Questões de Concurso Público SEFAZ-MG 2023 para Auditor Fiscal da Receita Estadual - Tecnologia da Informação (Tarde)

Foram encontradas 50 questões

( ) The effects of blockchain technology in auditing nowadays are quite clear.

( ) It will be necessary for CPA auditors to acquaint themselves with the fundamentals of blockchain and to team up with specialists to gauge technical hazards.

( ) The interest in blockchain technology is already dwindling.

The statements are, respectively

I. Auditors should try to keep abreast of the latest developments in technology.

II. CPA auditors’ skepticism is an asset to the profession.

III. Those involved in auditing seems to be rather refractory to change.

O HDFS foi projetado para armazenar arquivos grandes como uma sequência de blocos.

Em relação à replicação dos dados, assinale a afirmativa incorreta.

As opções a seguir apresentam características do framework Spark, à exceção de uma. Assinale-a.

Em relação aos RDDs e a suas operações, assinale a afirmativa incorreta.

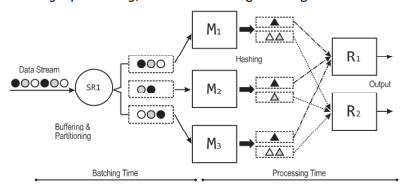

O processamento stream é obtido repetindo as fases de batching e processing para as novas tuplas de dados.

Em relação ao processamento stream em micro-batches, assinale a opção incorreta.

Assinale a opção que não figura como uma das operações MPI.

Assinale a opção que não figura como uma característica da arquitetura de Hadoop YARN.

Em relação ao código pyspark acima, assinale a afirmativa incorreta.

Em relação aos tensores, assinale a opção incorreta.

A esse respeito, assinale a opção incorreta.

Assinale a opção que indica o nome correto desse membro do time.

O principal pilar da orientação a objetos usado nesse design pattern é

Assinale a opção que indica seu principal objetivo.