Questões de Vestibular FGV 2015 para Vestibular - Inglês, Física, Química e Língua Portuguesa

Foram encontradas 135 questões

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false" rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes". Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting" with regulators, and hasn't been heard of since. Her Chinese husband says “she's gone on holiday". We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn't do what the high command wants it to." When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn't noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just" 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor's and Fitch Rating with market abuse for daring to downgrade Italy's credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing" other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market", it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China's stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China's factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country's burgeoning output of graduates. China's modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country's shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can't do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false" rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes". Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting" with regulators, and hasn't been heard of since. Her Chinese husband says “she's gone on holiday". We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn't do what the high command wants it to." When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn't noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just" 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor's and Fitch Rating with market abuse for daring to downgrade Italy's credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing" other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market", it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China's stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China's factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country's burgeoning output of graduates. China's modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country's shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can't do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false" rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes". Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting" with regulators, and hasn't been heard of since. Her Chinese husband says “she's gone on holiday". We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn't do what the high command wants it to." When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn't noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just" 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor's and Fitch Rating with market abuse for daring to downgrade Italy's credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing" other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market", it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China's stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China's factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country's burgeoning output of graduates. China's modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country's shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can't do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false" rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes". Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting" with regulators, and hasn't been heard of since. Her Chinese husband says “she's gone on holiday". We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn't do what the high command wants it to." When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn't noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just" 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor's and Fitch Rating with market abuse for daring to downgrade Italy's credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing" other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market", it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China's stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China's factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country's burgeoning output of graduates. China's modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country's shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can't do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false" rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes". Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting" with regulators, and hasn't been heard of since. Her Chinese husband says “she's gone on holiday". We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn't do what the high command wants it to." When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn't noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just" 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor's and Fitch Rating with market abuse for daring to downgrade Italy's credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing" other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market", it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China's stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China's factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country's burgeoning output of graduates. China's modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country's shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can't do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false" rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes". Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting" with regulators, and hasn't been heard of since. Her Chinese husband says “she's gone on holiday". We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn't do what the high command wants it to." When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn't noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just" 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor's and Fitch Rating with market abuse for daring to downgrade Italy's credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing" other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market", it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China's stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China's factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country's burgeoning output of graduates. China's modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country's shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can't do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false" rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes". Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting" with regulators, and hasn't been heard of since. Her Chinese husband says “she's gone on holiday". We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn't do what the high command wants it to." When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn't noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just" 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor's and Fitch Rating with market abuse for daring to downgrade Italy's credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing" other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market", it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China's stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China's factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country's burgeoning output of graduates. China's modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country's shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can't do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false" rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes". Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting" with regulators, and hasn't been heard of since. Her Chinese husband says “she's gone on holiday". We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn't do what the high command wants it to." When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn't noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just" 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor's and Fitch Rating with market abuse for daring to downgrade Italy's credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing" other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market", it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China's stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China's factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country's burgeoning output of graduates. China's modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country's shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can't do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false" rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes". Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting" with regulators, and hasn't been heard of since. Her Chinese husband says “she's gone on holiday". We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn't do what the high command wants it to." When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn't noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just" 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor's and Fitch Rating with market abuse for daring to downgrade Italy's credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing" other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market", it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China's stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China's factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country's burgeoning output of graduates. China's modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country's shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can't do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

By Jeremy Warner

3 Sep 2015

When in trouble, shoot the messenger. This timehonoured approach to dealing with unwelcome news was much in evidence in China this week when nearly 200 people were rounded up and criminally charged with spreading “false" rumours about the stock market and the economy, or otherwise profiting from their travails.

One luckless financial journalist was ritually paraded on state TV, tearfully confessing his “crimes". Meanwhile, the head of the Chinese desk of one London-based hedge fund group was summoned to a “meeting" with regulators, and hasn't been heard of since. Her Chinese husband says “she's gone on holiday". We can only hope it is not to the re-indoctrination of the asbestos mines. Despite the massive progress of recent decades, old habits die hard.

China was meant to have embraced free market reform, yet these latest actions suggest an altogether different approach. Roughly summarised, it amounts to: “Reform good, but woe betide the free market if it doesn't do what the high command wants it to." When the stock market was going up, the Chinese authorities were perfectly happy to tolerate what, to virtually all Western observers, looked like a dangerously speculative bubble, vaingloriously believing it to be a fair reflection of the wondrous successes of the Chinese economy.

The first rule of stock market investment – that share prices can go down as well as up – seems to have been almost wholly forgotten in the scramble for instant riches. When, inevitably, the stock market crashed, the authorities threw the kitchen sink at the problem, but they failed to halt the carnage. This was an even ruder awakening – for it demonstrated to an already disillusioned public that policy-makers were no longer in control of events. Perhaps they hadn't noticed, but there are today more Chinese with stock trading accounts – some 90 million – than there are members of the Communist Party – “just" 80 million. In any case, powerless before the storm, the authorities have instead turned to scapegoating.

Apparently more liberal, advanced economies, it ought to be said, are by no means averse to this kind of behaviour either. A few years back, Italian prosecutors charged nine employees of Standard & Poor's and Fitch Rating with market abuse for daring to downgrade Italy's credit rating, while it is still commonplace in France to blame Anglo-Saxon speculators and their cronies in the London press for any financial or economic setback.

Nor are Western governments and central bankers averse to a little market manipulation when it suits them. What is “quantitative easing" other than money printing to prop up asset prices, including stocks and shares? Chinese refusal to accept the judgments of “Mr Market", it might be argued, is just a more extreme version of the same thing. Small wonder that European officials sometimes look longingly across at the state-directed capitalism practised in China, and pronounce it a model we might perhaps aspire to ourselves.

As recent events have demonstrated, we should not. China's stock market crash is not the work of malicious financial journalists and short-selling hedge funds, but a signal of difficult time ahead and perhaps even of an economic roadcrash to come. After nearly 35 years of spectacular progress, the Chinese economy faces multiple challenges on many fronts which are not going to be solved by denying harsh realities and imprisoning journalists.

The progress of recent decades belies an industrial sector which in truth has become quite seriously uncompetitive by international standards. Many of China's factories need completely retooling to keep up with developments in robotics and other forms of mechanisation. Yet if industry is to get less labour intensive, this only further steepens the challenge of employment creation.

It is reckoned that China needs to create some 20 million jobs a year just to keep pace with employment demand as the population shifts from land to town, eight million of them in high-end professions to cater for the country's burgeoning output of graduates. China's modernisation has created a monster which it is struggling to feed.

As the export-growth story waned, China compensated by unleashing a massive investment boom, which internal demand is now struggling to keep up with, rendering many of the country's shiny new constructs uneconomic and overburdened with bad debts.

The Chinese leadership looks to growth in consumption and service industries to plug the gap, but these new sources of demand can't do so without further free-market reform, which in turn requires further loosening of the shackles of political control. Without growth, the Communist Party loses its political legitimacy, yet the old growth model is broken, and to achieve a new one, the authorities must cede the very power and influence that sustains them. Rumour-mongering journalists and short-selling speculators can only be blamed for so long.

(http://www.telegraph.co.uk. Adapted)

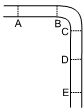

Um veículo desloca-se por uma pista horizontal, retilínea nos trechos AB, CD e DE, e curvilínea no trecho BC, este em forma de quarto de circunferência, como ilustra a figura.

Partindo do repouso no ponto A, o referido veículo aumenta

sua velocidade uniformemente até o ponto B; a partir de B,

ele mantém constante a velocidade adquirida até o ponto D;

de D até E, ele reduz uniformemente a velocidade até parar

em E. O valor absoluto de sua aceleração vetorial está qualitativa

e corretamente representado na alternativa:

A figura mostra o painel de instrumentos de um automóvel em movimento. Os maiores medidores são: à esquerda, o tacômetro (conta-giros do motor), e à direita, o velocímetro.

Levando-se em conta a precisão de medidas, as corretas

leituras do tacômetro, em rpmx1000, e do velocímetro, em

km/h, são, respectivamente,

Criança feliz é aquela que brinca, fato mais do que comprovado na realidade do dia a dia. A brincadeira ativa, a que faz gastar energia, que traz emoção, traz também felicidade. Mariana é uma criança que foi levada por seus pais para se divertir em um parquinho infantil.

Inicialmente, Mariana foi se divertir no balanço. Solta, do repouso, de uma certa altura, ela oscilou entre dois extremos elevados, a partir dos quais iniciou o retorno até o extremo oposto. Imagine-a no extremo da direita como na figura.

Desconsiderando o seu tamanho, bem como o do balanço, e

imaginando apenas um cabo sustentando o sistema, o correto

esquema das forças agentes sobre ela nessa posição, em

que cada seta representa uma força, é o da alternativa:

Criança feliz é aquela que brinca, fato mais do que comprovado na realidade do dia a dia. A brincadeira ativa, a que faz gastar energia, que traz emoção, traz também felicidade. Mariana é uma criança que foi levada por seus pais para se divertir em um parquinho infantil.

Em uma das oscilações, Mariana partiu do extremo, de uma altura de 80 cm acima do solo e, ao atingir a posição inferior da trajetória, chutou uma bola, de 0,5 kg de massa, que estava parada no solo. A bola adquiriu a velocidade de 24 m/s imediatamente após o chute, na direção horizontal do solo e do movimento da menina. O deslocamento de Mariana, do ponto extremo até o ponto inferior da trajetória, foi realizado sem dissipação de energia mecânica. Considere a massa de Mariana igual a 12 kg, e a aceleração da gravidade com o valor 10 m/s2 . A velocidade de Mariana, imediatamente após o chute na bola, passou a ser, em m/s, de

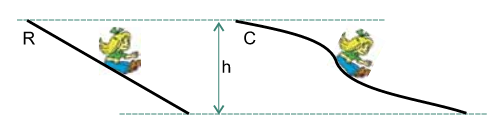

Nesse parquinho infantil, há dois escorregadores de mesma altura h relativamente ao chão. Um deles é retilíneo (R) e outro é curvilíneo (C) em forma de tobogã, como indica a figura.

Ao escorregar por R, de seu ponto superior até o nível do chão, Mariana teve uma perda de energia mecânica de 10% em relação a uma queda livre dessa altura. Ao escorregar por C, nas mesmas condições, ela teve uma perda de 15% de energia mecânica em relação a uma queda livre. A relação entre a velocidade final de Mariana ao sair de R e a velocidade final ao sair de C vale

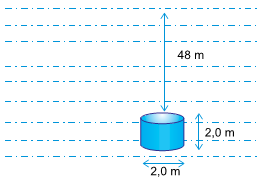

Para determinados tipos de pesquisa ou trabalho, cápsulas tripuladas são enviadas para as profundezas dos oceanos, mares ou lagos. Considere uma dessas cápsulas de forma cilíndrica, de 2,0 m de altura por 2,0 m de diâmetro, com sua base superior a 48 m de profundidade em água de densidade 1,0.103 kg/m3, em equilíbrio como ilustra a figura.

Dados: A pressão atmosférica no local é de 1,0.105 Pa, e a aceleração da gravidade é de 10 m/s2. Adote π = 3.

O peso dessa cápsula fora d’água, em N, e a pressão total

sobre sua base inferior, em Pa, valem, respectivamente,

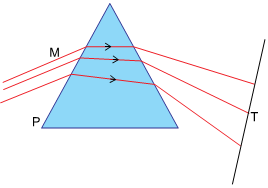

Sabe-se que a luz branca do Sol, após refratar em um prisma de acrílico ou de vidro, dispersa-se em um leque de cores, formando o que se chama de espectro. Na figura, representa-se o prisma por P; a tela em que se vê o espectro, por T; e o meio de onde a luz branca veio, por M.

Se M for