Questões de Inglês para Concurso

Foram encontradas 16.706 questões

Read the comic strip below and answer the question.

What did Nancy say in reported speech in the first panel of the comic strip?

Read the text and answer the question.

Scientists store entire human genome on ‘memory crystal’ that could survive billions of years

By Rosa Rahimi, CNN. Published 7:53 AM EDT, Fri September 20, 2024

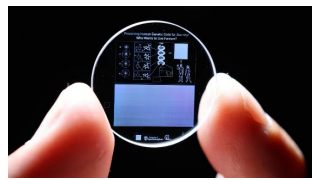

The crystal features a visual key, intended to explain what it contains to whoever finds it. University of Southampton/PA

Scientists in the United Kingdom have stored the entire human genome on a “5D memory crystal,” in the hope that it could be used in the future as a blueprint to bring humanity back from extinction.

The crystal, which was developed by a team of researchers at the University of Southampton’s Optoelectronics Research Centre, could also be used to create a record of plant and animal species faced with extinction.

It can hold up to 360 terabytes of information for billions of years and can withstand extreme conditions, including freezing, fires, direct impact force, cosmic radiation and temperatures of up to 1,000 degrees Celsius, the university said in a press statement published Thursday.

In 2014, the crystal was awarded the Guinness World Record for “most durable digital storage material.” Kazansky’s team used ultra-fast lasers to inscribe the human genome data into voids as small as 20 nanometers (a nanometer is about one-billionth of a meter).

They describe the data storage on the crystal as 5D because the information is translated into five different dimensions of its nanostructures — their height, length, width, orientation and position.

“The 5D memory crystal opens up possibilities for other researchers to build an everlasting repository of genomic information from which complex organisms like plants and animals might be restored should science in the future allow,” said Peter Kazansky, a professor of optoelectronics, who led the team at Southampton.

The team had to consider who – or what – would retrieve the information, so far off into the future.

It could be an intelligence (species or machine) – or it could be found in a future so distant that no frame of reference would exist for it. To help whoever finds it, the researchers included a visual key.

“The visual key inscribed on the crystal gives the finder knowledge of what data is stored inside and how it could be used,” said Kazansky.

“Their work is super impressive,” said Thomas Heinis, who leads research on DNA storage at Imperial College London and was not involved in the study. However, he says questions remain about how such data could be read in the future.

“What Southampton presents probably has a higher durability, however, this begs the question: what for? Future generations? Sure, but how will they know how to read the crystal? How will they know how to build the device to read the crystal? Will the device be available in hundreds of years?” he added. “I can barely connect my 10-year-old iPod and listen to what I listened back then.”

For now, the crystal is stored in the Memory of Mankind archive, a time capsule within a salt cave in Austria.

In 2018, Kazansky and his team used the memory crystal technology to store Isaac Asimov’s “Foundation” trilogy of science fiction books, which were then launched into space aboard a Tesla Roadster. The technology has also been used to store major documents from human history, including the Universal

Declaration of Human Rights and the Magna Carta. Earlier this year, scientists revealed a plan to safeguard Earth’s species in a cryogenic biorepository on the moon, intended to save species in the event of a disaster on our home planet.

https://edition.cnn.com/2024/09/20/science/human-genome-crystal-intl-scli/index.html

Read the text and answer the question.

Scientists store entire human genome on ‘memory crystal’ that could survive billions of years

By Rosa Rahimi, CNN. Published 7:53 AM EDT, Fri September 20, 2024

The crystal features a visual key, intended to explain what it contains to whoever finds it. University of Southampton/PA

Scientists in the United Kingdom have stored the entire human genome on a “5D memory crystal,” in the hope that it could be used in the future as a blueprint to bring humanity back from extinction.

The crystal, which was developed by a team of researchers at the University of Southampton’s Optoelectronics Research Centre, could also be used to create a record of plant and animal species faced with extinction.

It can hold up to 360 terabytes of information for billions of years and can withstand extreme conditions, including freezing, fires, direct impact force, cosmic radiation and temperatures of up to 1,000 degrees Celsius, the university said in a press statement published Thursday.

In 2014, the crystal was awarded the Guinness World Record for “most durable digital storage material.” Kazansky’s team used ultra-fast lasers to inscribe the human genome data into voids as small as 20 nanometers (a nanometer is about one-billionth of a meter).

They describe the data storage on the crystal as 5D because the information is translated into five different dimensions of its nanostructures — their height, length, width, orientation and position.

“The 5D memory crystal opens up possibilities for other researchers to build an everlasting repository of genomic information from which complex organisms like plants and animals might be restored should science in the future allow,” said Peter Kazansky, a professor of optoelectronics, who led the team at Southampton.

The team had to consider who – or what – would retrieve the information, so far off into the future.

It could be an intelligence (species or machine) – or it could be found in a future so distant that no frame of reference would exist for it. To help whoever finds it, the researchers included a visual key.

“The visual key inscribed on the crystal gives the finder knowledge of what data is stored inside and how it could be used,” said Kazansky.

“Their work is super impressive,” said Thomas Heinis, who leads research on DNA storage at Imperial College London and was not involved in the study. However, he says questions remain about how such data could be read in the future.

“What Southampton presents probably has a higher durability, however, this begs the question: what for? Future generations? Sure, but how will they know how to read the crystal? How will they know how to build the device to read the crystal? Will the device be available in hundreds of years?” he added. “I can barely connect my 10-year-old iPod and listen to what I listened back then.”

For now, the crystal is stored in the Memory of Mankind archive, a time capsule within a salt cave in Austria.

In 2018, Kazansky and his team used the memory crystal technology to store Isaac Asimov’s “Foundation” trilogy of science fiction books, which were then launched into space aboard a Tesla Roadster. The technology has also been used to store major documents from human history, including the Universal

Declaration of Human Rights and the Magna Carta. Earlier this year, scientists revealed a plan to safeguard Earth’s species in a cryogenic biorepository on the moon, intended to save species in the event of a disaster on our home planet.

https://edition.cnn.com/2024/09/20/science/human-genome-crystal-intl-scli/index.html

"The crystal, which was developed by a team of researchers at the University of Southampton’s Optoelectronics Research Centre, could also be used to create a record of plant and animal species faced with extinction.”

Consider the dialogue below:

David: Hi, Emily! Have you ever thought about the impact of technology on our daily lives?

Emily: Hi, David! Yes, I think about it often. Technology has certainly made our lives easier in many ways, but it also has its downsides.

David: Absolutely. For example, smartphones have made communication much faster, but at the same time, people seem to be more disconnected in real life.

Emily: I agree. It's ironic, isn't it? We have more ways to connect, yet it sometimes feels like we're more isolated.

David: That's true. Do you think there's a way to find a balance between using technology and maintaining real-world connections?

Emily: I believe there is. Perhaps it's about setting boundaries, like limiting screen time or having tech-free days to spend more quality time with family and friends.

David: That's a good point. It might also be helpful to be more mindful about how we use technology.

Emily: Definitely. Being conscious of our usage can help us use technology more purposefully rather than letting it control us.

Based on the dialogue, which of the following statements best captures the main theme of their conversation?

Read the following excerpt:

"Critical reading involves analyzing, interpreting, and evaluating the text. When reading critically, a reader not only understands the content but also questions the author's intentions, the validity of the arguments, and the relevance of the evidence provided."

Based on the excerpt, which of the following actions demonstrates a critical reading strategy?

O texto seguinte servirá de base para responder a questão.

HVAC Contractors Need to Adapt to Repair Market

Repair or replace is a question homeowners often need to answer, and it greatly impacts an HVAC contractor's business. During COVID, the residential HVAC industry saw a replacement market boom. But in 2023 and now the beginning of 2024, there has been a shift to a repair market that HVAC contractors need to be aware of as they run their businesses.

According to numbers from the Air-Conditioning, Heating and Refrigeration Institute (AHRI), shipments of unitary air conditioners and heat pumps were down 16.7% in 2023, compared to 2022. Gas furnaces were down 23%.

"The replacement market is performing worse when you strip out new construction," said industry leader Matt Michel. "Housing starts were down around 5%, according to the St. Louis Federal Reserve, so the replacement market for unitary air conditioners and heat pumps was down in the low 20s."

Distributors are seeing similar numbers, according to the Heating, Air-conditioning, & Refrigeration Distributors International (HARDI).

"We definitely are seeing a shift here. And that shift has actually been visible for some time," said Tim Fisher, HARDI director of market intelligence.

HARDI receives data from FieldEdge on the invoice and quote trends exhibited by their users. Invoices reflect work that has been completed, whereas quotes reflect potential future work and are most often provided for new system installations. HARDI has found that, over time, the ratio of new invoices to new quotes is a useful indicator of whether a market is trending more toward repair than replace and vice versa.

The numbers show the annual growth rate bottomed out in the spring of 2022 but remained negative through most of the year, indicating that replacement trends were broadly higher in 2022 than in 2021. That figure increased through 2023, peaking in May but generally remaining positive for most of the year. While the three-month growth rate has slowed in recent months — an encouraging sign — they don't expect much of a negative drift in 2024, meaning that repair versus replace trends will broadly remain similar to where they were in 2023.

So why is this change happening? It can't be attributed to any single factor but rather a combination of items. Certainly, higher costs of both HVAC systems and housing in general play a role.

"Adapting to the economy is something contractors need to do. We can't just assume people are going to reach into their pocket and replace," said ACCA CEO Bart James. "Contractors need to help customers get through the current need. People are slowing down on their spending. People are worried about what is coming and how they are preparing for it. Wages and other things are not keeping up with how fast prices are going up."

James said reading the numbers shows there is a shift in the home improvement market.

"Just look at the Walmart and Home Depot quarterly projections. Walmart did well with more visits but had smaller purchases, while Home Depot did not hit their numbers. That tells you that people are handling investments into housing differently. That will catch up with HVAC, too. "Contractors need to prepare by making investments in their team to meet the needs of the customer. And that need is not always a replacement option but also can be a repair option," James continued.

The sluggish home resale market is another reason for the shift towards a repair market. "Home improvement spending, in aggregate, tends to follow existing home sales totals nationally," Fisher said. "People invest more in their homes prior to selling to boost its value, and new homeowners spend more in their first year of moving than homeowners who stay put. This has major implications for HVAC replacement demand, which, historically, peaks when existing home sales are at their highest and falls off when existing home sales decline.

"Both the 3-month and 12-month growth rates bottomed out earlier in 2023, and while still negative, have slowed significantly," he continued. "We believe that home sale totals are at or nearing their trough, and over the duration of 2024 should steadily improve and finish at or ahead of 2023 totals."

The final reason is the cyclical nature of HVAC. It reflects the shipment cliff from 15 years ago, when the industry contracted 40% after peak shipments in 2005. Contractors cannot replace what was never installed.

How do HVAC contractors deal with this shift? Michel believes they should embrace the repair market.

"The money is better in replacements," he said. "It always has been and always will be. However, margins are better in service. For the next couple of years, anyway, contractors should focus on building up their service business and making money on it."

Since service involves more labor, and labor carries more overhead than equipment and material, keeping a close watch on overhead expenses is a must.

"Contractors need to build the service base, watch your marketing expenses drop, and down the road, the replacement margins and close rates to a satisfied service base will rise," Michel said. "Once we get past the shipment cliff, the replacement market will begin a decade-long run with every year being better than the year before it. We know this because it's what happened in the past, and when it comes to replacements, the past truly is a prologue."

Contractors in most parts of the country are already feeling the pinch of a slower market, and their experiences in 2024 are unlikely to be much different from their experiences in 2023 though rebounds from the milder temperatures we saw during peak months last year would go a long way in improving demand in 2024.

HARDI advises contractors should consider the following six tactics in '24:

- •Offer financing options: Any homeowner considering a new system is likely going to feel some sticker shock if it's been a few years since they

- last bought a system. Financing a new system helps to alleviate that shock, making the big sticker prices much more palatable monthly payments.

- •Protect margins: Work to ensure that your pricing for jobs is consistent with market trends, and attempt to pass through as much of the higher system costs as possible. Likewise, now is a critical time to manage operating expenses closely. Together, good cost management and smart pricing can help protect business margins in 2024.

- •Educate homeowners: Many homeowners may not fully understand the long-term benefits of replacing their HVAC system versus frequent repairs. Offer educational materials, such as blog posts, videos, or pamphlets, explaining the advantages of a new system

- in terms of energy efficiency, lower maintenance costs, and improved IAQ. Also, be sure to make clear to your customers which incentives they may qualify for through IRA or other state-level rebate/incentive programs.

- •Focus on value proposition: Emphasize the value proposition of a new HVAC system, highlighting its reliability, longevity, and performance. Help homeowners understand that investing in a replacement now can save them money and hassle in the long run.

- •Offer maintenance packages: Create maintenance packages that bundle regular servicing with discounts on repairs or replacements. This can encourage homeowners to invest in preventive maintenance and build a long-term relationship with your company.

- •Diversify services: Explore diversifying your services beyond just HVAC installations and repairs. For example, you could offer IAQ assessments, smart thermostat installations, or energy audits to provide additional value to homeowners and generate new revenue streams.

https://www.achrnews.com/articles/154324-hvac-contractors-need-to-ad apt-to-repair-market

O texto seguinte servirá de base para responder a questão.

HVAC Contractors Need to Adapt to Repair Market

Repair or replace is a question homeowners often need to answer, and it greatly impacts an HVAC contractor's business. During COVID, the residential HVAC industry saw a replacement market boom. But in 2023 and now the beginning of 2024, there has been a shift to a repair market that HVAC contractors need to be aware of as they run their businesses.

According to numbers from the Air-Conditioning, Heating and Refrigeration Institute (AHRI), shipments of unitary air conditioners and heat pumps were down 16.7% in 2023, compared to 2022. Gas furnaces were down 23%.

"The replacement market is performing worse when you strip out new construction," said industry leader Matt Michel. "Housing starts were down around 5%, according to the St. Louis Federal Reserve, so the replacement market for unitary air conditioners and heat pumps was down in the low 20s."

Distributors are seeing similar numbers, according to the Heating, Air-conditioning, & Refrigeration Distributors International (HARDI).

"We definitely are seeing a shift here. And that shift has actually been visible for some time," said Tim Fisher, HARDI director of market intelligence.

HARDI receives data from FieldEdge on the invoice and quote trends exhibited by their users. Invoices reflect work that has been completed, whereas quotes reflect potential future work and are most often provided for new system installations. HARDI has found that, over time, the ratio of new invoices to new quotes is a useful indicator of whether a market is trending more toward repair than replace and vice versa.

The numbers show the annual growth rate bottomed out in the spring of 2022 but remained negative through most of the year, indicating that replacement trends were broadly higher in 2022 than in 2021. That figure increased through 2023, peaking in May but generally remaining positive for most of the year. While the three-month growth rate has slowed in recent months — an encouraging sign — they don't expect much of a negative drift in 2024, meaning that repair versus replace trends will broadly remain similar to where they were in 2023.

So why is this change happening? It can't be attributed to any single factor but rather a combination of items. Certainly, higher costs of both HVAC systems and housing in general play a role.

"Adapting to the economy is something contractors need to do. We can't just assume people are going to reach into their pocket and replace," said ACCA CEO Bart James. "Contractors need to help customers get through the current need. People are slowing down on their spending. People are worried about what is coming and how they are preparing for it. Wages and other things are not keeping up with how fast prices are going up."

James said reading the numbers shows there is a shift in the home improvement market.

"Just look at the Walmart and Home Depot quarterly projections. Walmart did well with more visits but had smaller purchases, while Home Depot did not hit their numbers. That tells you that people are handling investments into housing differently. That will catch up with HVAC, too. "Contractors need to prepare by making investments in their team to meet the needs of the customer. And that need is not always a replacement option but also can be a repair option," James continued.

The sluggish home resale market is another reason for the shift towards a repair market. "Home improvement spending, in aggregate, tends to follow existing home sales totals nationally," Fisher said. "People invest more in their homes prior to selling to boost its value, and new homeowners spend more in their first year of moving than homeowners who stay put. This has major implications for HVAC replacement demand, which, historically, peaks when existing home sales are at their highest and falls off when existing home sales decline.

"Both the 3-month and 12-month growth rates bottomed out earlier in 2023, and while still negative, have slowed significantly," he continued. "We believe that home sale totals are at or nearing their trough, and over the duration of 2024 should steadily improve and finish at or ahead of 2023 totals."

The final reason is the cyclical nature of HVAC. It reflects the shipment cliff from 15 years ago, when the industry contracted 40% after peak shipments in 2005. Contractors cannot replace what was never installed.

How do HVAC contractors deal with this shift? Michel believes they should embrace the repair market.

"The money is better in replacements," he said. "It always has been and always will be. However, margins are better in service. For the next couple of years, anyway, contractors should focus on building up their service business and making money on it."

Since service involves more labor, and labor carries more overhead than equipment and material, keeping a close watch on overhead expenses is a must.

"Contractors need to build the service base, watch your marketing expenses drop, and down the road, the replacement margins and close rates to a satisfied service base will rise," Michel said. "Once we get past the shipment cliff, the replacement market will begin a decade-long run with every year being better than the year before it. We know this because it's what happened in the past, and when it comes to replacements, the past truly is a prologue."

Contractors in most parts of the country are already feeling the pinch of a slower market, and their experiences in 2024 are unlikely to be much different from their experiences in 2023 though rebounds from the milder temperatures we saw during peak months last year would go a long way in improving demand in 2024.

HARDI advises contractors should consider the following six tactics in '24:

- •Offer financing options: Any homeowner considering a new system is likely going to feel some sticker shock if it's been a few years since they

- last bought a system. Financing a new system helps to alleviate that shock, making the big sticker prices much more palatable monthly payments.

- •Protect margins: Work to ensure that your pricing for jobs is consistent with market trends, and attempt to pass through as much of the higher system costs as possible. Likewise, now is a critical time to manage operating expenses closely. Together, good cost management and smart pricing can help protect business margins in 2024.

- •Educate homeowners: Many homeowners may not fully understand the long-term benefits of replacing their HVAC system versus frequent repairs. Offer educational materials, such as blog posts, videos, or pamphlets, explaining the advantages of a new system

- in terms of energy efficiency, lower maintenance costs, and improved IAQ. Also, be sure to make clear to your customers which incentives they may qualify for through IRA or other state-level rebate/incentive programs.

- •Focus on value proposition: Emphasize the value proposition of a new HVAC system, highlighting its reliability, longevity, and performance. Help homeowners understand that investing in a replacement now can save them money and hassle in the long run.

- •Offer maintenance packages: Create maintenance packages that bundle regular servicing with discounts on repairs or replacements. This can encourage homeowners to invest in preventive maintenance and build a long-term relationship with your company.

- •Diversify services: Explore diversifying your services beyond just HVAC installations and repairs. For example, you could offer IAQ assessments, smart thermostat installations, or energy audits to provide additional value to homeowners and generate new revenue streams.

https://www.achrnews.com/articles/154324-hvac-contractors-need-to-ad apt-to-repair-market

O texto seguinte servirá de base para responder a questão.

HVAC Contractors Need to Adapt to Repair Market

Repair or replace is a question homeowners often need to answer, and it greatly impacts an HVAC contractor's business. During COVID, the residential HVAC industry saw a replacement market boom. But in 2023 and now the beginning of 2024, there has been a shift to a repair market that HVAC contractors need to be aware of as they run their businesses.

According to numbers from the Air-Conditioning, Heating and Refrigeration Institute (AHRI), shipments of unitary air conditioners and heat pumps were down 16.7% in 2023, compared to 2022. Gas furnaces were down 23%.

"The replacement market is performing worse when you strip out new construction," said industry leader Matt Michel. "Housing starts were down around 5%, according to the St. Louis Federal Reserve, so the replacement market for unitary air conditioners and heat pumps was down in the low 20s."

Distributors are seeing similar numbers, according to the Heating, Air-conditioning, & Refrigeration Distributors International (HARDI).

"We definitely are seeing a shift here. And that shift has actually been visible for some time," said Tim Fisher, HARDI director of market intelligence.

HARDI receives data from FieldEdge on the invoice and quote trends exhibited by their users. Invoices reflect work that has been completed, whereas quotes reflect potential future work and are most often provided for new system installations. HARDI has found that, over time, the ratio of new invoices to new quotes is a useful indicator of whether a market is trending more toward repair than replace and vice versa.

The numbers show the annual growth rate bottomed out in the spring of 2022 but remained negative through most of the year, indicating that replacement trends were broadly higher in 2022 than in 2021. That figure increased through 2023, peaking in May but generally remaining positive for most of the year. While the three-month growth rate has slowed in recent months — an encouraging sign — they don't expect much of a negative drift in 2024, meaning that repair versus replace trends will broadly remain similar to where they were in 2023.

So why is this change happening? It can't be attributed to any single factor but rather a combination of items. Certainly, higher costs of both HVAC systems and housing in general play a role.

"Adapting to the economy is something contractors need to do. We can't just assume people are going to reach into their pocket and replace," said ACCA CEO Bart James. "Contractors need to help customers get through the current need. People are slowing down on their spending. People are worried about what is coming and how they are preparing for it. Wages and other things are not keeping up with how fast prices are going up."

James said reading the numbers shows there is a shift in the home improvement market.

"Just look at the Walmart and Home Depot quarterly projections. Walmart did well with more visits but had smaller purchases, while Home Depot did not hit their numbers. That tells you that people are handling investments into housing differently. That will catch up with HVAC, too. "Contractors need to prepare by making investments in their team to meet the needs of the customer. And that need is not always a replacement option but also can be a repair option," James continued.

The sluggish home resale market is another reason for the shift towards a repair market. "Home improvement spending, in aggregate, tends to follow existing home sales totals nationally," Fisher said. "People invest more in their homes prior to selling to boost its value, and new homeowners spend more in their first year of moving than homeowners who stay put. This has major implications for HVAC replacement demand, which, historically, peaks when existing home sales are at their highest and falls off when existing home sales decline.

"Both the 3-month and 12-month growth rates bottomed out earlier in 2023, and while still negative, have slowed significantly," he continued. "We believe that home sale totals are at or nearing their trough, and over the duration of 2024 should steadily improve and finish at or ahead of 2023 totals."

The final reason is the cyclical nature of HVAC. It reflects the shipment cliff from 15 years ago, when the industry contracted 40% after peak shipments in 2005. Contractors cannot replace what was never installed.

How do HVAC contractors deal with this shift? Michel believes they should embrace the repair market.

"The money is better in replacements," he said. "It always has been and always will be. However, margins are better in service. For the next couple of years, anyway, contractors should focus on building up their service business and making money on it."

Since service involves more labor, and labor carries more overhead than equipment and material, keeping a close watch on overhead expenses is a must.

"Contractors need to build the service base, watch your marketing expenses drop, and down the road, the replacement margins and close rates to a satisfied service base will rise," Michel said. "Once we get past the shipment cliff, the replacement market will begin a decade-long run with every year being better than the year before it. We know this because it's what happened in the past, and when it comes to replacements, the past truly is a prologue."

Contractors in most parts of the country are already feeling the pinch of a slower market, and their experiences in 2024 are unlikely to be much different from their experiences in 2023 though rebounds from the milder temperatures we saw during peak months last year would go a long way in improving demand in 2024.

HARDI advises contractors should consider the following six tactics in '24:

- •Offer financing options: Any homeowner considering a new system is likely going to feel some sticker shock if it's been a few years since they

- last bought a system. Financing a new system helps to alleviate that shock, making the big sticker prices much more palatable monthly payments.

- •Protect margins: Work to ensure that your pricing for jobs is consistent with market trends, and attempt to pass through as much of the higher system costs as possible. Likewise, now is a critical time to manage operating expenses closely. Together, good cost management and smart pricing can help protect business margins in 2024.

- •Educate homeowners: Many homeowners may not fully understand the long-term benefits of replacing their HVAC system versus frequent repairs. Offer educational materials, such as blog posts, videos, or pamphlets, explaining the advantages of a new system

- in terms of energy efficiency, lower maintenance costs, and improved IAQ. Also, be sure to make clear to your customers which incentives they may qualify for through IRA or other state-level rebate/incentive programs.

- •Focus on value proposition: Emphasize the value proposition of a new HVAC system, highlighting its reliability, longevity, and performance. Help homeowners understand that investing in a replacement now can save them money and hassle in the long run.

- •Offer maintenance packages: Create maintenance packages that bundle regular servicing with discounts on repairs or replacements. This can encourage homeowners to invest in preventive maintenance and build a long-term relationship with your company.

- •Diversify services: Explore diversifying your services beyond just HVAC installations and repairs. For example, you could offer IAQ assessments, smart thermostat installations, or energy audits to provide additional value to homeowners and generate new revenue streams.

https://www.achrnews.com/articles/154324-hvac-contractors-need-to-ad apt-to-repair-market

O texto seguinte servirá de base para responder a questão.

HVAC Contractors Need to Adapt to Repair Market

Repair or replace is a question homeowners often need to answer, and it greatly impacts an HVAC contractor's business. During COVID, the residential HVAC industry saw a replacement market boom. But in 2023 and now the beginning of 2024, there has been a shift to a repair market that HVAC contractors need to be aware of as they run their businesses.

According to numbers from the Air-Conditioning, Heating and Refrigeration Institute (AHRI), shipments of unitary air conditioners and heat pumps were down 16.7% in 2023, compared to 2022. Gas furnaces were down 23%.

"The replacement market is performing worse when you strip out new construction," said industry leader Matt Michel. "Housing starts were down around 5%, according to the St. Louis Federal Reserve, so the replacement market for unitary air conditioners and heat pumps was down in the low 20s."

Distributors are seeing similar numbers, according to the Heating, Air-conditioning, & Refrigeration Distributors International (HARDI).

"We definitely are seeing a shift here. And that shift has actually been visible for some time," said Tim Fisher, HARDI director of market intelligence.

HARDI receives data from FieldEdge on the invoice and quote trends exhibited by their users. Invoices reflect work that has been completed, whereas quotes reflect potential future work and are most often provided for new system installations. HARDI has found that, over time, the ratio of new invoices to new quotes is a useful indicator of whether a market is trending more toward repair than replace and vice versa.

The numbers show the annual growth rate bottomed out in the spring of 2022 but remained negative through most of the year, indicating that replacement trends were broadly higher in 2022 than in 2021. That figure increased through 2023, peaking in May but generally remaining positive for most of the year. While the three-month growth rate has slowed in recent months — an encouraging sign — they don't expect much of a negative drift in 2024, meaning that repair versus replace trends will broadly remain similar to where they were in 2023.

So why is this change happening? It can't be attributed to any single factor but rather a combination of items. Certainly, higher costs of both HVAC systems and housing in general play a role.

"Adapting to the economy is something contractors need to do. We can't just assume people are going to reach into their pocket and replace," said ACCA CEO Bart James. "Contractors need to help customers get through the current need. People are slowing down on their spending. People are worried about what is coming and how they are preparing for it. Wages and other things are not keeping up with how fast prices are going up."

James said reading the numbers shows there is a shift in the home improvement market.

"Just look at the Walmart and Home Depot quarterly projections. Walmart did well with more visits but had smaller purchases, while Home Depot did not hit their numbers. That tells you that people are handling investments into housing differently. That will catch up with HVAC, too. "Contractors need to prepare by making investments in their team to meet the needs of the customer. And that need is not always a replacement option but also can be a repair option," James continued.

The sluggish home resale market is another reason for the shift towards a repair market. "Home improvement spending, in aggregate, tends to follow existing home sales totals nationally," Fisher said. "People invest more in their homes prior to selling to boost its value, and new homeowners spend more in their first year of moving than homeowners who stay put. This has major implications for HVAC replacement demand, which, historically, peaks when existing home sales are at their highest and falls off when existing home sales decline.

"Both the 3-month and 12-month growth rates bottomed out earlier in 2023, and while still negative, have slowed significantly," he continued. "We believe that home sale totals are at or nearing their trough, and over the duration of 2024 should steadily improve and finish at or ahead of 2023 totals."

The final reason is the cyclical nature of HVAC. It reflects the shipment cliff from 15 years ago, when the industry contracted 40% after peak shipments in 2005. Contractors cannot replace what was never installed.

How do HVAC contractors deal with this shift? Michel believes they should embrace the repair market.

"The money is better in replacements," he said. "It always has been and always will be. However, margins are better in service. For the next couple of years, anyway, contractors should focus on building up their service business and making money on it."

Since service involves more labor, and labor carries more overhead than equipment and material, keeping a close watch on overhead expenses is a must.

"Contractors need to build the service base, watch your marketing expenses drop, and down the road, the replacement margins and close rates to a satisfied service base will rise," Michel said. "Once we get past the shipment cliff, the replacement market will begin a decade-long run with every year being better than the year before it. We know this because it's what happened in the past, and when it comes to replacements, the past truly is a prologue."

Contractors in most parts of the country are already feeling the pinch of a slower market, and their experiences in 2024 are unlikely to be much different from their experiences in 2023 though rebounds from the milder temperatures we saw during peak months last year would go a long way in improving demand in 2024.

HARDI advises contractors should consider the following six tactics in '24:

- •Offer financing options: Any homeowner considering a new system is likely going to feel some sticker shock if it's been a few years since they

- last bought a system. Financing a new system helps to alleviate that shock, making the big sticker prices much more palatable monthly payments.

- •Protect margins: Work to ensure that your pricing for jobs is consistent with market trends, and attempt to pass through as much of the higher system costs as possible. Likewise, now is a critical time to manage operating expenses closely. Together, good cost management and smart pricing can help protect business margins in 2024.

- •Educate homeowners: Many homeowners may not fully understand the long-term benefits of replacing their HVAC system versus frequent repairs. Offer educational materials, such as blog posts, videos, or pamphlets, explaining the advantages of a new system

- in terms of energy efficiency, lower maintenance costs, and improved IAQ. Also, be sure to make clear to your customers which incentives they may qualify for through IRA or other state-level rebate/incentive programs.

- •Focus on value proposition: Emphasize the value proposition of a new HVAC system, highlighting its reliability, longevity, and performance. Help homeowners understand that investing in a replacement now can save them money and hassle in the long run.

- •Offer maintenance packages: Create maintenance packages that bundle regular servicing with discounts on repairs or replacements. This can encourage homeowners to invest in preventive maintenance and build a long-term relationship with your company.

- •Diversify services: Explore diversifying your services beyond just HVAC installations and repairs. For example, you could offer IAQ assessments, smart thermostat installations, or energy audits to provide additional value to homeowners and generate new revenue streams.

https://www.achrnews.com/articles/154324-hvac-contractors-need-to-ad apt-to-repair-market

Consider the sentence below:

"The sluggish home resale market is another reason for the shift towards a repair market."

What is the best synonym for the word "sluggish" in the context of the passage?

O texto seguinte servirá de base para responder a questão.

HVAC Contractors Need to Adapt to Repair Market

Repair or replace is a question homeowners often need to answer, and it greatly impacts an HVAC contractor's business. During COVID, the residential HVAC industry saw a replacement market boom. But in 2023 and now the beginning of 2024, there has been a shift to a repair market that HVAC contractors need to be aware of as they run their businesses.

According to numbers from the Air-Conditioning, Heating and Refrigeration Institute (AHRI), shipments of unitary air conditioners and heat pumps were down 16.7% in 2023, compared to 2022. Gas furnaces were down 23%.

"The replacement market is performing worse when you strip out new construction," said industry leader Matt Michel. "Housing starts were down around 5%, according to the St. Louis Federal Reserve, so the replacement market for unitary air conditioners and heat pumps was down in the low 20s."

Distributors are seeing similar numbers, according to the Heating, Air-conditioning, & Refrigeration Distributors International (HARDI).

"We definitely are seeing a shift here. And that shift has actually been visible for some time," said Tim Fisher, HARDI director of market intelligence.

HARDI receives data from FieldEdge on the invoice and quote trends exhibited by their users. Invoices reflect work that has been completed, whereas quotes reflect potential future work and are most often provided for new system installations. HARDI has found that, over time, the ratio of new invoices to new quotes is a useful indicator of whether a market is trending more toward repair than replace and vice versa.

The numbers show the annual growth rate bottomed out in the spring of 2022 but remained negative through most of the year, indicating that replacement trends were broadly higher in 2022 than in 2021. That figure increased through 2023, peaking in May but generally remaining positive for most of the year. While the three-month growth rate has slowed in recent months — an encouraging sign — they don't expect much of a negative drift in 2024, meaning that repair versus replace trends will broadly remain similar to where they were in 2023.

So why is this change happening? It can't be attributed to any single factor but rather a combination of items. Certainly, higher costs of both HVAC systems and housing in general play a role.

"Adapting to the economy is something contractors need to do. We can't just assume people are going to reach into their pocket and replace," said ACCA CEO Bart James. "Contractors need to help customers get through the current need. People are slowing down on their spending. People are worried about what is coming and how they are preparing for it. Wages and other things are not keeping up with how fast prices are going up."

James said reading the numbers shows there is a shift in the home improvement market.

"Just look at the Walmart and Home Depot quarterly projections. Walmart did well with more visits but had smaller purchases, while Home Depot did not hit their numbers. That tells you that people are handling investments into housing differently. That will catch up with HVAC, too. "Contractors need to prepare by making investments in their team to meet the needs of the customer. And that need is not always a replacement option but also can be a repair option," James continued.

The sluggish home resale market is another reason for the shift towards a repair market. "Home improvement spending, in aggregate, tends to follow existing home sales totals nationally," Fisher said. "People invest more in their homes prior to selling to boost its value, and new homeowners spend more in their first year of moving than homeowners who stay put. This has major implications for HVAC replacement demand, which, historically, peaks when existing home sales are at their highest and falls off when existing home sales decline.

"Both the 3-month and 12-month growth rates bottomed out earlier in 2023, and while still negative, have slowed significantly," he continued. "We believe that home sale totals are at or nearing their trough, and over the duration of 2024 should steadily improve and finish at or ahead of 2023 totals."

The final reason is the cyclical nature of HVAC. It reflects the shipment cliff from 15 years ago, when the industry contracted 40% after peak shipments in 2005. Contractors cannot replace what was never installed.

How do HVAC contractors deal with this shift? Michel believes they should embrace the repair market.

"The money is better in replacements," he said. "It always has been and always will be. However, margins are better in service. For the next couple of years, anyway, contractors should focus on building up their service business and making money on it."

Since service involves more labor, and labor carries more overhead than equipment and material, keeping a close watch on overhead expenses is a must.

"Contractors need to build the service base, watch your marketing expenses drop, and down the road, the replacement margins and close rates to a satisfied service base will rise," Michel said. "Once we get past the shipment cliff, the replacement market will begin a decade-long run with every year being better than the year before it. We know this because it's what happened in the past, and when it comes to replacements, the past truly is a prologue."

Contractors in most parts of the country are already feeling the pinch of a slower market, and their experiences in 2024 are unlikely to be much different from their experiences in 2023 though rebounds from the milder temperatures we saw during peak months last year would go a long way in improving demand in 2024.

HARDI advises contractors should consider the following six tactics in '24:

- •Offer financing options: Any homeowner considering a new system is likely going to feel some sticker shock if it's been a few years since they

- last bought a system. Financing a new system helps to alleviate that shock, making the big sticker prices much more palatable monthly payments.

- •Protect margins: Work to ensure that your pricing for jobs is consistent with market trends, and attempt to pass through as much of the higher system costs as possible. Likewise, now is a critical time to manage operating expenses closely. Together, good cost management and smart pricing can help protect business margins in 2024.

- •Educate homeowners: Many homeowners may not fully understand the long-term benefits of replacing their HVAC system versus frequent repairs. Offer educational materials, such as blog posts, videos, or pamphlets, explaining the advantages of a new system

- in terms of energy efficiency, lower maintenance costs, and improved IAQ. Also, be sure to make clear to your customers which incentives they may qualify for through IRA or other state-level rebate/incentive programs.

- •Focus on value proposition: Emphasize the value proposition of a new HVAC system, highlighting its reliability, longevity, and performance. Help homeowners understand that investing in a replacement now can save them money and hassle in the long run.

- •Offer maintenance packages: Create maintenance packages that bundle regular servicing with discounts on repairs or replacements. This can encourage homeowners to invest in preventive maintenance and build a long-term relationship with your company.

- •Diversify services: Explore diversifying your services beyond just HVAC installations and repairs. For example, you could offer IAQ assessments, smart thermostat installations, or energy audits to provide additional value to homeowners and generate new revenue streams.

https://www.achrnews.com/articles/154324-hvac-contractors-need-to-ad apt-to-repair-market

O texto seguinte servirá de base para responder a questão.

HVAC Contractors Need to Adapt to Repair Market

Repair or replace is a question homeowners often need to answer, and it greatly impacts an HVAC contractor's business. During COVID, the residential HVAC industry saw a replacement market boom. But in 2023 and now the beginning of 2024, there has been a shift to a repair market that HVAC contractors need to be aware of as they run their businesses.

According to numbers from the Air-Conditioning, Heating and Refrigeration Institute (AHRI), shipments of unitary air conditioners and heat pumps were down 16.7% in 2023, compared to 2022. Gas furnaces were down 23%.

"The replacement market is performing worse when you strip out new construction," said industry leader Matt Michel. "Housing starts were down around 5%, according to the St. Louis Federal Reserve, so the replacement market for unitary air conditioners and heat pumps was down in the low 20s."

Distributors are seeing similar numbers, according to the Heating, Air-conditioning, & Refrigeration Distributors International (HARDI).

"We definitely are seeing a shift here. And that shift has actually been visible for some time," said Tim Fisher, HARDI director of market intelligence.

HARDI receives data from FieldEdge on the invoice and quote trends exhibited by their users. Invoices reflect work that has been completed, whereas quotes reflect potential future work and are most often provided for new system installations. HARDI has found that, over time, the ratio of new invoices to new quotes is a useful indicator of whether a market is trending more toward repair than replace and vice versa.

The numbers show the annual growth rate bottomed out in the spring of 2022 but remained negative through most of the year, indicating that replacement trends were broadly higher in 2022 than in 2021. That figure increased through 2023, peaking in May but generally remaining positive for most of the year. While the three-month growth rate has slowed in recent months — an encouraging sign — they don't expect much of a negative drift in 2024, meaning that repair versus replace trends will broadly remain similar to where they were in 2023.

So why is this change happening? It can't be attributed to any single factor but rather a combination of items. Certainly, higher costs of both HVAC systems and housing in general play a role.

"Adapting to the economy is something contractors need to do. We can't just assume people are going to reach into their pocket and replace," said ACCA CEO Bart James. "Contractors need to help customers get through the current need. People are slowing down on their spending. People are worried about what is coming and how they are preparing for it. Wages and other things are not keeping up with how fast prices are going up."

James said reading the numbers shows there is a shift in the home improvement market.

"Just look at the Walmart and Home Depot quarterly projections. Walmart did well with more visits but had smaller purchases, while Home Depot did not hit their numbers. That tells you that people are handling investments into housing differently. That will catch up with HVAC, too. "Contractors need to prepare by making investments in their team to meet the needs of the customer. And that need is not always a replacement option but also can be a repair option," James continued.

The sluggish home resale market is another reason for the shift towards a repair market. "Home improvement spending, in aggregate, tends to follow existing home sales totals nationally," Fisher said. "People invest more in their homes prior to selling to boost its value, and new homeowners spend more in their first year of moving than homeowners who stay put. This has major implications for HVAC replacement demand, which, historically, peaks when existing home sales are at their highest and falls off when existing home sales decline.

"Both the 3-month and 12-month growth rates bottomed out earlier in 2023, and while still negative, have slowed significantly," he continued. "We believe that home sale totals are at or nearing their trough, and over the duration of 2024 should steadily improve and finish at or ahead of 2023 totals."

The final reason is the cyclical nature of HVAC. It reflects the shipment cliff from 15 years ago, when the industry contracted 40% after peak shipments in 2005. Contractors cannot replace what was never installed.

How do HVAC contractors deal with this shift? Michel believes they should embrace the repair market.

"The money is better in replacements," he said. "It always has been and always will be. However, margins are better in service. For the next couple of years, anyway, contractors should focus on building up their service business and making money on it."

Since service involves more labor, and labor carries more overhead than equipment and material, keeping a close watch on overhead expenses is a must.

"Contractors need to build the service base, watch your marketing expenses drop, and down the road, the replacement margins and close rates to a satisfied service base will rise," Michel said. "Once we get past the shipment cliff, the replacement market will begin a decade-long run with every year being better than the year before it. We know this because it's what happened in the past, and when it comes to replacements, the past truly is a prologue."

Contractors in most parts of the country are already feeling the pinch of a slower market, and their experiences in 2024 are unlikely to be much different from their experiences in 2023 though rebounds from the milder temperatures we saw during peak months last year would go a long way in improving demand in 2024.

HARDI advises contractors should consider the following six tactics in '24:

- •Offer financing options: Any homeowner considering a new system is likely going to feel some sticker shock if it's been a few years since they

- last bought a system. Financing a new system helps to alleviate that shock, making the big sticker prices much more palatable monthly payments.

- •Protect margins: Work to ensure that your pricing for jobs is consistent with market trends, and attempt to pass through as much of the higher system costs as possible. Likewise, now is a critical time to manage operating expenses closely. Together, good cost management and smart pricing can help protect business margins in 2024.

- •Educate homeowners: Many homeowners may not fully understand the long-term benefits of replacing their HVAC system versus frequent repairs. Offer educational materials, such as blog posts, videos, or pamphlets, explaining the advantages of a new system

- in terms of energy efficiency, lower maintenance costs, and improved IAQ. Also, be sure to make clear to your customers which incentives they may qualify for through IRA or other state-level rebate/incentive programs.

- •Focus on value proposition: Emphasize the value proposition of a new HVAC system, highlighting its reliability, longevity, and performance. Help homeowners understand that investing in a replacement now can save them money and hassle in the long run.

- •Offer maintenance packages: Create maintenance packages that bundle regular servicing with discounts on repairs or replacements. This can encourage homeowners to invest in preventive maintenance and build a long-term relationship with your company.

- •Diversify services: Explore diversifying your services beyond just HVAC installations and repairs. For example, you could offer IAQ assessments, smart thermostat installations, or energy audits to provide additional value to homeowners and generate new revenue streams.

https://www.achrnews.com/articles/154324-hvac-contractors-need-to-ad apt-to-repair-market

O texto seguinte servirá de base para responder a questão.

HVAC Contractors Need to Adapt to Repair Market

Repair or replace is a question homeowners often need to answer, and it greatly impacts an HVAC contractor's business. During COVID, the residential HVAC industry saw a replacement market boom. But in 2023 and now the beginning of 2024, there has been a shift to a repair market that HVAC contractors need to be aware of as they run their businesses.

According to numbers from the Air-Conditioning, Heating and Refrigeration Institute (AHRI), shipments of unitary air conditioners and heat pumps were down 16.7% in 2023, compared to 2022. Gas furnaces were down 23%.

"The replacement market is performing worse when you strip out new construction," said industry leader Matt Michel. "Housing starts were down around 5%, according to the St. Louis Federal Reserve, so the replacement market for unitary air conditioners and heat pumps was down in the low 20s."

Distributors are seeing similar numbers, according to the Heating, Air-conditioning, & Refrigeration Distributors International (HARDI).

"We definitely are seeing a shift here. And that shift has actually been visible for some time," said Tim Fisher, HARDI director of market intelligence.

HARDI receives data from FieldEdge on the invoice and quote trends exhibited by their users. Invoices reflect work that has been completed, whereas quotes reflect potential future work and are most often provided for new system installations. HARDI has found that, over time, the ratio of new invoices to new quotes is a useful indicator of whether a market is trending more toward repair than replace and vice versa.

The numbers show the annual growth rate bottomed out in the spring of 2022 but remained negative through most of the year, indicating that replacement trends were broadly higher in 2022 than in 2021. That figure increased through 2023, peaking in May but generally remaining positive for most of the year. While the three-month growth rate has slowed in recent months — an encouraging sign — they don't expect much of a negative drift in 2024, meaning that repair versus replace trends will broadly remain similar to where they were in 2023.

So why is this change happening? It can't be attributed to any single factor but rather a combination of items. Certainly, higher costs of both HVAC systems and housing in general play a role.

"Adapting to the economy is something contractors need to do. We can't just assume people are going to reach into their pocket and replace," said ACCA CEO Bart James. "Contractors need to help customers get through the current need. People are slowing down on their spending. People are worried about what is coming and how they are preparing for it. Wages and other things are not keeping up with how fast prices are going up."

James said reading the numbers shows there is a shift in the home improvement market.

"Just look at the Walmart and Home Depot quarterly projections. Walmart did well with more visits but had smaller purchases, while Home Depot did not hit their numbers. That tells you that people are handling investments into housing differently. That will catch up with HVAC, too. "Contractors need to prepare by making investments in their team to meet the needs of the customer. And that need is not always a replacement option but also can be a repair option," James continued.

The sluggish home resale market is another reason for the shift towards a repair market. "Home improvement spending, in aggregate, tends to follow existing home sales totals nationally," Fisher said. "People invest more in their homes prior to selling to boost its value, and new homeowners spend more in their first year of moving than homeowners who stay put. This has major implications for HVAC replacement demand, which, historically, peaks when existing home sales are at their highest and falls off when existing home sales decline.

"Both the 3-month and 12-month growth rates bottomed out earlier in 2023, and while still negative, have slowed significantly," he continued. "We believe that home sale totals are at or nearing their trough, and over the duration of 2024 should steadily improve and finish at or ahead of 2023 totals."

The final reason is the cyclical nature of HVAC. It reflects the shipment cliff from 15 years ago, when the industry contracted 40% after peak shipments in 2005. Contractors cannot replace what was never installed.

How do HVAC contractors deal with this shift? Michel believes they should embrace the repair market.

"The money is better in replacements," he said. "It always has been and always will be. However, margins are better in service. For the next couple of years, anyway, contractors should focus on building up their service business and making money on it."

Since service involves more labor, and labor carries more overhead than equipment and material, keeping a close watch on overhead expenses is a must.

"Contractors need to build the service base, watch your marketing expenses drop, and down the road, the replacement margins and close rates to a satisfied service base will rise," Michel said. "Once we get past the shipment cliff, the replacement market will begin a decade-long run with every year being better than the year before it. We know this because it's what happened in the past, and when it comes to replacements, the past truly is a prologue."

Contractors in most parts of the country are already feeling the pinch of a slower market, and their experiences in 2024 are unlikely to be much different from their experiences in 2023 though rebounds from the milder temperatures we saw during peak months last year would go a long way in improving demand in 2024.

HARDI advises contractors should consider the following six tactics in '24:

- •Offer financing options: Any homeowner considering a new system is likely going to feel some sticker shock if it's been a few years since they

- last bought a system. Financing a new system helps to alleviate that shock, making the big sticker prices much more palatable monthly payments.

- •Protect margins: Work to ensure that your pricing for jobs is consistent with market trends, and attempt to pass through as much of the higher system costs as possible. Likewise, now is a critical time to manage operating expenses closely. Together, good cost management and smart pricing can help protect business margins in 2024.

- •Educate homeowners: Many homeowners may not fully understand the long-term benefits of replacing their HVAC system versus frequent repairs. Offer educational materials, such as blog posts, videos, or pamphlets, explaining the advantages of a new system

- in terms of energy efficiency, lower maintenance costs, and improved IAQ. Also, be sure to make clear to your customers which incentives they may qualify for through IRA or other state-level rebate/incentive programs.

- •Focus on value proposition: Emphasize the value proposition of a new HVAC system, highlighting its reliability, longevity, and performance. Help homeowners understand that investing in a replacement now can save them money and hassle in the long run.

- •Offer maintenance packages: Create maintenance packages that bundle regular servicing with discounts on repairs or replacements. This can encourage homeowners to invest in preventive maintenance and build a long-term relationship with your company.

- •Diversify services: Explore diversifying your services beyond just HVAC installations and repairs. For example, you could offer IAQ assessments, smart thermostat installations, or energy audits to provide additional value to homeowners and generate new revenue streams.

https://www.achrnews.com/articles/154324-hvac-contractors-need-to-ad apt-to-repair-market

Shonto Begay, artista, poeta e diretor cinematográfico, nasceu na nação Navajo, Estados Unidos. “Grandmother”, apresentado para leitura e exame a seguir, exibe algumas de suas impressões acerca da cultura dos povos originários norte-americanos que estão especificamente conectadas às escolhas representadas em:

Grandmother

Grandmother was strong, like a distant mesa.

From her sprang many stories of days long ago.

From her gentle manners

Lessons were learned

Not easily forgotten.

She told us time and again

That the earth is our mother,

Our holy mother.

“Always greet the coming day

by greeting your grandparents,

Ya at eeh Shi cheii (Hello, My Grandfather)

To the young juniper tree.

Ya at eeh Shi masani (Hello, My Grandmother)

To the young pinon tree.”

The lines in her face were marks of honor,

Countless winters gazing into the blizzard,

Many summers in the hot cornfield.

Her strong brown hands, once smooth,

Carried many generations,

Gestured many stories,

Wiped away many tears.

The whiteness of her windblown hair,

A halo against the setting sun.

My grandmother was called Asdzan Alts iisi,

Small Woman. Wife of Little Hat,

Mother of generations of Bitter Water Clan,

She lived 113 years.

(Disponível em: https://cassandraljackson.tripod.com/cassandrasreadingcorner/id133.html. Acesso em: outubro de 2024.)