Questões de Concurso Público Receita Federal 2005 para Auditor Fiscal da Receita Federal - Área Tributária e Aduaneira - Prova 1

Foram encontradas 60 questões

text below entitled "A dip in the middle":

A dip in the middle

Source: The Economist (adapted)

Sep 8th 2005

Income tax has been paid in Britain for more

than two centuries. First introduced by William Pitt the

Younger to finance the war against Napoleonic France,

it is the Treasury´s biggest source of revenue, raising

30% of tax receipts. It arouses strong political emotions,

regarded as fair by some because it makes the rich pay a

bigger share of their income than the poor, but unfair by

others because it penalizes enterprise and hard work.

During the past 30 years, income tax has been

subject to sweeping changes, notably the cut in the top

rate from 98% to 40% under Margaret Thatcher between

1979 and 1988. Now another Conservative politician,

George Osborne, is floating a radical reform to match

that earlier exploit. The shadow chancellor announced

on September 7th that he was setting up a commission

to explore the possible introduction of a flat income tax

in Britain.

Introducing a flat income tax into Britain would

involve two main changes. At present, there are three

marginal tax rates. These three rates would be replaced

by a single rate, which would be considerably lower than

the current top rate. At the same time there would be an

increase in the tax-free personal allowance, currently

worth 4,895 pounds.

text below entitled "A dip in the middle":

A dip in the middle

Source: The Economist (adapted)

Sep 8th 2005

Income tax has been paid in Britain for more

than two centuries. First introduced by William Pitt the

Younger to finance the war against Napoleonic France,

it is the Treasury´s biggest source of revenue, raising

30% of tax receipts. It arouses strong political emotions,

regarded as fair by some because it makes the rich pay a

bigger share of their income than the poor, but unfair by

others because it penalizes enterprise and hard work.

During the past 30 years, income tax has been

subject to sweeping changes, notably the cut in the top

rate from 98% to 40% under Margaret Thatcher between

1979 and 1988. Now another Conservative politician,

George Osborne, is floating a radical reform to match

that earlier exploit. The shadow chancellor announced

on September 7th that he was setting up a commission

to explore the possible introduction of a flat income tax

in Britain.

Introducing a flat income tax into Britain would

involve two main changes. At present, there are three

marginal tax rates. These three rates would be replaced

by a single rate, which would be considerably lower than

the current top rate. At the same time there would be an

increase in the tax-free personal allowance, currently

worth 4,895 pounds.

text below entitled "A dip in the middle":

A dip in the middle

Source: The Economist (adapted)

Sep 8th 2005

Income tax has been paid in Britain for more

than two centuries. First introduced by William Pitt the

Younger to finance the war against Napoleonic France,

it is the Treasury´s biggest source of revenue, raising

30% of tax receipts. It arouses strong political emotions,

regarded as fair by some because it makes the rich pay a

bigger share of their income than the poor, but unfair by

others because it penalizes enterprise and hard work.

During the past 30 years, income tax has been

subject to sweeping changes, notably the cut in the top

rate from 98% to 40% under Margaret Thatcher between

1979 and 1988. Now another Conservative politician,

George Osborne, is floating a radical reform to match

that earlier exploit. The shadow chancellor announced

on September 7th that he was setting up a commission

to explore the possible introduction of a flat income tax

in Britain.

Introducing a flat income tax into Britain would

involve two main changes. At present, there are three

marginal tax rates. These three rates would be replaced

by a single rate, which would be considerably lower than

the current top rate. At the same time there would be an

increase in the tax-free personal allowance, currently

worth 4,895 pounds.

text below entitled "A dip in the middle":

A dip in the middle

Source: The Economist (adapted)

Sep 8th 2005

Income tax has been paid in Britain for more

than two centuries. First introduced by William Pitt the

Younger to finance the war against Napoleonic France,

it is the Treasury´s biggest source of revenue, raising

30% of tax receipts. It arouses strong political emotions,

regarded as fair by some because it makes the rich pay a

bigger share of their income than the poor, but unfair by

others because it penalizes enterprise and hard work.

During the past 30 years, income tax has been

subject to sweeping changes, notably the cut in the top

rate from 98% to 40% under Margaret Thatcher between

1979 and 1988. Now another Conservative politician,

George Osborne, is floating a radical reform to match

that earlier exploit. The shadow chancellor announced

on September 7th that he was setting up a commission

to explore the possible introduction of a flat income tax

in Britain.

Introducing a flat income tax into Britain would

involve two main changes. At present, there are three

marginal tax rates. These three rates would be replaced

by a single rate, which would be considerably lower than

the current top rate. At the same time there would be an

increase in the tax-free personal allowance, currently

worth 4,895 pounds.

text below entitled "Flight of the French":

Flight of the French

Source: Newsweek (adapted)

Sept 26th/Oct 3rd 2005

The Belgians call them "fiscal refugees", but these

refugees wear Chanel. They are runaways from high

taxes in France. Officially, France has lost, on average,

one millionaire or billionaire tax payer per day for tax

reasons since 1997, when the government started trying

to track capital flight. Privately, economists say the

number is much higher. "The statistic is stupid," holds

French economist Nicolas Baverez. "It's as if, to count

contraband, you only counted what people declared at

the border."

While much of Europe has revised its tax codes, France's

fiscal inertia is virtually begging its rich to leave. Holding dear

its commitment to égalité and fraternité, France has bucked

the trend in the European Union, where most member states

have dropped the wealth tax since the mid-1990s. France

went the opposite way in 1997 by abolishing a cap that limited

the wealth-tax bill, which kicks in at incomes over 720,000

euros to 85% of a taxpayer's income. The result: some pay

more taxes than they earn in income.

text below entitled "Flight of the French":

Flight of the French

Source: Newsweek (adapted)

Sept 26th/Oct 3rd 2005

The Belgians call them "fiscal refugees", but these

refugees wear Chanel. They are runaways from high

taxes in France. Officially, France has lost, on average,

one millionaire or billionaire tax payer per day for tax

reasons since 1997, when the government started trying

to track capital flight. Privately, economists say the

number is much higher. "The statistic is stupid," holds

French economist Nicolas Baverez. "It's as if, to count

contraband, you only counted what people declared at

the border."

While much of Europe has revised its tax codes, France's

fiscal inertia is virtually begging its rich to leave. Holding dear

its commitment to égalité and fraternité, France has bucked

the trend in the European Union, where most member states

have dropped the wealth tax since the mid-1990s. France

went the opposite way in 1997 by abolishing a cap that limited

the wealth-tax bill, which kicks in at incomes over 720,000

euros to 85% of a taxpayer's income. The result: some pay

more taxes than they earn in income.

text below entitled "Flight of the French":

Flight of the French

Source: Newsweek (adapted)

Sept 26th/Oct 3rd 2005

The Belgians call them "fiscal refugees", but these

refugees wear Chanel. They are runaways from high

taxes in France. Officially, France has lost, on average,

one millionaire or billionaire tax payer per day for tax

reasons since 1997, when the government started trying

to track capital flight. Privately, economists say the

number is much higher. "The statistic is stupid," holds

French economist Nicolas Baverez. "It's as if, to count

contraband, you only counted what people declared at

the border."

While much of Europe has revised its tax codes, France's

fiscal inertia is virtually begging its rich to leave. Holding dear

its commitment to égalité and fraternité, France has bucked

the trend in the European Union, where most member states

have dropped the wealth tax since the mid-1990s. France

went the opposite way in 1997 by abolishing a cap that limited

the wealth-tax bill, which kicks in at incomes over 720,000

euros to 85% of a taxpayer's income. The result: some pay

more taxes than they earn in income.

the text below entitled "The real medicine":

The real medicine

Source: Newsweek (adapted)

Oct 17th 2005

People who survive a heart attack often

describe it as a wake-up call. But for a 61-year old

executive I met recently, it was more than that. This

man was in the midst of a divorce when he was

stricken last spring, and he had fallen out of touch

with friends and family members. The executive´s

doctor, unaware of the strife in his life, counseled him

to change his diet, start exercising and quit smoking.

He also prescribed drugs to lower cholesterol and

blood pressure. It was sound advice, but in combing

the medical literature, the patient discovered that he

needed to do more. Studies suggested that his risk of

dying within six months would be four times greater

if he remained depressed and lonely. So he joined

a support group and reordered his priorities, placing

relationships at the top of the list instead of the bottom.

His health has improved steadily since then, and so

has his outlook on life. In fact he now describes his

heart attack as the best thing that ever happened to

him. "Yes, my arteries are more open," he says. "But

even more important, I´m more open."

the text below entitled "The real medicine":

The real medicine

Source: Newsweek (adapted)

Oct 17th 2005

People who survive a heart attack often

describe it as a wake-up call. But for a 61-year old

executive I met recently, it was more than that. This

man was in the midst of a divorce when he was

stricken last spring, and he had fallen out of touch

with friends and family members. The executive´s

doctor, unaware of the strife in his life, counseled him

to change his diet, start exercising and quit smoking.

He also prescribed drugs to lower cholesterol and

blood pressure. It was sound advice, but in combing

the medical literature, the patient discovered that he

needed to do more. Studies suggested that his risk of

dying within six months would be four times greater

if he remained depressed and lonely. So he joined

a support group and reordered his priorities, placing

relationships at the top of the list instead of the bottom.

His health has improved steadily since then, and so

has his outlook on life. In fact he now describes his

heart attack as the best thing that ever happened to

him. "Yes, my arteries are more open," he says. "But

even more important, I´m more open."

the text below entitled "The real medicine":

The real medicine

Source: Newsweek (adapted)

Oct 17th 2005

People who survive a heart attack often

describe it as a wake-up call. But for a 61-year old

executive I met recently, it was more than that. This

man was in the midst of a divorce when he was

stricken last spring, and he had fallen out of touch

with friends and family members. The executive´s

doctor, unaware of the strife in his life, counseled him

to change his diet, start exercising and quit smoking.

He also prescribed drugs to lower cholesterol and

blood pressure. It was sound advice, but in combing

the medical literature, the patient discovered that he

needed to do more. Studies suggested that his risk of

dying within six months would be four times greater

if he remained depressed and lonely. So he joined

a support group and reordered his priorities, placing

relationships at the top of the list instead of the bottom.

His health has improved steadily since then, and so

has his outlook on life. In fact he now describes his

heart attack as the best thing that ever happened to

him. "Yes, my arteries are more open," he says. "But

even more important, I´m more open."

(Se necessário utilize as tabelas das páginas 21 e 22)

(Se necessário utilize as tabelas das páginas 21 e 22)

(Se necessário utilize as tabelas das páginas 21 e 22)

(Se necessário utilize as tabelas das páginas 21 e 22)

(Se necessário utilize as tabelas das páginas 21 e 22)

(Se necessário utilize as tabelas das páginas 21 e 22)

(Se necessário utilize as tabelas das páginas 21 e 22)

(Se necessário utilize as tabelas das páginas 21 e 22)

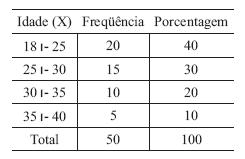

Uma empresa verifi cou que, historicamente, a idade média dos consumidores de seu principal produto é de 25 anos, considerada baixa por seus dirigentes. Com o objetivo de ampliar sua participação no mercado, a empresa realizou uma campanha de divulgação voltada para consumidores com idades mais avançadas. Um levantamento realizado para medir o impacto da campanha indicou que as idades dos consumidores apresentaram a seguinte distribuição:

Assinale a opção que corresponde ao resultado da campanha considerando o seguinte critério de decisão: se a diferença X - 25 for maior que o valor ,

então a campanha de divulgação surtiu efeito, isto é, a idade média aumentou; caso contrário, a campanha de divulgação não alcançou o resultado desejado.