Questões de Vestibular FGV 2015 para Vestibular - Inglês, Física, Química e Língua Portuguesa

Foram encontradas 135 questões

Das sete maravilhas mencionadas pelo grego Antíparo de Sídon há mais de 2100 anos, hoje só se pode conferir uma, a pirâmide egípcia de Quéops. Para que a humanidade não sofra no futuro com o mesmo lapso, arqueólogos e especialistas em impressão 3D criaram o Projeto Mosul. O objetivo é recriar no computador relíquias que estão sendo destruídas pelos terroristas do Estado Islâmico, como um leão do museu de Mosul.

(Veja, 3 jun. 2015. Adaptado)

A tecnologia 3D está contribuindo para preservar a história humana como os sítios arqueológicos de Mosul, situados

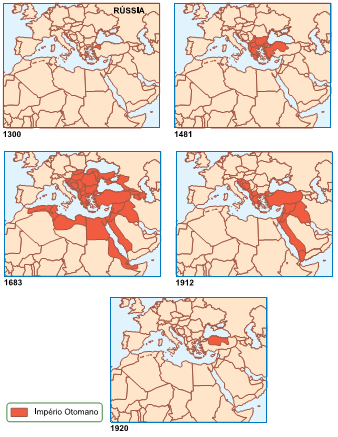

Evolução do Império Otomano

(Folha de S.Paulo, 24 abr. 2015)

Em 2015, comemorou-se o centenário de um desses massacres, que se refere ao povo

Em novembro de 2014, Estados Unidos e China haviam fechado acordo para redução das emissões, com metas variáveis entre 2025 e 2050. Os países emergentes, no entanto, cobraram metas mais ambiciosas e claras.

Todos os esforços feitos até agora para criar esboço do novo acordo climático têm esbarrado na divisão de dois blocos: países desenvolvidos e em desenvolvimento. Ambos ainda estão preocupados com as responsabilidades que caberão a cada grupo nas ações para reduzir as emissões de gases do efeito estufa.

(www.socioambiental.org)

A COP-21 será realizada entre novembro e dezembro de 2015 e é conhecida como

É previsível a continuada oposição da Argentina e da Venezuela à flexibilização das regras do bloco. É do interesse brasileiro ignorar essa oposição e assumir a liderança nas tratativas para retomar os entendimentos com a UE e aceitar a ampliação na negociação externa com países mais desenvolvidos, como o Canadá e a Coreia do Sul. A Espanha defendeu abertamente uma opção pragmática para que as conversações entre a União Europeia e o bloco possam avançar.

(O Estado de S.Paulo, 9 jun. 2015. Adaptado)

O texto refere-se ao bloco

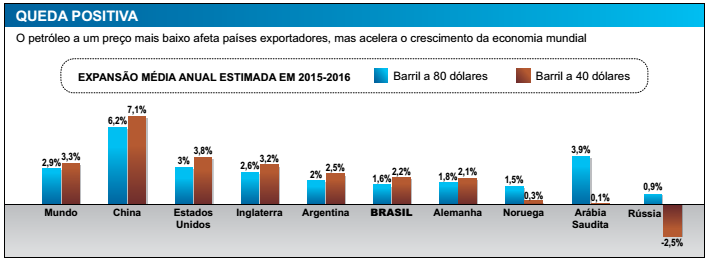

Os anos de bonança para os países produtores e exportadores de petróleo ficaram para trás. O ciclo de cotações acima de 100 dólares viabilizou e rentabilizou novas fronteiras de exploração, como o xisto norte-americano, as areias betuminosas canadenses e o pré-sal brasileiro. Mas o preço do barril, em trajetória de queda há seis meses, caiu abaixo do patamar psicológico de 50 dólares.

Os exportadores sofrem com o encolhimento das receitas. Nesse grupo, estão países como Arábia Saudita, Rússia, Venezuela e Noruega.

(Veja, 14 jan. 2015. Adaptado)

A partir de seus conhecimentos e da análise do gráfico, é correto afirmar que o país que tem maior dependência de suas exportações de petróleo é

Considerado uma fonte estratégica para todo o mundo e, principalmente, para o Brasil, o mar vem chamando a atenção de especialistas em energia, que já testam e implantam algumas alternativas de geração, como a usina de ondas.

Localizada no quebra-mar do Porto de Pecém, a usina de ondas é a primeira na América Latina responsável pela geração de energia elétrica por meio do movimento das ondas do mar. Com tecnologia 100% nacional, a estimativa é de que o equipamento de baixo impacto ambiental esteja completamente pronto para funcionar até o ano de 2020.

A cidade em que está sendo implantado o projeto é:

O país exportou menos armas em 2014. Cortes nos orçamentos de defesa de vários países ocidentais fizeram sistemas bélicos do país cair para US$ 5,7 bilhões – US$ 1 bilhão a menos do que em 2013. Inesperadamente, outro segmento relacionado à segurança ocupou o espaço vazio. Pela primeira vez, vendeu mais softwares de cibersegurança do que armas. Segundo dados divulgados recentemente pela força-tarefa em cibernética, em 2014, suas empresas faturaram cerca de US$ 6 bilhões com softwares destinados a prover segurança na internet, valor que corresponde a aproximadamente 10% do faturamento mundial do segmento.

Além disso, o país também está produzindo grande quantidade de startups de cibersegurança. Em 2014, oito delas foram vendidas para investidores estrangeiros por um total de US$ 700 milhões.

Nele o número de companhias de cibersegurança dobrou ao longo dos últimos cinco anos. Hoje são 300. A demanda por seus produtos aumentou muito, agora que governos e empresas se deram conta de que precisam se proteger contra os hackers. Esse país dispõe de um contingente considerável de engenheiros de software experientes, oriundos, em sua maioria, de dois importantes mananciais: em primeiro lugar, os quadros de funcionários dos 280 centros de alta tecnologia mantidos no país por multinacionais estrangeiras, de onde saem indivíduos que começam a se lançar em empreendimentos próprios; e, em segundo lugar, as fileiras das forças armadas do país, das quais, todos os anos, são dispensadas centenas de pessoas tecnologicamente capacitadas. Há décadas, os militares vêm desenvolvendo seu arsenal – tanto defensivo quanto ofensivo – para o conflito cibernético, e essa política agora está pagando dividendos.

(O Estado de São Paulo, 4 ago. 2015. The Economist. Adaptado)

O país que apresenta as características mencionadas no texto é

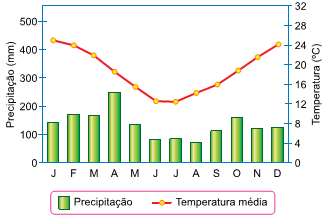

Analise o seguinte pluviograma:

(Climatologia, Ed. Oficina de Textos.)

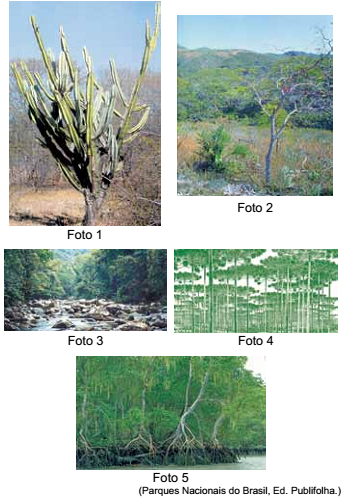

A formação vegetal que ocorre no clima representado no pluviograma é encontrada na

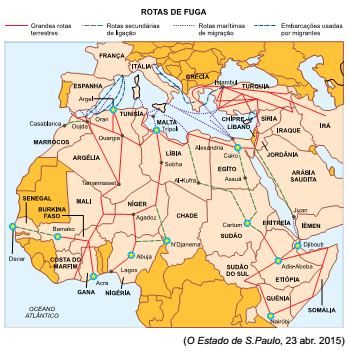

A partir desse mapa, é correto afirmar que

Todos os processos que causam desagregação das rochas, com separação dos grãos minerais antes coesos e com sua fragmentação, transformando a rocha inalterada em material descontínuo e friável, constituem o processo de

(Decifrando a Terra, Cia Ed. Nacional)

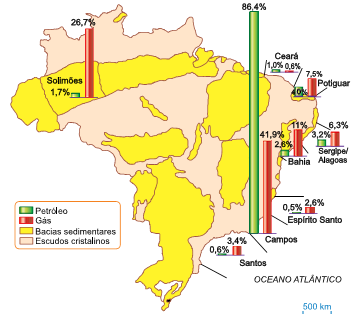

Sabendo-se que as reservas foram distribuídas em um mapa de formações geológicas, é correto afirmar:

(Foreing Affairs, jan/fev 2015

Essa figura mostra

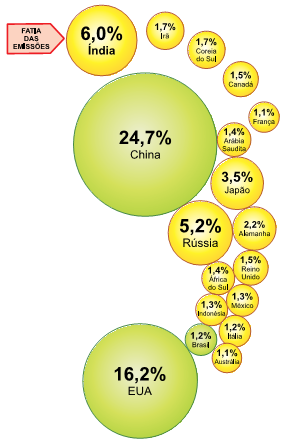

A DIVISÃO DA PEGADA DE CARBONO

(Folha de S.Paulo, 13 nov. 2014)

A partir das informações mostradas e demais conhecimentos sobre a situação dos países apresentados, é correto afirmar que

As filas passaram a fazer parte do cotidiano do país. Falta de leite a farinha de milho – base da receita da arepa, um dos principais alimentos da dieta desse país –, de fralda descartável a pasta de dente, de material escolar a medicamentos.

Há, certamente, mais de uma razão para explicar o índice de desabastecimento, que atinge 75% dos produtos monitorados pelo governo, e é quase certo também que ele exercerá uma influência decisiva nas próximas eleições parlamentares.

Há controle oficial de preços, ameaça a setores produtivos, falta de incentivo à indústria, desconfiança do mercado, ausência de crédito e uma série de questões que afetam as produções de bens e produtos. Nenhum grande país produtor de petróleo sentiu o impacto da fortíssima queda das cotações tanto quanto esse país, onde o petróleo responde por 96% das exportações.

O texto retrata a situação crítica

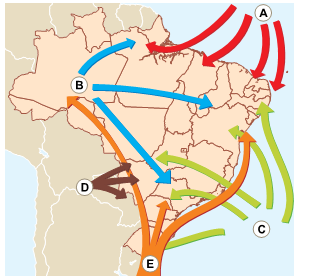

Para que essa cinza chegasse até o Rio Grande do Sul, é mais provável que tenha sido impulsionada pela massa de ar indicada no mapa por:

by Julia Leite and Paula Sambo

August 26, 2015

Not long ago, Brazil's real-estate market was one of the biggest symbols of the country's burgeoning economic might. Now, it's fallen victim to an ever-deepening recession.

PDG Realty SA, once the largest homebuilder by revenue, hired Rothschild last week to help restructure 5.8 billion reais ($1.6 billion) of debt after second-quarter net sales sank 88 percent. Earlier this month, Rossi Residencial SA, which has 2.5 billion reais in debt, also brought in advisers to “restructure operations and review strategies." Since 2010, the builder has lost 99 percent of its stock-market value.

The real-estate industry, which is equal to about 10 percent of Brazil's economy, is emerging as one of the latest casualties of a recession that analysts forecast will be its longest since the 1930s. To make matters worse, interest rates are the highest in almost a decade while inflation is soaring. “There is no real estate company that survives without sales," Bruno Mendonça Lima de Carvalho, the head of fixed income at Guide Investimentos SA, said from Sao Paulo. “You can't import or export apartments. You're relying solely on domestic activity."

PDG tried to boost revenue by lowering prices, financing up to 20 percent of some home purchases and even offering to buy back apartments if banks deny financing. Still, it sold just 217 units in the second quarter on a net basis, compared with 1,749 in 2014.

Negative Outlook

On Friday, Moody's Investors Service cut PDG's rating three levels to Caa3, citing the possibility of significant losses for bondholders and other lenders. Secured creditors may recover less than 80 percent in a default, according to Moody's, which kept a negative outlook on the rating. “The company is facing additional liquidity pressures from a prolonged deterioration in industry dynamics, including weak sales speed, tight financing availability and declining real estate prices," Moody's said.

Sao Paulo-based Rossi said in an e-mailed response to questions that second quarter sales improved and that the company's main focus is to reduce debt. Gross debt fell about 30 percent in the 12 months ended in June, Rossi said.

Home sales in Latin America's biggest economy tumbled 14 percent in the first half of 2015, according to data from the national real estate institute. Builders cut new projects by 20 percent during that span, while available financing shrank by about a quarter.

Real's Collapse

That's a reversal from just two years ago, when realestate prices in places like Rio de Janeiro and Sao Paulo had surged as much as 230 percent as rising incomes, a soaring real and record-low borrowing costs ignited a wave of home buying.

Brazilians find themselves in drastically different circumstances today. The currency fell 0.4 percent Wednesday as of 3:25 p.m. in New York, extending its loss this year to 26 percent. The jobless rate climbed to a five-year high of 7.5 percent last month.

The central bank boosted its key rate to 14.25 percent in July, making it ever more expensive to finance the purchase of a home. “It's a matter of demand, and demand is really weak," Will Landers, who manages Latin American stocks at BlackRock, said from Princeton, New Jersey. “We may have reached a peak in interest rates, but they should continue to be at these levels for a while. Consumers will stay on the sidelines because debt levels are still high, and employment will get worse."

(Business Week at www.bloomberg.com/news. Adapted)

by Julia Leite and Paula Sambo

August 26, 2015

Not long ago, Brazil's real-estate market was one of the biggest symbols of the country's burgeoning economic might. Now, it's fallen victim to an ever-deepening recession.

PDG Realty SA, once the largest homebuilder by revenue, hired Rothschild last week to help restructure 5.8 billion reais ($1.6 billion) of debt after second-quarter net sales sank 88 percent. Earlier this month, Rossi Residencial SA, which has 2.5 billion reais in debt, also brought in advisers to “restructure operations and review strategies." Since 2010, the builder has lost 99 percent of its stock-market value.

The real-estate industry, which is equal to about 10 percent of Brazil's economy, is emerging as one of the latest casualties of a recession that analysts forecast will be its longest since the 1930s. To make matters worse, interest rates are the highest in almost a decade while inflation is soaring. “There is no real estate company that survives without sales," Bruno Mendonça Lima de Carvalho, the head of fixed income at Guide Investimentos SA, said from Sao Paulo. “You can't import or export apartments. You're relying solely on domestic activity."

PDG tried to boost revenue by lowering prices, financing up to 20 percent of some home purchases and even offering to buy back apartments if banks deny financing. Still, it sold just 217 units in the second quarter on a net basis, compared with 1,749 in 2014.

Negative Outlook

On Friday, Moody's Investors Service cut PDG's rating three levels to Caa3, citing the possibility of significant losses for bondholders and other lenders. Secured creditors may recover less than 80 percent in a default, according to Moody's, which kept a negative outlook on the rating. “The company is facing additional liquidity pressures from a prolonged deterioration in industry dynamics, including weak sales speed, tight financing availability and declining real estate prices," Moody's said.

Sao Paulo-based Rossi said in an e-mailed response to questions that second quarter sales improved and that the company's main focus is to reduce debt. Gross debt fell about 30 percent in the 12 months ended in June, Rossi said.

Home sales in Latin America's biggest economy tumbled 14 percent in the first half of 2015, according to data from the national real estate institute. Builders cut new projects by 20 percent during that span, while available financing shrank by about a quarter.

Real's Collapse

That's a reversal from just two years ago, when realestate prices in places like Rio de Janeiro and Sao Paulo had surged as much as 230 percent as rising incomes, a soaring real and record-low borrowing costs ignited a wave of home buying.

Brazilians find themselves in drastically different circumstances today. The currency fell 0.4 percent Wednesday as of 3:25 p.m. in New York, extending its loss this year to 26 percent. The jobless rate climbed to a five-year high of 7.5 percent last month.

The central bank boosted its key rate to 14.25 percent in July, making it ever more expensive to finance the purchase of a home. “It's a matter of demand, and demand is really weak," Will Landers, who manages Latin American stocks at BlackRock, said from Princeton, New Jersey. “We may have reached a peak in interest rates, but they should continue to be at these levels for a while. Consumers will stay on the sidelines because debt levels are still high, and employment will get worse."

(Business Week at www.bloomberg.com/news. Adapted)

by Julia Leite and Paula Sambo

August 26, 2015

Not long ago, Brazil's real-estate market was one of the biggest symbols of the country's burgeoning economic might. Now, it's fallen victim to an ever-deepening recession.

PDG Realty SA, once the largest homebuilder by revenue, hired Rothschild last week to help restructure 5.8 billion reais ($1.6 billion) of debt after second-quarter net sales sank 88 percent. Earlier this month, Rossi Residencial SA, which has 2.5 billion reais in debt, also brought in advisers to “restructure operations and review strategies." Since 2010, the builder has lost 99 percent of its stock-market value.

The real-estate industry, which is equal to about 10 percent of Brazil's economy, is emerging as one of the latest casualties of a recession that analysts forecast will be its longest since the 1930s. To make matters worse, interest rates are the highest in almost a decade while inflation is soaring. “There is no real estate company that survives without sales," Bruno Mendonça Lima de Carvalho, the head of fixed income at Guide Investimentos SA, said from Sao Paulo. “You can't import or export apartments. You're relying solely on domestic activity."

PDG tried to boost revenue by lowering prices, financing up to 20 percent of some home purchases and even offering to buy back apartments if banks deny financing. Still, it sold just 217 units in the second quarter on a net basis, compared with 1,749 in 2014.

Negative Outlook

On Friday, Moody's Investors Service cut PDG's rating three levels to Caa3, citing the possibility of significant losses for bondholders and other lenders. Secured creditors may recover less than 80 percent in a default, according to Moody's, which kept a negative outlook on the rating. “The company is facing additional liquidity pressures from a prolonged deterioration in industry dynamics, including weak sales speed, tight financing availability and declining real estate prices," Moody's said.

Sao Paulo-based Rossi said in an e-mailed response to questions that second quarter sales improved and that the company's main focus is to reduce debt. Gross debt fell about 30 percent in the 12 months ended in June, Rossi said.

Home sales in Latin America's biggest economy tumbled 14 percent in the first half of 2015, according to data from the national real estate institute. Builders cut new projects by 20 percent during that span, while available financing shrank by about a quarter.

Real's Collapse

That's a reversal from just two years ago, when realestate prices in places like Rio de Janeiro and Sao Paulo had surged as much as 230 percent as rising incomes, a soaring real and record-low borrowing costs ignited a wave of home buying.

Brazilians find themselves in drastically different circumstances today. The currency fell 0.4 percent Wednesday as of 3:25 p.m. in New York, extending its loss this year to 26 percent. The jobless rate climbed to a five-year high of 7.5 percent last month.

The central bank boosted its key rate to 14.25 percent in July, making it ever more expensive to finance the purchase of a home. “It's a matter of demand, and demand is really weak," Will Landers, who manages Latin American stocks at BlackRock, said from Princeton, New Jersey. “We may have reached a peak in interest rates, but they should continue to be at these levels for a while. Consumers will stay on the sidelines because debt levels are still high, and employment will get worse."

(Business Week at www.bloomberg.com/news. Adapted)

by Julia Leite and Paula Sambo

August 26, 2015

Not long ago, Brazil's real-estate market was one of the biggest symbols of the country's burgeoning economic might. Now, it's fallen victim to an ever-deepening recession.

PDG Realty SA, once the largest homebuilder by revenue, hired Rothschild last week to help restructure 5.8 billion reais ($1.6 billion) of debt after second-quarter net sales sank 88 percent. Earlier this month, Rossi Residencial SA, which has 2.5 billion reais in debt, also brought in advisers to “restructure operations and review strategies." Since 2010, the builder has lost 99 percent of its stock-market value.

The real-estate industry, which is equal to about 10 percent of Brazil's economy, is emerging as one of the latest casualties of a recession that analysts forecast will be its longest since the 1930s. To make matters worse, interest rates are the highest in almost a decade while inflation is soaring. “There is no real estate company that survives without sales," Bruno Mendonça Lima de Carvalho, the head of fixed income at Guide Investimentos SA, said from Sao Paulo. “You can't import or export apartments. You're relying solely on domestic activity."

PDG tried to boost revenue by lowering prices, financing up to 20 percent of some home purchases and even offering to buy back apartments if banks deny financing. Still, it sold just 217 units in the second quarter on a net basis, compared with 1,749 in 2014.

Negative Outlook

On Friday, Moody's Investors Service cut PDG's rating three levels to Caa3, citing the possibility of significant losses for bondholders and other lenders. Secured creditors may recover less than 80 percent in a default, according to Moody's, which kept a negative outlook on the rating. “The company is facing additional liquidity pressures from a prolonged deterioration in industry dynamics, including weak sales speed, tight financing availability and declining real estate prices," Moody's said.

Sao Paulo-based Rossi said in an e-mailed response to questions that second quarter sales improved and that the company's main focus is to reduce debt. Gross debt fell about 30 percent in the 12 months ended in June, Rossi said.

Home sales in Latin America's biggest economy tumbled 14 percent in the first half of 2015, according to data from the national real estate institute. Builders cut new projects by 20 percent during that span, while available financing shrank by about a quarter.

Real's Collapse

That's a reversal from just two years ago, when realestate prices in places like Rio de Janeiro and Sao Paulo had surged as much as 230 percent as rising incomes, a soaring real and record-low borrowing costs ignited a wave of home buying.

Brazilians find themselves in drastically different circumstances today. The currency fell 0.4 percent Wednesday as of 3:25 p.m. in New York, extending its loss this year to 26 percent. The jobless rate climbed to a five-year high of 7.5 percent last month.

The central bank boosted its key rate to 14.25 percent in July, making it ever more expensive to finance the purchase of a home. “It's a matter of demand, and demand is really weak," Will Landers, who manages Latin American stocks at BlackRock, said from Princeton, New Jersey. “We may have reached a peak in interest rates, but they should continue to be at these levels for a while. Consumers will stay on the sidelines because debt levels are still high, and employment will get worse."

(Business Week at www.bloomberg.com/news. Adapted)

by Julia Leite and Paula Sambo

August 26, 2015

Not long ago, Brazil's real-estate market was one of the biggest symbols of the country's burgeoning economic might. Now, it's fallen victim to an ever-deepening recession.

PDG Realty SA, once the largest homebuilder by revenue, hired Rothschild last week to help restructure 5.8 billion reais ($1.6 billion) of debt after second-quarter net sales sank 88 percent. Earlier this month, Rossi Residencial SA, which has 2.5 billion reais in debt, also brought in advisers to “restructure operations and review strategies." Since 2010, the builder has lost 99 percent of its stock-market value.

The real-estate industry, which is equal to about 10 percent of Brazil's economy, is emerging as one of the latest casualties of a recession that analysts forecast will be its longest since the 1930s. To make matters worse, interest rates are the highest in almost a decade while inflation is soaring. “There is no real estate company that survives without sales," Bruno Mendonça Lima de Carvalho, the head of fixed income at Guide Investimentos SA, said from Sao Paulo. “You can't import or export apartments. You're relying solely on domestic activity."

PDG tried to boost revenue by lowering prices, financing up to 20 percent of some home purchases and even offering to buy back apartments if banks deny financing. Still, it sold just 217 units in the second quarter on a net basis, compared with 1,749 in 2014.

Negative Outlook

On Friday, Moody's Investors Service cut PDG's rating three levels to Caa3, citing the possibility of significant losses for bondholders and other lenders. Secured creditors may recover less than 80 percent in a default, according to Moody's, which kept a negative outlook on the rating. “The company is facing additional liquidity pressures from a prolonged deterioration in industry dynamics, including weak sales speed, tight financing availability and declining real estate prices," Moody's said.

Sao Paulo-based Rossi said in an e-mailed response to questions that second quarter sales improved and that the company's main focus is to reduce debt. Gross debt fell about 30 percent in the 12 months ended in June, Rossi said.

Home sales in Latin America's biggest economy tumbled 14 percent in the first half of 2015, according to data from the national real estate institute. Builders cut new projects by 20 percent during that span, while available financing shrank by about a quarter.

Real's Collapse

That's a reversal from just two years ago, when realestate prices in places like Rio de Janeiro and Sao Paulo had surged as much as 230 percent as rising incomes, a soaring real and record-low borrowing costs ignited a wave of home buying.

Brazilians find themselves in drastically different circumstances today. The currency fell 0.4 percent Wednesday as of 3:25 p.m. in New York, extending its loss this year to 26 percent. The jobless rate climbed to a five-year high of 7.5 percent last month.

The central bank boosted its key rate to 14.25 percent in July, making it ever more expensive to finance the purchase of a home. “It's a matter of demand, and demand is really weak," Will Landers, who manages Latin American stocks at BlackRock, said from Princeton, New Jersey. “We may have reached a peak in interest rates, but they should continue to be at these levels for a while. Consumers will stay on the sidelines because debt levels are still high, and employment will get worse."

(Business Week at www.bloomberg.com/news. Adapted)