis às

massas.

III. Por conseguinte, esse monólogo passa a gerar imagens

sobre si mesmo, imagens de imagens, sem diálogo,

produtos fortuitos que a indústria da cultura massifi ca,

difunde, impõe, substitui, esquece, retoma, redimensiona,

rejeita e reinventa.... As razões do “silêncio”, portanto, são

também razões sociais e econômicas. Neste silêncio, o

que se absorve não são apenas imagens, mas também

o imaginário em seu conjunto pré-delimitado, um

imaginário que não identifi ca as fontes de suas imagens,

que nem sequer se preocupa em identifi cá-las, que aos

poucos as esquece.

Estão respeitadas as regras gramaticais apenas

As opções trazem o diagnóstico e a indicação de correção do que estiver gramatical e lingüisticamente errado no trecho abaixo.

Podemos prever o traço fundamental do comércio

colonial: ele deriva imediatamente do próprio caráter

da colonização, organizada como ela está na base

da produção de gêneros tropicais e metais preciosos

para o fornecimento do mercado internacional. É a

exportação desses gêneros, pois, que constituirá

o elemento essencial das atividades comerciais da

colônia.

O comércio exterior brasileiro é todo ele, pode-se

dizer, marítimo. Nossas fronteiras atravessavam áreas

muito pouco povoadas, quando não inteiramente

indevassadas. A colonização portuguesa vinda do

Atlântico, e a espanhola, quase toda do Pacífi co, mal

tinham ainda engajado suas vanguardas, de sorte

que entre ambas ainda sobravam vastos territórios

ocupados.

Circunstância essa ditada por contingências

geográfi cas e econômicas, e que tem grande

signifi cação política e administrativa, pois facilitou,

pode-se dizer mesmo que tornou possível, o monopólio

do comércio da colônia que a metrópole pretendia para

si. Foi bastante reservar-se a navegação, providência

muito mais simples que uma fi scalização fronteiriça

– difícil, se não impraticável, nos extensos limites do

país.

(Caio Prado Júnior, História econômica do Brasil, com

adaptações)

Em relação ao texto, assinale a opção correta.

IBGE e BNDES mostraram que a desesperança nas cidades pequenas empurra a força de trabalho para as médias, que detêm maior dinamismo econômico. A carga da pesada máquina administrativa das pequenas "cidades mortas" é paga pelas verbas federais do Fundo de Participação dos Municípios. A economia local nesses municípios, como o IBGE também já mostrou, é dependente da chegada do pagamento dos aposentados do Instituto Nacional de Seguridade Social. O seminário "Qualicidade", por sua vez, confi rmou que a favelização é produto de "duas ausências", a do crescimento econômico e a de política urbana.

(Gazeta Mercantil, 17/10/2005, Editorial)

Competência tributária é o poder que a Constituição Federal atribui a determinado ente político para que este institua um tributo, descrevendo-lhe a hipótese de incidência, o sujeito ativo, o sujeito passivo, a base de cálculo e a alíquota.

Sobre a competência tributária, avalie o asserto das afi rmações adiante e marque com (V) as verdadeiras e com (F) as falsas; em seguida, marque a opção correta.

( ) A competência tributária é indelegável, salvo atribuição das funções de arrecadar ou fi scalizar tributos, ou de executar leis, serviços, atos ou decisões administrativas em matéria tributária, conferida por uma pessoa jurídica de direito público a outra.

( ) O não-exercício da competência tributária por determinada pessoa política autoriza a União a exercitar tal competência, com base no princípio da isonomia.

( ) A pessoa política que detém a competência tributária para instituir o imposto também é competente para aumentá-lo, diminuí-lo ou mesmo conceder isenções, observados os limites constitucionais e legais.