Questões de Concurso

Comentadas para segep-ma

Foram encontradas 809 questões

Resolva questões gratuitamente!

Junte-se a mais de 4 milhões de concurseiros!

Atenção: Para responder à questão, considere o texto abaixo.

The sole proprietor of a plumbing shop was sentenced to 13 months in prison, three years of supervised release for tax evasion and ordered to pay approximately $130,000 in restitution to the IRS. The business owner willfully attempted to evade paying his federal income taxes by skimming gross receipts of his plumbing business and paying personal expenses from his business accounts and claiming them as business expenses.

As part of his tax evasion scheme, he instructed several of his employees to solicit checks from clients payable in his name, rather than in the name of the business. He then cashed these checks and did not deposit the monies into his business’ bank account. Since this money was not recorded on the books of the business, nor deposited into the business’ account, he did not include these gross receipts on his income tax return. He also deducted personal expenses as business expenses thereby substantially reducing his tax for tax years 2003 through 2006.

(Adapted from http://www.bizfilings.com/toolkit/sbg/tax-info/fed-taxes/tax-avoidance-and-tax-evasion.aspx)

Atenção: Para responder à questão, considere o texto abaixo.

The sole proprietor of a plumbing shop was sentenced to 13 months in prison, three years of supervised release for tax evasion and ordered to pay approximately $130,000 in restitution to the IRS. The business owner willfully attempted to evade paying his federal income taxes by skimming gross receipts of his plumbing business and paying personal expenses from his business accounts and claiming them as business expenses.

As part of his tax evasion scheme, he instructed several of his employees to solicit checks from clients payable in his name, rather than in the name of the business. He then cashed these checks and did not deposit the monies into his business’ bank account. Since this money was not recorded on the books of the business, nor deposited into the business’ account, he did not include these gross receipts on his income tax return. He also deducted personal expenses as business expenses thereby substantially reducing his tax for tax years 2003 through 2006.

(Adapted from http://www.bizfilings.com/toolkit/sbg/tax-info/fed-taxes/tax-avoidance-and-tax-evasion.aspx)

Atenção: Para responder à questão, considere o texto abaixo.

The sole proprietor of a plumbing shop was sentenced to 13 months in prison, three years of supervised release for tax evasion and ordered to pay approximately $130,000 in restitution to the IRS. The business owner willfully attempted to evade paying his federal income taxes by skimming gross receipts of his plumbing business and paying personal expenses from his business accounts and claiming them as business expenses.

As part of his tax evasion scheme, he instructed several of his employees to solicit checks from clients payable in his name, rather than in the name of the business. He then cashed these checks and did not deposit the monies into his business’ bank account. Since this money was not recorded on the books of the business, nor deposited into the business’ account, he did not include these gross receipts on his income tax return. He also deducted personal expenses as business expenses thereby substantially reducing his tax for tax years 2003 through 2006.

(Adapted from http://www.bizfilings.com/toolkit/sbg/tax-info/fed-taxes/tax-avoidance-and-tax-evasion.aspx)

Atenção: Para responder à questão, considere o texto abaixo.

The sole proprietor of a plumbing shop was sentenced to 13 months in prison, three years of supervised release for tax evasion and ordered to pay approximately $130,000 in restitution to the IRS. The business owner willfully attempted to evade paying his federal income taxes by skimming gross receipts of his plumbing business and paying personal expenses from his business accounts and claiming them as business expenses.

As part of his tax evasion scheme, he instructed several of his employees to solicit checks from clients payable in his name, rather than in the name of the business. He then cashed these checks and did not deposit the monies into his business’ bank account. Since this money was not recorded on the books of the business, nor deposited into the business’ account, he did not include these gross receipts on his income tax return. He also deducted personal expenses as business expenses thereby substantially reducing his tax for tax years 2003 through 2006.

(Adapted from http://www.bizfilings.com/toolkit/sbg/tax-info/fed-taxes/tax-avoidance-and-tax-evasion.aspx)

Atenção: Para responder à questão, considere o texto abaixo.

In the United States of America, an income tax audit is the examination of a business or individual tax return by the Internal Revenue Service (IRS) or state tax authority. The IRS and various state revenue departments use the terms audit, examination, review, and notice to describe various aspects of enforcement and administration of the tax laws.

The purpose of a tax audit or a return examination is to determine  reports filed with the taxing authorities are correct. The

tax agencies identify and resolve taxpayer errors.

reports filed with the taxing authorities are correct. The

tax agencies identify and resolve taxpayer errors.

There are several different methods used to select individuals and businesses for examination.

Employers and financial institutions, among other organizations, are required by law to send documentation (W-2's and 1099's, for example) to the IRS. The IRS uses software to ensure that the numbers on a tax return match the numbers the IRS receives from third parties. If the documentation does not match, the return may be examined.

When a tax return is filed, the IRS uses computer software called the Discriminant Index Function System (DIF) to analyze the return for oddities and discrepancies. Once the return has been processed through DIF, it is given a score. If the DIF score is high enough (i.e. a large amount of oddities or discrepancies are found), that tax return may be selected for examination. The formulas the IRS use to create the DIF software and analysis are a closely guarded secret.

Filed tax returns are also subjected to an evaluation called the UIDIF, or the Unreported Income Discriminant Function System. This evaluation involves the analysis of tax returns based on a series of factors to determine a tax return's potential for unreported income. Returns that are found to have a high UIDIF score (i.e. the likelihood of unreported income) and a high DIF score may be selected for examination. The IRS formulas used to calculate UDIF are secret, but it is commonly thought that the IRS uses statistical comparisons between returns to determine UIDIF potential.

The IRS selects a certain amount of income tax returns to be audited each year through random selection. No errors need to be found for the Enforcement branch to examine a tax return. Random selection exams tend to be more extensive and time-consuming than other forms of review.

The practice of random selection has been a source of controversy for many years. The practice was suspended for a short time in the early 2000s amid criticism that the audits were too burdensome and intrusive. The IRS revived the practice in the fall of 2006.

(Adapted from https://en.wikipedia.org/wiki/Income_tax_audit)

Atenção: Para responder à questão, considere o texto abaixo.

In the United States of America, an income tax audit is the examination of a business or individual tax return by the Internal Revenue Service (IRS) or state tax authority. The IRS and various state revenue departments use the terms audit, examination, review, and notice to describe various aspects of enforcement and administration of the tax laws.

The purpose of a tax audit or a return examination is to determine  reports filed with the taxing authorities are correct. The

tax agencies identify and resolve taxpayer errors.

reports filed with the taxing authorities are correct. The

tax agencies identify and resolve taxpayer errors.

There are several different methods used to select individuals and businesses for examination.

Employers and financial institutions, among other organizations, are required by law to send documentation (W-2's and 1099's, for example) to the IRS. The IRS uses software to ensure that the numbers on a tax return match the numbers the IRS receives from third parties. If the documentation does not match, the return may be examined.

When a tax return is filed, the IRS uses computer software called the Discriminant Index Function System (DIF) to analyze the return for oddities and discrepancies. Once the return has been processed through DIF, it is given a score. If the DIF score is high enough (i.e. a large amount of oddities or discrepancies are found), that tax return may be selected for examination. The formulas the IRS use to create the DIF software and analysis are a closely guarded secret.

Filed tax returns are also subjected to an evaluation called the UIDIF, or the Unreported Income Discriminant Function System. This evaluation involves the analysis of tax returns based on a series of factors to determine a tax return's potential for unreported income. Returns that are found to have a high UIDIF score (i.e. the likelihood of unreported income) and a high DIF score may be selected for examination. The IRS formulas used to calculate UDIF are secret, but it is commonly thought that the IRS uses statistical comparisons between returns to determine UIDIF potential.

The IRS selects a certain amount of income tax returns to be audited each year through random selection. No errors need to be found for the Enforcement branch to examine a tax return. Random selection exams tend to be more extensive and time-consuming than other forms of review.

The practice of random selection has been a source of controversy for many years. The practice was suspended for a short time in the early 2000s amid criticism that the audits were too burdensome and intrusive. The IRS revived the practice in the fall of 2006.

(Adapted from https://en.wikipedia.org/wiki/Income_tax_audit)

Atenção: Para responder à questão, considere o texto abaixo.

In the United States of America, an income tax audit is the examination of a business or individual tax return by the Internal Revenue Service (IRS) or state tax authority. The IRS and various state revenue departments use the terms audit, examination, review, and notice to describe various aspects of enforcement and administration of the tax laws.

The purpose of a tax audit or a return examination is to determine  reports filed with the taxing authorities are correct. The

tax agencies identify and resolve taxpayer errors.

reports filed with the taxing authorities are correct. The

tax agencies identify and resolve taxpayer errors.

There are several different methods used to select individuals and businesses for examination.

Employers and financial institutions, among other organizations, are required by law to send documentation (W-2's and 1099's, for example) to the IRS. The IRS uses software to ensure that the numbers on a tax return match the numbers the IRS receives from third parties. If the documentation does not match, the return may be examined.

When a tax return is filed, the IRS uses computer software called the Discriminant Index Function System (DIF) to analyze the return for oddities and discrepancies. Once the return has been processed through DIF, it is given a score. If the DIF score is high enough (i.e. a large amount of oddities or discrepancies are found), that tax return may be selected for examination. The formulas the IRS use to create the DIF software and analysis are a closely guarded secret.

Filed tax returns are also subjected to an evaluation called the UIDIF, or the Unreported Income Discriminant Function System. This evaluation involves the analysis of tax returns based on a series of factors to determine a tax return's potential for unreported income. Returns that are found to have a high UIDIF score (i.e. the likelihood of unreported income) and a high DIF score may be selected for examination. The IRS formulas used to calculate UDIF are secret, but it is commonly thought that the IRS uses statistical comparisons between returns to determine UIDIF potential.

The IRS selects a certain amount of income tax returns to be audited each year through random selection. No errors need to be found for the Enforcement branch to examine a tax return. Random selection exams tend to be more extensive and time-consuming than other forms of review.

The practice of random selection has been a source of controversy for many years. The practice was suspended for a short time in the early 2000s amid criticism that the audits were too burdensome and intrusive. The IRS revived the practice in the fall of 2006.

(Adapted from https://en.wikipedia.org/wiki/Income_tax_audit)

Atenção: Para responder à questão, considere o texto abaixo.

In the United States of America, an income tax audit is the examination of a business or individual tax return by the Internal Revenue Service (IRS) or state tax authority. The IRS and various state revenue departments use the terms audit, examination, review, and notice to describe various aspects of enforcement and administration of the tax laws.

The purpose of a tax audit or a return examination is to determine  reports filed with the taxing authorities are correct. The

tax agencies identify and resolve taxpayer errors.

reports filed with the taxing authorities are correct. The

tax agencies identify and resolve taxpayer errors.

There are several different methods used to select individuals and businesses for examination.

Employers and financial institutions, among other organizations, are required by law to send documentation (W-2's and 1099's, for example) to the IRS. The IRS uses software to ensure that the numbers on a tax return match the numbers the IRS receives from third parties. If the documentation does not match, the return may be examined.

When a tax return is filed, the IRS uses computer software called the Discriminant Index Function System (DIF) to analyze the return for oddities and discrepancies. Once the return has been processed through DIF, it is given a score. If the DIF score is high enough (i.e. a large amount of oddities or discrepancies are found), that tax return may be selected for examination. The formulas the IRS use to create the DIF software and analysis are a closely guarded secret.

Filed tax returns are also subjected to an evaluation called the UIDIF, or the Unreported Income Discriminant Function System. This evaluation involves the analysis of tax returns based on a series of factors to determine a tax return's potential for unreported income. Returns that are found to have a high UIDIF score (i.e. the likelihood of unreported income) and a high DIF score may be selected for examination. The IRS formulas used to calculate UDIF are secret, but it is commonly thought that the IRS uses statistical comparisons between returns to determine UIDIF potential.

The IRS selects a certain amount of income tax returns to be audited each year through random selection. No errors need to be found for the Enforcement branch to examine a tax return. Random selection exams tend to be more extensive and time-consuming than other forms of review.

The practice of random selection has been a source of controversy for many years. The practice was suspended for a short time in the early 2000s amid criticism that the audits were too burdensome and intrusive. The IRS revived the practice in the fall of 2006.

(Adapted from https://en.wikipedia.org/wiki/Income_tax_audit)

é

é Atenção: Para responder à questão, considere o texto abaixo.

In the United States of America, an income tax audit is the examination of a business or individual tax return by the Internal Revenue Service (IRS) or state tax authority. The IRS and various state revenue departments use the terms audit, examination, review, and notice to describe various aspects of enforcement and administration of the tax laws.

The purpose of a tax audit or a return examination is to determine  reports filed with the taxing authorities are correct. The

tax agencies identify and resolve taxpayer errors.

reports filed with the taxing authorities are correct. The

tax agencies identify and resolve taxpayer errors.

There are several different methods used to select individuals and businesses for examination.

Employers and financial institutions, among other organizations, are required by law to send documentation (W-2's and 1099's, for example) to the IRS. The IRS uses software to ensure that the numbers on a tax return match the numbers the IRS receives from third parties. If the documentation does not match, the return may be examined.

When a tax return is filed, the IRS uses computer software called the Discriminant Index Function System (DIF) to analyze the return for oddities and discrepancies. Once the return has been processed through DIF, it is given a score. If the DIF score is high enough (i.e. a large amount of oddities or discrepancies are found), that tax return may be selected for examination. The formulas the IRS use to create the DIF software and analysis are a closely guarded secret.

Filed tax returns are also subjected to an evaluation called the UIDIF, or the Unreported Income Discriminant Function System. This evaluation involves the analysis of tax returns based on a series of factors to determine a tax return's potential for unreported income. Returns that are found to have a high UIDIF score (i.e. the likelihood of unreported income) and a high DIF score may be selected for examination. The IRS formulas used to calculate UDIF are secret, but it is commonly thought that the IRS uses statistical comparisons between returns to determine UIDIF potential.

The IRS selects a certain amount of income tax returns to be audited each year through random selection. No errors need to be found for the Enforcement branch to examine a tax return. Random selection exams tend to be more extensive and time-consuming than other forms of review.

The practice of random selection has been a source of controversy for many years. The practice was suspended for a short time in the early 2000s amid criticism that the audits were too burdensome and intrusive. The IRS revived the practice in the fall of 2006.

(Adapted from https://en.wikipedia.org/wiki/Income_tax_audit)

Atenção: Para responder à questão, considere o texto abaixo.

In the United States of America, an income tax audit is the examination of a business or individual tax return by the Internal Revenue Service (IRS) or state tax authority. The IRS and various state revenue departments use the terms audit, examination, review, and notice to describe various aspects of enforcement and administration of the tax laws.

The purpose of a tax audit or a return examination is to determine  reports filed with the taxing authorities are correct. The

tax agencies identify and resolve taxpayer errors.

reports filed with the taxing authorities are correct. The

tax agencies identify and resolve taxpayer errors.

There are several different methods used to select individuals and businesses for examination.

Employers and financial institutions, among other organizations, are required by law to send documentation (W-2's and 1099's, for example) to the IRS. The IRS uses software to ensure that the numbers on a tax return match the numbers the IRS receives from third parties. If the documentation does not match, the return may be examined.

When a tax return is filed, the IRS uses computer software called the Discriminant Index Function System (DIF) to analyze the return for oddities and discrepancies. Once the return has been processed through DIF, it is given a score. If the DIF score is high enough (i.e. a large amount of oddities or discrepancies are found), that tax return may be selected for examination. The formulas the IRS use to create the DIF software and analysis are a closely guarded secret.

Filed tax returns are also subjected to an evaluation called the UIDIF, or the Unreported Income Discriminant Function System. This evaluation involves the analysis of tax returns based on a series of factors to determine a tax return's potential for unreported income. Returns that are found to have a high UIDIF score (i.e. the likelihood of unreported income) and a high DIF score may be selected for examination. The IRS formulas used to calculate UDIF are secret, but it is commonly thought that the IRS uses statistical comparisons between returns to determine UIDIF potential.

The IRS selects a certain amount of income tax returns to be audited each year through random selection. No errors need to be found for the Enforcement branch to examine a tax return. Random selection exams tend to be more extensive and time-consuming than other forms of review.

The practice of random selection has been a source of controversy for many years. The practice was suspended for a short time in the early 2000s amid criticism that the audits were too burdensome and intrusive. The IRS revived the practice in the fall of 2006.

(Adapted from https://en.wikipedia.org/wiki/Income_tax_audit)

Atenção: Para responder à questão, considere o texto abaixo.

Tolerância brasileira?

A internet vem ajudando a derrubar o mito de que nós, brasileiros, somos tolerantes às diferenças. Expressões preconceituosas predominam em postagens que revelam todo tipo de intransigência em relação ao outro, rejeitado por sua aparência, classe social, deficiência, opção política, idade, raça, religião etc.

Num primeiro momento, parece que a internet criou uma onda de intolerância. O fato, porém, é que as redes sociais apenas amplificaram discursos existentes no nosso dia a dia. No fundo, as pessoas são as mesmas, nas ruas e nas redes.

(Adaptado de: COSTA, Bob Vieira da. Folha de S.Paulo, 3/08/2016)

Atenção: Para responder à questão, considere o texto abaixo.

Tolerância brasileira?

A internet vem ajudando a derrubar o mito de que nós, brasileiros, somos tolerantes às diferenças. Expressões preconceituosas predominam em postagens que revelam todo tipo de intransigência em relação ao outro, rejeitado por sua aparência, classe social, deficiência, opção política, idade, raça, religião etc.

Num primeiro momento, parece que a internet criou uma onda de intolerância. O fato, porém, é que as redes sociais apenas amplificaram discursos existentes no nosso dia a dia. No fundo, as pessoas são as mesmas, nas ruas e nas redes.

(Adaptado de: COSTA, Bob Vieira da. Folha de S.Paulo, 3/08/2016)

Atenção: Para responder à questão, considere o texto abaixo.

Nostalgias perigosas

Numa recente e polêmica crônica de jornal, o escritor Contardo Calligaris manifestou preocupação com estes dois traços perigosos de nostalgia que, segundo ele, costumam caracterizar a velhice:

“1) Uma avareza mesquinha (e generalizada – não só financeira), que consiste em tentar preservar e conservar qualquer coisa, como metáfora da preservação (impossível) da nossa vida que se vai;

2) Uma idealização fantasiosa de passados que nunca existiram. Os idosos parecem sempre evocar o "tempo feliz" de sua infância, quando os pais eram severos e por isso educavam bem, quando dava para brincar na rua e a escola pública era muito boa.”

E completou sua crônica acusando o fato de que os idosos costumam se apoiar em lembranças inventadas, em algo que efetivamente não conheceram, mas que gostariam de ter vivido. Resta saber se a imaginação do vivido, para esses velhos, não é em si mesma uma sensação real e necessária, no final da vida.

(Adamastor Linhares, inédito)

Atenção: Para responder à questão, considere o texto abaixo.

Anedotas

Um dos mistérios da vida é: de onde vêm as anedotas? O enigma da criação da anedota se compara ao enigma da criação da matéria. Em todas as teorias conhecidas sobre a evolução do universo sempre se chega a um ponto em que a única explicação possível é a da geração espontânea. Do nada surge alguma coisa. As anedotas também nasceriam assim, já prontas, aparentemente autogeradas. Você não conhece ninguém que tenha inventado uma anedota. Os que contam uma anedota sempre a ouviram de outro, que ouviu de outro, que não se lembra de quem ouviu. Se anedota fosse crime, sua repressão seria dificílima.

Os humoristas profissionais não fazem anedotas. Inventam piadas, frases, cenas, histórias, mas as anedotas que correm o país não são deles. São de autores desconhecidos mas nem por isso menos competentes. Uma anedota geralmente tem o rigor formal de um teorema. Exposição, desenvolvimento, desenlace. Grande parte do sucesso de uma anedota depende do estilo de quem conta. A anedota é uma continuação da tradição homérica, de narrativa oral, que transmitia histórias antes do livro. Anedota impressa deixa de ser anedota. Existem contadores eméritos. E casos pungentes de grandes contadores que, com o tempo, vão perdendo a habilidade, até chegarem ao supremo vexame de, um dia, esquecerem o fim da anedota.

Dizem que, eventualmente, um computador bem programado poderá escrever teses e romances. Mas duvido que algum computador, algum dia, possa fazer uma anedota.

(VERISSIMO, Luis Fernando. Comédias para se ler na escola. Rio de Janeiro: Objetiva, 2001, p. 107-108)

Atenção: Para responder à questão, considere o texto abaixo.

Anedotas

Um dos mistérios da vida é: de onde vêm as anedotas? O enigma da criação da anedota se compara ao enigma da criação da matéria. Em todas as teorias conhecidas sobre a evolução do universo sempre se chega a um ponto em que a única explicação possível é a da geração espontânea. Do nada surge alguma coisa. As anedotas também nasceriam assim, já prontas, aparentemente autogeradas. Você não conhece ninguém que tenha inventado uma anedota. Os que contam uma anedota sempre a ouviram de outro, que ouviu de outro, que não se lembra de quem ouviu. Se anedota fosse crime, sua repressão seria dificílima.

Os humoristas profissionais não fazem anedotas. Inventam piadas, frases, cenas, histórias, mas as anedotas que correm o país não são deles. São de autores desconhecidos mas nem por isso menos competentes. Uma anedota geralmente tem o rigor formal de um teorema. Exposição, desenvolvimento, desenlace. Grande parte do sucesso de uma anedota depende do estilo de quem conta. A anedota é uma continuação da tradição homérica, de narrativa oral, que transmitia histórias antes do livro. Anedota impressa deixa de ser anedota. Existem contadores eméritos. E casos pungentes de grandes contadores que, com o tempo, vão perdendo a habilidade, até chegarem ao supremo vexame de, um dia, esquecerem o fim da anedota.

Dizem que, eventualmente, um computador bem programado poderá escrever teses e romances. Mas duvido que algum computador, algum dia, possa fazer uma anedota.

(VERISSIMO, Luis Fernando. Comédias para se ler na escola. Rio de Janeiro: Objetiva, 2001, p. 107-108)

Determinada empresa de economia mista do Estado fez o seguro do ativo imobilizado, junto à seguradora Martelo, para o período de 24 meses: 01/10/2015 a 30/09/2017.

− O prêmio de seguro foi de R$ 600.000,00, pago 40% no ato e o restante 30 e 60 dias.

− A empresa encerra seu exercício social em 31 de dezembro de cada ano.

− O lucro do exercício de 2015 foi de R$ 1.390.000,00.

O auditor independente no exame dos registros contábeis da apólice do seguro contratado constatou que:

− 300.000,00 – foram contabilizados (apropriados) como despesas de seguro do exercício de 2015, e que o valor da apropriação

do seguro está incorreto.

− 300.000,00 – foram contabilizados na conta “Seguros a Vencer” classificada no realizável de curto prazo.

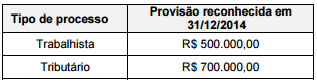

Para a elaboração do Balanço Patrimonial de 31/12/2015, as informações obtidas pela empresa sobre os processos existentes em 31/12/2014 e sobre outros que surgiram durante o ano de 2015 são apresentadas na tabela a seguir:

O efeito líquido causado na Demonstração do Resultado de 2015 da empresa relacionado com as provisões foi, em reais:

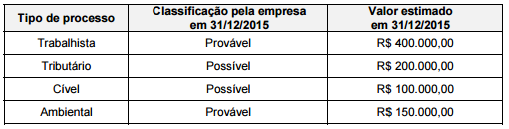

As seguintes informações adicionais são conhecidas: − A empresa não tinha saldo a receber de vendas no início de 2015. − Do total das vendas efetuadas em 2015, 20% foram vendidos a prazo e serão recebidos em 2016. − Todas as mercadorias vendidas foram adquiridas e pagas em 2015 e não havia estoques iniciais de mercadorias. − No início do período, a empresa não tinha dívidas com fornecedores. − Todas as outras despesas operacionais foram pagas no próprio ano de 2015. − Do total de Despesas Financeiras, a empresa pagou 80% no próprio ano de 2015. A empresa classifica as Despesas Financeiras no grupo das atividades operacionais. − O Imposto de Renda será pago em 2016. Desconsiderando os tributos sobre vendas e sobre compras, o valor correspondente ao Caixa das Atividades Operacionais do ano de 2015 foi, em reais: