Questões de Concurso

Comentadas para sefaz-sp

Foram encontradas 291 questões

Resolva questões gratuitamente!

Junte-se a mais de 4 milhões de concurseiros!

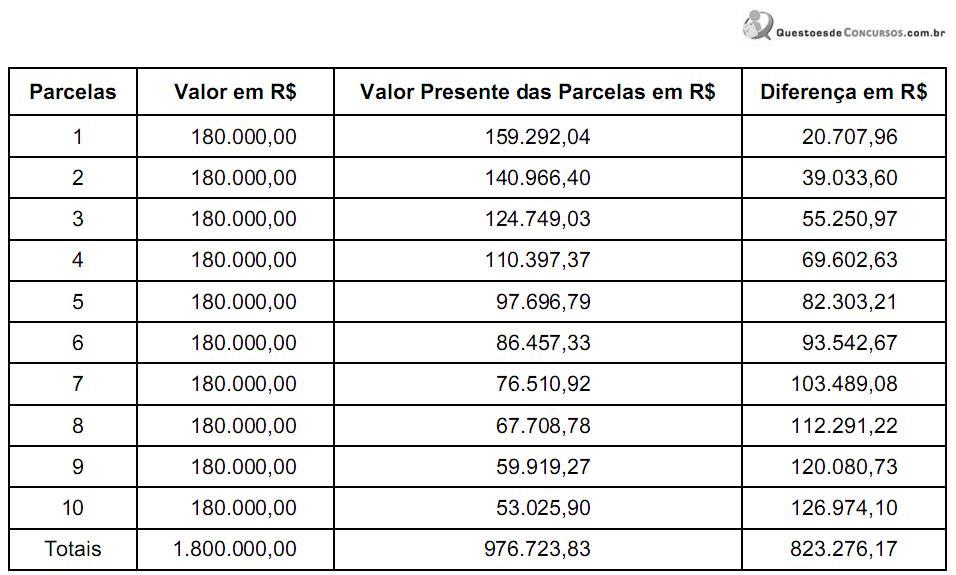

Lançamento contábil que deveria ter sido feito pela empresa Ativa S.A., em 01/02/2013, em R$:

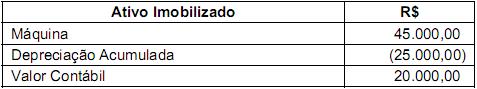

Para realizar o teste de recuperabilidade da máquina, foram identificados:

- Valor justo da máquina em 31/12/2012: R$ 19.000,00

- Gastos estimados para a retirada e venda da máquina (despesa de venda) em 31/12/2012: R$ 2.000,00

- Tempo de vida útil remanescente estimado para a máquina em 31/12/2012: 3 anos

- Valor em uso em 31/12/2012: R$ 18.000,00

- Valor de venda estimado da máquina, no final de sua vida útil: R$ 1.500,00

- Gastos estimados para a retirada e venda da máquina (despesa de venda), no final de sua vida útil: R$ 500,00.

- Taxa de desconto: 10% a.a.

Nessas condições, o valor registrado como perda por redução ao valor recuperável foi, em 31/12/2012, em R$:

I. Se a elasticidade-preço da demanda de um bem X é, em módulo, menor que 1, uma das possíveis explicações para o fato é a existência no mercado de um grande número de bens substitutos para o bem X.

II. Se a demanda do bem X for expressa pela função QD = 15.000 P-2, onde QD representa a quantidade demandada e P, o preço de mercado, então a elasticidade-preço da demanda do bem X, em módulo, é constante e igual a 2.

III. Se os bens X e Y forem complementares, então a elasticidade-cruzada da demanda do bem X em relação ao preço do bem Y é positiva.

IV. Se a elasticidade-preço for constante e maior que 1 ao longo de toda a curva da demanda, um aumento de preço diminuirá o dispêndio total dos consumidores com o bem.

Está correto o que se afirma APENAS em

Metas

I. Eficiência

II. Eficácia

III. Efetividade

IV. Equidade

Caracterização

1. Está relacionada ao grau de adequação com que os recursos mobilizados pelo Estado são utilizados para alcançar seus objetivos e metas.

2. Exigência para que o Estado atue de maneira competente para realizar a justiça social.

3. Ocorre quando os bens e serviços resultantes de determinada ação alcançam os resultados mais benéficos para a sociedade.

4. Esforços da esfera governamental para ofertar adequadamente os bens e serviços esperados, previamente definidos em seus objetivos e metas. O que

importa nesses esforços é conseguir que os efeitos de uma ação correspondam aos desejados.

A primeira coluna apresenta quatro possíveis grandes metas de atuação da Administração Pública; a segunda apresenta a caracterização de cada uma delas. A correspondência correta entre as duas colunas é:

Modelos da Gestão Pública Características dos Modelos

I. Burocrático 1. Representa o tipo ideal da dominação racional-legal weberiana

II. Patrimonialista 2. Abre espaço para a atuação de novas figuras institucionais, como as Parcerias Público-Privadas e Organizações da Sociedade Civil.

III. Gerencial 3. Típico das monarquias absolutistas

Na primeira coluna estão relacionados os três tipos consagrados de modelos para a administração do Estado; a segunda coluna apresenta três características referentes aos modelos. A alternativa que apresenta a associação correta é:

I. Orientação das políticas de recursos humanos pelo parâmetro de permanência no cargo.

II. Redirecionamento do sistema de avaliação dentro da administração governamental para uma ação centrada no eixo da avaliação do desempenho do serviço prestado – qualitativa e quantitativamente – pelos diversos setores e unidades.

III. Elaboração e divulgação de sistemas de indicadores de desempenho do serviço público.

IV. Garantia de ampla divulgação e acompanhamento dos indicadores de desempenho e seus resultados.

Apontam ações desejáveis para a melhoria do sistema de avaliação do desempenho público o que consta em

I. mitiga o foco em uma gestão voltada para os processos, privilegiando a obtenção de resultados.

II. despreza a constituição de parcerias, fortalecendo a ação isolada do Estado.

III. busca uma mudança da qualidade gerencial, trazendo destaque à transparência e ao controle social.

IV. visa uma maior rapidez na circulação de informações, bem como uma maior qualidade destas, fomentando o diálogo público sobre a atuação do Estado.

Está correto o que se afirma em

DREW OLANOFF JOSH CONSTINE, COLLEEN TAYLOR, INGRID LUNDEN

Tuesday, January 15th, 2013

Today at Facebook’s press event, Mark Zuckerberg, CEO of Facebook, announced its latest product, called Graph Search.

Zuckerberg made it very clear that this is not web search, but completely different.

He explained the difference between web search and Graph Search. “Web search is designed to take any open-ended query and give

you links that might have answers.” Linking things together based on things that you’re interested in is a “very hard technical problem,”

according to Zuckerberg.

Graph Search is designed to take a precise query and give you an answer, rather than links that might provide the answer.” For

example, you could ask Graph Search “Who are my friends that live in San Francisco?”

Zuckerberg says that Graph Search is in “very early beta.” People, photos, places and interests are the focus for the first iteration of the

product.

Facebook Graph Search is completely personalized. Tom Stocky of the search team explains he gets unique results for a search of

“friends who like Star Wars and Harry Potter.” Then, “If anyone else does this search they get a completely different set of results. ...C...

someone had the same set of friends as me, the results would be different [because we have different relationships with our friends].”

You can also use Graph Search for recruiting. Stocky says if he was looking for people to join the team at Facebook, he could search

for NASA Ames employees who are friends with people at Facebook. “If I wanted to reach out and recruit them, I could see who their friends

are at Facebook. To refine them I can look for people who wrote they are “founders.”

Photos is another big part of Graph Search. Results are sorted by engagement so you see the ones with the most likes and comments

at the top. For example, Lars Rasmussen, Facebook engineer, searched for “photos of my friends taken at National Parks.” He got a gorgeous

page of photos from Yosemite, Machu Pichu, and other parks.

(Adapted from http://techcrunch.com/2013/01/15/facebook-announces-its-third-pillar-graph-search/)

Segundo o texto,

DREW OLANOFF JOSH CONSTINE, COLLEEN TAYLOR, INGRID LUNDEN

Tuesday, January 15th, 2013

Today at Facebook’s press event, Mark Zuckerberg, CEO of Facebook, announced its latest product, called Graph Search.

Zuckerberg made it very clear that this is not web search, but completely different.

He explained the difference between web search and Graph Search. “Web search is designed to take any open-ended query and give you links that might have answers.” Linking things together based on things that you’re interested in is a “very hard technical problem,” according to Zuckerberg.

Graph Search is designed to take a precise query and give you an answer, rather than links that might provide the answer.” For example, you could ask Graph Search “Who are my friends that live in San Francisco?”

Zuckerberg says that Graph Search is in “very early beta.” People, photos, places and interests are the focus for the first iteration of the product.

Facebook Graph Search is completely personalized. Tom Stocky of the search team explains he gets unique results for a search of “friends who like Star Wars and Harry Potter.” Then, “If anyone else does this search they get a completely different set of results. ...C... someone had the same set of friends as me, the results would be different [because we have different relationships with our friends].”

You can also use Graph Search for recruiting. Stocky says if he was looking for people to join the team at Facebook, he could search for NASA Ames employees who are friends with people at Facebook. “If I wanted to reach out and recruit them, I could see who their friends are at Facebook. To refine them I can look for people who wrote they are “founders.”

Photos is another big part of Graph Search. Results are sorted by engagement so you see the ones with the most likes and comments at the top. For example, Lars Rasmussen, Facebook engineer, searched for “photos of my friends taken at National Parks.” He got a gorgeous page of photos from Yosemite, Machu Pichu, and other parks.

(Adapted from http://techcrunch.com/2013/01/15/facebook-announce...)

A alternativa que preenche corretamente a lacuna ...C... é

DREW OLANOFF JOSH CONSTINE, COLLEEN TAYLOR, INGRID LUNDEN

Tuesday, January 15th, 2013

Today at Facebook’s press event, Mark Zuckerberg, CEO of Facebook, announced its latest product, called Graph Search.

Zuckerberg made it very clear that this is not web search, but completely different.

He explained the difference between web search and Graph Search. “Web search is designed to take any open-ended query and give

you links that might have answers.” Linking things together based on things that you’re interested in is a “very hard technical problem,”

according to Zuckerberg.

Graph Search is designed to take a precise query and give you an answer, rather than links that might provide the answer.” For

example, you could ask Graph Search “Who are my friends that live in San Francisco?”

Zuckerberg says that Graph Search is in “very early beta.” People, photos, places and interests are the focus for the first iteration of the

product.

Facebook Graph Search is completely personalized. Tom Stocky of the search team explains he gets unique results for a search of

“friends who like Star Wars and Harry Potter.” Then, “If anyone else does this search they get a completely different set of results. ...C...

someone had the same set of friends as me, the results would be different [because we have different relationships with our friends].”

You can also use Graph Search for recruiting. Stocky says if he was looking for people to join the team at Facebook, he could search

for NASA Ames employees who are friends with people at Facebook. “If I wanted to reach out and recruit them, I could see who their friends

are at Facebook. To refine them I can look for people who wrote they are “founders.”

Photos is another big part of Graph Search. Results are sorted by engagement so you see the ones with the most likes and comments

at the top. For example, Lars Rasmussen, Facebook engineer, searched for “photos of my friends taken at National Parks.” He got a gorgeous

page of photos from Yosemite, Machu Pichu, and other parks.

(Adapted from http://techcrunch.com/2013/01/15/facebook-announces-its-third-pillar-graph-search/)

No texto, “latest” significa

By Michelle Singletary, Published: January 15, 2013

It’s not nice to tell people “I told you so.” But if anybody has the right to say that, it’s Nina E. Olson, the national taxpayer advocate.

Olson recently submitted her annual report to Congress and top on her list of things that need to be fixed is the complexity of the tax

code, which she called the most serious problem facing taxpayers.

Let’s just look at the most recent evidence of complexity run amok. The Internal Revenue Service had to delay the tax-filing season so it

could update forms and its programming to accommodate recent changes made under the American Taxpayer Relief Act. The IRS won’t start

processing individual income tax returns until Jan. 30. Yet one thing remains unchanged − the April 15 tax deadline.

Because of the new tax laws, the IRS also had to release updated income-tax withholding tables for 2013. These replace the tables

issued Dec. 31. Yes, let’s just keep making more work for the agency that is already overburdened. Not to mention the extra work for

employers, who have to use the revised information to correct the amount of Social Security tax withheld in 2013. And they have to make that

correction in order to withhold a larger Social Security tax of 6.2 percent on wages, following the expiration of the payroll tax cut in effect for

2011 and 2012.

Oh, and there was the near miss with the alternative minimum tax that could have delayed the tax filing season to late March. The AMT

was created to target high-income taxpayers who were claiming so many deductions that they owed little or no income tax. Olson and many

others have complained for years that the AMT wasn’t indexed for inflation.

“Many middle- and upper-middle-class taxpayers pay the AMT, while most wealthy taxpayers do not, and thousands of millionaires pay

..A.. income tax at all,” Olson said.

As part of the recent “fiscal cliff” deal, the AMT is now fixed, a move that the IRS was anticipating. It had already decided to program its

systems on the assumption that an AMT patch would be passed, Olson said. Had the agency not taken the risk, the time it would have taken to

update the systems “would have brought about the most chaotic filing season in memory,” she said in her report.

The tax code contains almost 4 million words. Since 2001, there have been about 4,680 changes, or an average of more than one

change a day. What else troubles Olson? Here’s what:

− Nearly 60 percent of taxpayers hire paid preparers, and another 30 percent rely on commercial software to prepare their returns.

− Many taxpayers don’t really know how their taxes are computed and what rate of tax they pay.

− The complex code makes tax fraud ..B.. to detect.

− Because the code is so complicated, it creates an impression that many taxpayers are not paying their fair share. This reduces trust

in the system and perhaps leads some people to cheat. Who wants to be the sucker in this game? So someone might not declare

all of his income, rationalizing that millionaires get to use the convoluted code to greatly reduce their tax liability.

− In fiscal year 2012, the IRS received around 125 million calls. But the agency answered only about two out of three calls from

people trying to reach a live person, and those taxpayers had to wait, on average, about 17 minutes to get through.

“I hope 2013 brings about fundamental tax simplification,” Olson pleaded in her report. She urged Congress to reassess the need for

the tax breaks we know as income exclusions, exemptions, deductions and credits. It’s all these tax advantage breaks that complicate the

code. If done right, and without reducing revenue, tax rates could be substantially lowered in exchange for ending tax breaks, she said.

(Adapted from http://js.washingtonpost.com/business/economy/for-taxpayer-advocate-a-familiar-refrain/2013/01/15/a10327ce-5f59-

11e2-b05a-605528f6b712_story.html)

Infere-se do texto que

By Michelle Singletary, Published: January 15, 2013

It’s not nice to tell people “I told you so.” But if anybody has the right to say that, it’s Nina E. Olson, the national taxpayer advocate.

Olson recently submitted her annual report to Congress and top on her list of things that need to be fixed is the complexity of the tax

code, which she called the most serious problem facing taxpayers.

Let’s just look at the most recent evidence of complexity run amok. The Internal Revenue Service had to delay the tax-filing season so it

could update forms and its programming to accommodate recent changes made under the American Taxpayer Relief Act. The IRS won’t start

processing individual income tax returns until Jan. 30. Yet one thing remains unchanged − the April 15 tax deadline.

Because of the new tax laws, the IRS also had to release updated income-tax withholding tables for 2013. These replace the tables

issued Dec. 31. Yes, let’s just keep making more work for the agency that is already overburdened. Not to mention the extra work for

employers, who have to use the revised information to correct the amount of Social Security tax withheld in 2013. And they have to make that

correction in order to withhold a larger Social Security tax of 6.2 percent on wages, following the expiration of the payroll tax cut in effect for

2011 and 2012.

Oh, and there was the near miss with the alternative minimum tax that could have delayed the tax filing season to late March. The AMT

was created to target high-income taxpayers who were claiming so many deductions that they owed little or no income tax. Olson and many

others have complained for years that the AMT wasn’t indexed for inflation.

“Many middle- and upper-middle-class taxpayers pay the AMT, while most wealthy taxpayers do not, and thousands of millionaires pay

..A.. income tax at all,” Olson said.

As part of the recent “fiscal cliff” deal, the AMT is now fixed, a move that the IRS was anticipating. It had already decided to program its

systems on the assumption that an AMT patch would be passed, Olson said. Had the agency not taken the risk, the time it would have taken to

update the systems “would have brought about the most chaotic filing season in memory,” she said in her report.

The tax code contains almost 4 million words. Since 2001, there have been about 4,680 changes, or an average of more than one

change a day. What else troubles Olson? Here’s what:

− Nearly 60 percent of taxpayers hire paid preparers, and another 30 percent rely on commercial software to prepare their returns.

− Many taxpayers don’t really know how their taxes are computed and what rate of tax they pay.

− The complex code makes tax fraud ..B.. to detect.

− Because the code is so complicated, it creates an impression that many taxpayers are not paying their fair share. This reduces trust

in the system and perhaps leads some people to cheat. Who wants to be the sucker in this game? So someone might not declare

all of his income, rationalizing that millionaires get to use the convoluted code to greatly reduce their tax liability.

− In fiscal year 2012, the IRS received around 125 million calls. But the agency answered only about two out of three calls from

people trying to reach a live person, and those taxpayers had to wait, on average, about 17 minutes to get through.

“I hope 2013 brings about fundamental tax simplification,” Olson pleaded in her report. She urged Congress to reassess the need for

the tax breaks we know as income exclusions, exemptions, deductions and credits. It’s all these tax advantage breaks that complicate the

code. If done right, and without reducing revenue, tax rates could be substantially lowered in exchange for ending tax breaks, she said.

(Adapted from http://js.washingtonpost.com/business/economy/for-taxpayer-advocate-a-familiar-refrain/2013/01/15/a10327ce-5f59-

11e2-b05a-605528f6b712_story.html)

No texto, “overburdened” significa

By Michelle Singletary, Published: January 15, 2013

It’s not nice to tell people “I told you so.” But if anybody has the right to say that, it’s Nina E. Olson, the national taxpayer advocate.

Olson recently submitted her annual report to Congress and top on her list of things that need to be fixed is the complexity of the tax

code, which she called the most serious problem facing taxpayers.

Let’s just look at the most recent evidence of complexity run amok. The Internal Revenue Service had to delay the tax-filing season so it

could update forms and its programming to accommodate recent changes made under the American Taxpayer Relief Act. The IRS won’t start

processing individual income tax returns until Jan. 30. Yet one thing remains unchanged − the April 15 tax deadline.

Because of the new tax laws, the IRS also had to release updated income-tax withholding tables for 2013. These replace the tables

issued Dec. 31. Yes, let’s just keep making more work for the agency that is already overburdened. Not to mention the extra work for

employers, who have to use the revised information to correct the amount of Social Security tax withheld in 2013. And they have to make that

correction in order to withhold a larger Social Security tax of 6.2 percent on wages, following the expiration of the payroll tax cut in effect for

2011 and 2012.

Oh, and there was the near miss with the alternative minimum tax that could have delayed the tax filing season to late March. The AMT

was created to target high-income taxpayers who were claiming so many deductions that they owed little or no income tax. Olson and many

others have complained for years that the AMT wasn’t indexed for inflation.

“Many middle- and upper-middle-class taxpayers pay the AMT, while most wealthy taxpayers do not, and thousands of millionaires pay

..A.. income tax at all,” Olson said.

As part of the recent “fiscal cliff” deal, the AMT is now fixed, a move that the IRS was anticipating. It had already decided to program its

systems on the assumption that an AMT patch would be passed, Olson said. Had the agency not taken the risk, the time it would have taken to

update the systems “would have brought about the most chaotic filing season in memory,” she said in her report.

The tax code contains almost 4 million words. Since 2001, there have been about 4,680 changes, or an average of more than one

change a day. What else troubles Olson? Here’s what:

− Nearly 60 percent of taxpayers hire paid preparers, and another 30 percent rely on commercial software to prepare their returns.

− Many taxpayers don’t really know how their taxes are computed and what rate of tax they pay.

− The complex code makes tax fraud ..B.. to detect.

− Because the code is so complicated, it creates an impression that many taxpayers are not paying their fair share. This reduces trust

in the system and perhaps leads some people to cheat. Who wants to be the sucker in this game? So someone might not declare

all of his income, rationalizing that millionaires get to use the convoluted code to greatly reduce their tax liability.

− In fiscal year 2012, the IRS received around 125 million calls. But the agency answered only about two out of three calls from

people trying to reach a live person, and those taxpayers had to wait, on average, about 17 minutes to get through.

“I hope 2013 brings about fundamental tax simplification,” Olson pleaded in her report. She urged Congress to reassess the need for

the tax breaks we know as income exclusions, exemptions, deductions and credits. It’s all these tax advantage breaks that complicate the

code. If done right, and without reducing revenue, tax rates could be substantially lowered in exchange for ending tax breaks, she said.

(Adapted from http://js.washingtonpost.com/business/economy/for-taxpayer-advocate-a-familiar-refrain/2013/01/15/a10327ce-5f59-

11e2-b05a-605528f6b712_story.html)

A alternativa que, no contexto, preenche adequadamente a lacuna ..B.. é