Questões de Concurso

Comentadas para analista de gestão - contabilidade

Foram encontradas 419 questões

Resolva questões gratuitamente!

Junte-se a mais de 4 milhões de concurseiros!

Identifique qual dos aspectos abaixo NÃO se aplica à referida definição.

como o montante produzido pela aplicação de R$ 10.000,00, por 3 meses, à taxa de 3% no regime de juros compostos e

como o montante produzido pela aplicação de R$ 10.000,00, por 3 meses, à taxa de 3% no regime de juros compostos e  como o montante produzido pelo mesmo valor, no mesmo prazo, à taxa de 3,0909% ao mês no regime de juros simples. Concluiu, então, que

como o montante produzido pelo mesmo valor, no mesmo prazo, à taxa de 3,0909% ao mês no regime de juros simples. Concluiu, então, que  em reais, correspondem, respectivamente, a

em reais, correspondem, respectivamente, a

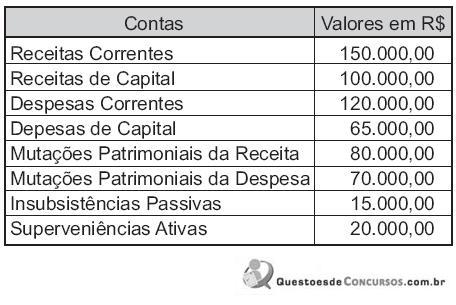

Considerando-se os dados apresentados, o total das variações ativas corresponde, em reais, a

Reducing the dependence on oil

Ildo Sauer, Gas and Energy Director, Petrobras.

Brazil's energy sector is following the worldwide

tendency towards greater diversification of primary energy

sources and the increased use of natural gas and

biofuels. There are several reasons for this change. The

most important are the environmental restrictions that

are gradually being adopted in the world's principal

energy-consuming markets and the need to reduce the

dependence on oil, set against a scenario of accelerated

depletion in oil reserves and escalating prices.

The share of gas in Brazilian primary energy

consumption has more than doubled in a short period,

increasing from 4.1% in 1999 to 8.9% in 2004, and this

share is forecast to rise to 12% by 2010.

Over the past two decades, the world gas industry

has experienced a structural and regulatory

transformation. These changes have altered the strategic

behaviour of gas firms, with an intensification of

competition, the search for diversification (especially in

the case of power generation) and the internationalisation

of industry activities. Together, these changes have

radically changed the economic environment and the level

of competition in the industry.

Brazil's gas industry is characterised by its late

development, although in recent years, internal supply

imports and demand have grown significantly - the

growth trajectory of recent years exceeds that of countries

with more mature markets, such as Spain, Argentina,

the UK and the US. And the outlook is positive for

continued growth over the next few years, particularly

when set against the investment plans already

announced in Brazil.

The country has a small transportation network

concentrated near the coast. The distribution network is

concentrated in the major consumption centres.

Domestic gas sources are largely offshore in the Campos

basin and Bolivia provides imports. Given the degree

of gas penetration in the country's primary energy

consumption, the industry is poorly developed when

compared with other countries. The industry requires

heavy investment in expanding the transport and

distribution (T&D) networks, as well as in diversifying and

increasing its supplies. Such investments are necessary

for realising the industry's enormous potential.

Another key industry highlight is the changing profile

of gas supply. A large part of the gas produced

domestically to date has been associated with oil

production. The latter diluting or even totally absorbing

the costs of exploiting the gas. In most cases, gas

production was feasible only in conjunction with oil

production activities. However, the country's latest gas

finds are non-associated. Thus, an exclusively dedicated

structure must be developed to produce this gas -

translating into a significant rise in production costs. This

is more significant when analysed against the high costs

associated with the market for exploration and production

(E&P) sector equipment. In recent years, the leasing costs

of drilling rigs and E&P equipment have been climbing in

parallel with escalating oil prices. This directly affects endconsumer

prices.

In a world of primary energy consumption

diversification, of greater environmental restrictions and

the reduced dependence on oil, Brazil has been seeking

to develop alternative energy sources - principally natural

gas and biofuels. The gas industry holds enormous

potential for Brazil, although there is still a long way to go

before it reaches maturity and major investment is

required.

p.29-31 (adapted)

"Natural gas is fast becoming the economic and environmental fuel of choice. The last 30 years have seen the global industry almost triple in size and similar growth can be expected in the next 30, as national governments and global industry look to gas to ensure the stability and diversity of their energy supplies."

This comment by Linda Cook, Executive Director of a British Gas and Power Company, reproduces a similar idea to that in the following segment from Ildo Sauer's text:

Reducing the dependence on oil

Ildo Sauer, Gas and Energy Director, Petrobras.

Brazil's energy sector is following the worldwide

tendency towards greater diversification of primary energy

sources and the increased use of natural gas and

biofuels. There are several reasons for this change. The

most important are the environmental restrictions that

are gradually being adopted in the world's principal

energy-consuming markets and the need to reduce the

dependence on oil, set against a scenario of accelerated

depletion in oil reserves and escalating prices.

The share of gas in Brazilian primary energy

consumption has more than doubled in a short period,

increasing from 4.1% in 1999 to 8.9% in 2004, and this

share is forecast to rise to 12% by 2010.

Over the past two decades, the world gas industry

has experienced a structural and regulatory

transformation. These changes have altered the strategic

behaviour of gas firms, with an intensification of

competition, the search for diversification (especially in

the case of power generation) and the internationalisation

of industry activities. Together, these changes have

radically changed the economic environment and the level

of competition in the industry.

Brazil's gas industry is characterised by its late

development, although in recent years, internal supply

imports and demand have grown significantly - the

growth trajectory of recent years exceeds that of countries

with more mature markets, such as Spain, Argentina,

the UK and the US. And the outlook is positive for

continued growth over the next few years, particularly

when set against the investment plans already

announced in Brazil.

The country has a small transportation network

concentrated near the coast. The distribution network is

concentrated in the major consumption centres.

Domestic gas sources are largely offshore in the Campos

basin and Bolivia provides imports. Given the degree

of gas penetration in the country's primary energy

consumption, the industry is poorly developed when

compared with other countries. The industry requires

heavy investment in expanding the transport and

distribution (T&D) networks, as well as in diversifying and

increasing its supplies. Such investments are necessary

for realising the industry's enormous potential.

Another key industry highlight is the changing profile

of gas supply. A large part of the gas produced

domestically to date has been associated with oil

production. The latter diluting or even totally absorbing

the costs of exploiting the gas. In most cases, gas

production was feasible only in conjunction with oil

production activities. However, the country's latest gas

finds are non-associated. Thus, an exclusively dedicated

structure must be developed to produce this gas -

translating into a significant rise in production costs. This

is more significant when analysed against the high costs

associated with the market for exploration and production

(E&P) sector equipment. In recent years, the leasing costs

of drilling rigs and E&P equipment have been climbing in

parallel with escalating oil prices. This directly affects endconsumer

prices.

In a world of primary energy consumption

diversification, of greater environmental restrictions and

the reduced dependence on oil, Brazil has been seeking

to develop alternative energy sources - principally natural

gas and biofuels. The gas industry holds enormous

potential for Brazil, although there is still a long way to go

before it reaches maturity and major investment is

required.

p.29-31 (adapted)

Reducing the dependence on oil

Ildo Sauer, Gas and Energy Director, Petrobras.

Brazil's energy sector is following the worldwide

tendency towards greater diversification of primary energy

sources and the increased use of natural gas and

biofuels. There are several reasons for this change. The

most important are the environmental restrictions that

are gradually being adopted in the world's principal

energy-consuming markets and the need to reduce the

dependence on oil, set against a scenario of accelerated

depletion in oil reserves and escalating prices.

The share of gas in Brazilian primary energy

consumption has more than doubled in a short period,

increasing from 4.1% in 1999 to 8.9% in 2004, and this

share is forecast to rise to 12% by 2010.

Over the past two decades, the world gas industry

has experienced a structural and regulatory

transformation. These changes have altered the strategic

behaviour of gas firms, with an intensification of

competition, the search for diversification (especially in

the case of power generation) and the internationalisation

of industry activities. Together, these changes have

radically changed the economic environment and the level

of competition in the industry.

Brazil's gas industry is characterised by its late

development, although in recent years, internal supply

imports and demand have grown significantly - the

growth trajectory of recent years exceeds that of countries

with more mature markets, such as Spain, Argentina,

the UK and the US. And the outlook is positive for

continued growth over the next few years, particularly

when set against the investment plans already

announced in Brazil.

The country has a small transportation network

concentrated near the coast. The distribution network is

concentrated in the major consumption centres.

Domestic gas sources are largely offshore in the Campos

basin and Bolivia provides imports. Given the degree

of gas penetration in the country's primary energy

consumption, the industry is poorly developed when

compared with other countries. The industry requires

heavy investment in expanding the transport and

distribution (T&D) networks, as well as in diversifying and

increasing its supplies. Such investments are necessary

for realising the industry's enormous potential.

Another key industry highlight is the changing profile

of gas supply. A large part of the gas produced

domestically to date has been associated with oil

production. The latter diluting or even totally absorbing

the costs of exploiting the gas. In most cases, gas

production was feasible only in conjunction with oil

production activities. However, the country's latest gas

finds are non-associated. Thus, an exclusively dedicated

structure must be developed to produce this gas -

translating into a significant rise in production costs. This

is more significant when analysed against the high costs

associated with the market for exploration and production

(E&P) sector equipment. In recent years, the leasing costs

of drilling rigs and E&P equipment have been climbing in

parallel with escalating oil prices. This directly affects endconsumer

prices.

In a world of primary energy consumption

diversification, of greater environmental restrictions and

the reduced dependence on oil, Brazil has been seeking

to develop alternative energy sources - principally natural

gas and biofuels. The gas industry holds enormous

potential for Brazil, although there is still a long way to go

before it reaches maturity and major investment is

required.

p.29-31 (adapted)

Reducing the dependence on oil

Ildo Sauer, Gas and Energy Director, Petrobras.

Brazil's energy sector is following the worldwide

tendency towards greater diversification of primary energy

sources and the increased use of natural gas and

biofuels. There are several reasons for this change. The

most important are the environmental restrictions that

are gradually being adopted in the world's principal

energy-consuming markets and the need to reduce the

dependence on oil, set against a scenario of accelerated

depletion in oil reserves and escalating prices.

The share of gas in Brazilian primary energy

consumption has more than doubled in a short period,

increasing from 4.1% in 1999 to 8.9% in 2004, and this

share is forecast to rise to 12% by 2010.

Over the past two decades, the world gas industry

has experienced a structural and regulatory

transformation. These changes have altered the strategic

behaviour of gas firms, with an intensification of

competition, the search for diversification (especially in

the case of power generation) and the internationalisation

of industry activities. Together, these changes have

radically changed the economic environment and the level

of competition in the industry.

Brazil's gas industry is characterised by its late

development, although in recent years, internal supply

imports and demand have grown significantly - the

growth trajectory of recent years exceeds that of countries

with more mature markets, such as Spain, Argentina,

the UK and the US. And the outlook is positive for

continued growth over the next few years, particularly

when set against the investment plans already

announced in Brazil.

The country has a small transportation network

concentrated near the coast. The distribution network is

concentrated in the major consumption centres.

Domestic gas sources are largely offshore in the Campos

basin and Bolivia provides imports. Given the degree

of gas penetration in the country's primary energy

consumption, the industry is poorly developed when

compared with other countries. The industry requires

heavy investment in expanding the transport and

distribution (T&D) networks, as well as in diversifying and

increasing its supplies. Such investments are necessary

for realising the industry's enormous potential.

Another key industry highlight is the changing profile

of gas supply. A large part of the gas produced

domestically to date has been associated with oil

production. The latter diluting or even totally absorbing

the costs of exploiting the gas. In most cases, gas

production was feasible only in conjunction with oil

production activities. However, the country's latest gas

finds are non-associated. Thus, an exclusively dedicated

structure must be developed to produce this gas -

translating into a significant rise in production costs. This

is more significant when analysed against the high costs

associated with the market for exploration and production

(E&P) sector equipment. In recent years, the leasing costs

of drilling rigs and E&P equipment have been climbing in

parallel with escalating oil prices. This directly affects endconsumer

prices.

In a world of primary energy consumption

diversification, of greater environmental restrictions and

the reduced dependence on oil, Brazil has been seeking

to develop alternative energy sources - principally natural

gas and biofuels. The gas industry holds enormous

potential for Brazil, although there is still a long way to go

before it reaches maturity and major investment is

required.

p.29-31 (adapted)

Reducing the dependence on oil

Ildo Sauer, Gas and Energy Director, Petrobras.

Brazil's energy sector is following the worldwide

tendency towards greater diversification of primary energy

sources and the increased use of natural gas and

biofuels. There are several reasons for this change. The

most important are the environmental restrictions that

are gradually being adopted in the world's principal

energy-consuming markets and the need to reduce the

dependence on oil, set against a scenario of accelerated

depletion in oil reserves and escalating prices.

The share of gas in Brazilian primary energy

consumption has more than doubled in a short period,

increasing from 4.1% in 1999 to 8.9% in 2004, and this

share is forecast to rise to 12% by 2010.

Over the past two decades, the world gas industry

has experienced a structural and regulatory

transformation. These changes have altered the strategic

behaviour of gas firms, with an intensification of

competition, the search for diversification (especially in

the case of power generation) and the internationalisation

of industry activities. Together, these changes have

radically changed the economic environment and the level

of competition in the industry.

Brazil's gas industry is characterised by its late

development, although in recent years, internal supply

imports and demand have grown significantly - the

growth trajectory of recent years exceeds that of countries

with more mature markets, such as Spain, Argentina,

the UK and the US. And the outlook is positive for

continued growth over the next few years, particularly

when set against the investment plans already

announced in Brazil.

The country has a small transportation network

concentrated near the coast. The distribution network is

concentrated in the major consumption centres.

Domestic gas sources are largely offshore in the Campos

basin and Bolivia provides imports. Given the degree

of gas penetration in the country's primary energy

consumption, the industry is poorly developed when

compared with other countries. The industry requires

heavy investment in expanding the transport and

distribution (T&D) networks, as well as in diversifying and

increasing its supplies. Such investments are necessary

for realising the industry's enormous potential.

Another key industry highlight is the changing profile

of gas supply. A large part of the gas produced

domestically to date has been associated with oil

production. The latter diluting or even totally absorbing

the costs of exploiting the gas. In most cases, gas

production was feasible only in conjunction with oil

production activities. However, the country's latest gas

finds are non-associated. Thus, an exclusively dedicated

structure must be developed to produce this gas -

translating into a significant rise in production costs. This

is more significant when analysed against the high costs

associated with the market for exploration and production

(E&P) sector equipment. In recent years, the leasing costs

of drilling rigs and E&P equipment have been climbing in

parallel with escalating oil prices. This directly affects endconsumer

prices.

In a world of primary energy consumption

diversification, of greater environmental restrictions and

the reduced dependence on oil, Brazil has been seeking

to develop alternative energy sources - principally natural

gas and biofuels. The gas industry holds enormous

potential for Brazil, although there is still a long way to go

before it reaches maturity and major investment is

required.

p.29-31 (adapted)

Reducing the dependence on oil

Ildo Sauer, Gas and Energy Director, Petrobras.

Brazil's energy sector is following the worldwide

tendency towards greater diversification of primary energy

sources and the increased use of natural gas and

biofuels. There are several reasons for this change. The

most important are the environmental restrictions that

are gradually being adopted in the world's principal

energy-consuming markets and the need to reduce the

dependence on oil, set against a scenario of accelerated

depletion in oil reserves and escalating prices.

The share of gas in Brazilian primary energy

consumption has more than doubled in a short period,

increasing from 4.1% in 1999 to 8.9% in 2004, and this

share is forecast to rise to 12% by 2010.

Over the past two decades, the world gas industry

has experienced a structural and regulatory

transformation. These changes have altered the strategic

behaviour of gas firms, with an intensification of

competition, the search for diversification (especially in

the case of power generation) and the internationalisation

of industry activities. Together, these changes have

radically changed the economic environment and the level

of competition in the industry.

Brazil's gas industry is characterised by its late

development, although in recent years, internal supply

imports and demand have grown significantly - the

growth trajectory of recent years exceeds that of countries

with more mature markets, such as Spain, Argentina,

the UK and the US. And the outlook is positive for

continued growth over the next few years, particularly

when set against the investment plans already

announced in Brazil.

The country has a small transportation network

concentrated near the coast. The distribution network is

concentrated in the major consumption centres.

Domestic gas sources are largely offshore in the Campos

basin and Bolivia provides imports. Given the degree

of gas penetration in the country's primary energy

consumption, the industry is poorly developed when

compared with other countries. The industry requires

heavy investment in expanding the transport and

distribution (T&D) networks, as well as in diversifying and

increasing its supplies. Such investments are necessary

for realising the industry's enormous potential.

Another key industry highlight is the changing profile

of gas supply. A large part of the gas produced

domestically to date has been associated with oil

production. The latter diluting or even totally absorbing

the costs of exploiting the gas. In most cases, gas

production was feasible only in conjunction with oil

production activities. However, the country's latest gas

finds are non-associated. Thus, an exclusively dedicated

structure must be developed to produce this gas -

translating into a significant rise in production costs. This

is more significant when analysed against the high costs

associated with the market for exploration and production

(E&P) sector equipment. In recent years, the leasing costs

of drilling rigs and E&P equipment have been climbing in

parallel with escalating oil prices. This directly affects endconsumer

prices.

In a world of primary energy consumption

diversification, of greater environmental restrictions and

the reduced dependence on oil, Brazil has been seeking

to develop alternative energy sources - principally natural

gas and biofuels. The gas industry holds enormous

potential for Brazil, although there is still a long way to go

before it reaches maturity and major investment is

required.

p.29-31 (adapted)

Reducing the dependence on oil

Ildo Sauer, Gas and Energy Director, Petrobras.

Brazil's energy sector is following the worldwide

tendency towards greater diversification of primary energy

sources and the increased use of natural gas and

biofuels. There are several reasons for this change. The

most important are the environmental restrictions that

are gradually being adopted in the world's principal

energy-consuming markets and the need to reduce the

dependence on oil, set against a scenario of accelerated

depletion in oil reserves and escalating prices.

The share of gas in Brazilian primary energy

consumption has more than doubled in a short period,

increasing from 4.1% in 1999 to 8.9% in 2004, and this

share is forecast to rise to 12% by 2010.

Over the past two decades, the world gas industry

has experienced a structural and regulatory

transformation. These changes have altered the strategic

behaviour of gas firms, with an intensification of

competition, the search for diversification (especially in

the case of power generation) and the internationalisation

of industry activities. Together, these changes have

radically changed the economic environment and the level

of competition in the industry.

Brazil's gas industry is characterised by its late

development, although in recent years, internal supply

imports and demand have grown significantly - the

growth trajectory of recent years exceeds that of countries

with more mature markets, such as Spain, Argentina,

the UK and the US. And the outlook is positive for

continued growth over the next few years, particularly

when set against the investment plans already

announced in Brazil.

The country has a small transportation network

concentrated near the coast. The distribution network is

concentrated in the major consumption centres.

Domestic gas sources are largely offshore in the Campos

basin and Bolivia provides imports. Given the degree

of gas penetration in the country's primary energy

consumption, the industry is poorly developed when

compared with other countries. The industry requires

heavy investment in expanding the transport and

distribution (T&D) networks, as well as in diversifying and

increasing its supplies. Such investments are necessary

for realising the industry's enormous potential.

Another key industry highlight is the changing profile

of gas supply. A large part of the gas produced

domestically to date has been associated with oil

production. The latter diluting or even totally absorbing

the costs of exploiting the gas. In most cases, gas

production was feasible only in conjunction with oil

production activities. However, the country's latest gas

finds are non-associated. Thus, an exclusively dedicated

structure must be developed to produce this gas -

translating into a significant rise in production costs. This

is more significant when analysed against the high costs

associated with the market for exploration and production

(E&P) sector equipment. In recent years, the leasing costs

of drilling rigs and E&P equipment have been climbing in

parallel with escalating oil prices. This directly affects endconsumer

prices.

In a world of primary energy consumption

diversification, of greater environmental restrictions and

the reduced dependence on oil, Brazil has been seeking

to develop alternative energy sources - principally natural

gas and biofuels. The gas industry holds enormous

potential for Brazil, although there is still a long way to go

before it reaches maturity and major investment is

required.

p.29-31 (adapted)

Reducing the dependence on oil

Ildo Sauer, Gas and Energy Director, Petrobras.

Brazil's energy sector is following the worldwide

tendency towards greater diversification of primary energy

sources and the increased use of natural gas and

biofuels. There are several reasons for this change. The

most important are the environmental restrictions that

are gradually being adopted in the world's principal

energy-consuming markets and the need to reduce the

dependence on oil, set against a scenario of accelerated

depletion in oil reserves and escalating prices.

The share of gas in Brazilian primary energy

consumption has more than doubled in a short period,

increasing from 4.1% in 1999 to 8.9% in 2004, and this

share is forecast to rise to 12% by 2010.

Over the past two decades, the world gas industry

has experienced a structural and regulatory

transformation. These changes have altered the strategic

behaviour of gas firms, with an intensification of

competition, the search for diversification (especially in

the case of power generation) and the internationalisation

of industry activities. Together, these changes have

radically changed the economic environment and the level

of competition in the industry.

Brazil's gas industry is characterised by its late

development, although in recent years, internal supply

imports and demand have grown significantly - the

growth trajectory of recent years exceeds that of countries

with more mature markets, such as Spain, Argentina,

the UK and the US. And the outlook is positive for

continued growth over the next few years, particularly

when set against the investment plans already

announced in Brazil.

The country has a small transportation network

concentrated near the coast. The distribution network is

concentrated in the major consumption centres.

Domestic gas sources are largely offshore in the Campos

basin and Bolivia provides imports. Given the degree

of gas penetration in the country's primary energy

consumption, the industry is poorly developed when

compared with other countries. The industry requires

heavy investment in expanding the transport and

distribution (T&D) networks, as well as in diversifying and

increasing its supplies. Such investments are necessary

for realising the industry's enormous potential.

Another key industry highlight is the changing profile

of gas supply. A large part of the gas produced

domestically to date has been associated with oil

production. The latter diluting or even totally absorbing

the costs of exploiting the gas. In most cases, gas

production was feasible only in conjunction with oil

production activities. However, the country's latest gas

finds are non-associated. Thus, an exclusively dedicated

structure must be developed to produce this gas -

translating into a significant rise in production costs. This

is more significant when analysed against the high costs

associated with the market for exploration and production

(E&P) sector equipment. In recent years, the leasing costs

of drilling rigs and E&P equipment have been climbing in

parallel with escalating oil prices. This directly affects endconsumer

prices.

In a world of primary energy consumption

diversification, of greater environmental restrictions and

the reduced dependence on oil, Brazil has been seeking

to develop alternative energy sources - principally natural

gas and biofuels. The gas industry holds enormous

potential for Brazil, although there is still a long way to go

before it reaches maturity and major investment is

required.

p.29-31 (adapted)

Reducing the dependence on oil

Ildo Sauer, Gas and Energy Director, Petrobras.

Brazil's energy sector is following the worldwide

tendency towards greater diversification of primary energy

sources and the increased use of natural gas and

biofuels. There are several reasons for this change. The

most important are the environmental restrictions that

are gradually being adopted in the world's principal

energy-consuming markets and the need to reduce the

dependence on oil, set against a scenario of accelerated

depletion in oil reserves and escalating prices.

The share of gas in Brazilian primary energy

consumption has more than doubled in a short period,

increasing from 4.1% in 1999 to 8.9% in 2004, and this

share is forecast to rise to 12% by 2010.

Over the past two decades, the world gas industry

has experienced a structural and regulatory

transformation. These changes have altered the strategic

behaviour of gas firms, with an intensification of

competition, the search for diversification (especially in

the case of power generation) and the internationalisation

of industry activities. Together, these changes have

radically changed the economic environment and the level

of competition in the industry.

Brazil's gas industry is characterised by its late

development, although in recent years, internal supply

imports and demand have grown significantly - the

growth trajectory of recent years exceeds that of countries

with more mature markets, such as Spain, Argentina,

the UK and the US. And the outlook is positive for

continued growth over the next few years, particularly

when set against the investment plans already

announced in Brazil.

The country has a small transportation network

concentrated near the coast. The distribution network is

concentrated in the major consumption centres.

Domestic gas sources are largely offshore in the Campos

basin and Bolivia provides imports. Given the degree

of gas penetration in the country's primary energy

consumption, the industry is poorly developed when

compared with other countries. The industry requires

heavy investment in expanding the transport and

distribution (T&D) networks, as well as in diversifying and

increasing its supplies. Such investments are necessary

for realising the industry's enormous potential.

Another key industry highlight is the changing profile

of gas supply. A large part of the gas produced

domestically to date has been associated with oil

production. The latter diluting or even totally absorbing

the costs of exploiting the gas. In most cases, gas

production was feasible only in conjunction with oil

production activities. However, the country's latest gas

finds are non-associated. Thus, an exclusively dedicated

structure must be developed to produce this gas -

translating into a significant rise in production costs. This

is more significant when analysed against the high costs

associated with the market for exploration and production

(E&P) sector equipment. In recent years, the leasing costs

of drilling rigs and E&P equipment have been climbing in

parallel with escalating oil prices. This directly affects endconsumer

prices.

In a world of primary energy consumption

diversification, of greater environmental restrictions and

the reduced dependence on oil, Brazil has been seeking

to develop alternative energy sources - principally natural

gas and biofuels. The gas industry holds enormous

potential for Brazil, although there is still a long way to go

before it reaches maturity and major investment is

required.

p.29-31 (adapted)

A NBC T 16.10 estabelece critérios e procedimentos para a avaliação e a mensuração de ativos e passivos integrantes do patrimônio de entidades do setor público. Para tanto, é necessário conhecer algumas definições, também expressas na referida norma. Nesse sentido, considerando o definido na NBC T 16.5 “ __________________________ é o ajuste ao valor de mercado ou de consenso entre as partes para bens do ativo, quando esse for inferior ao valor líquido contábil”.

Assinale a alternativa que preenche corretamente a lacuna do trecho acima.

Considere as seguintes assertivas:

I. Dispensar ou inexigir licitação fora das hipóteses previstas em lei, ou deixar de observar as formalidades pertinentes à dispensa ou à inexigibilidade.

II. Impedir, perturbar ou fraudar a realização de qualquer ato de procedimento licitatório.

III. Afastar ou procurar afastar licitante, por meio de violência, grave ameaça, fraude ou oferecimento de vantagem de qualquer tipo.

IV. Admitir à licitação ou celebrar contrato com empresa ou profissional declarado inidôneo.

De acordo com a Lei n° 8.666/1993, são crimes e estão sujeitos a pena de detenção e multa o que se afirma em

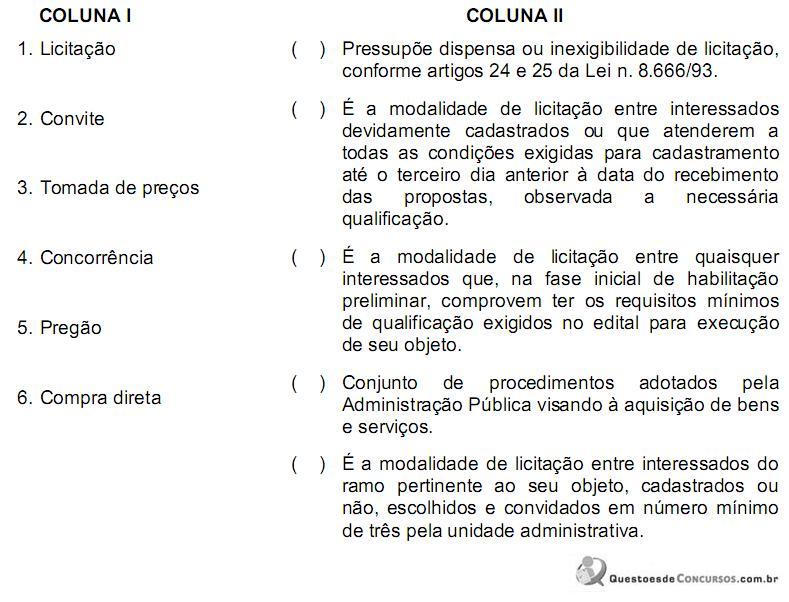

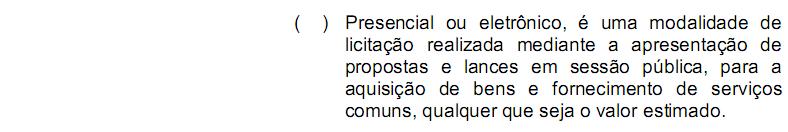

Assinale a alternativa que apresenta a sequência de números >CORRETA.