Questões de Concurso Público Prefeitura de São Luís - MA 2018 para Auditor Fiscal de Tributos I - Tecnologia da Informação (TI)

Foram encontradas 100 questões

Na metodologia ágil XP são realizados testes que são muito ligados com as user stories e buscam testar o sistema do ponto de vista do usuário. Este tipo de teste objetiva validar com o cliente o que foi definido nos requisitos do software, de forma a verificar se o produto desenvolvido está de acordo com o que foi estabelecido. As funcionalidades do sistema são validadas, as entradas podem ser simuladas e o comportamento de saída pode ser observado. Como o sistema é testado com todos os componentes interligados e configurados, inclusive bancos de dados e gerenciadores de filas, há garantias de que cada serviço oferecido está funcionando.

(Adaptado de: https://github.com/fga-gpp-mds/A-Disciplina/wiki/Programação-Extrema-(XP))

O texto se refere

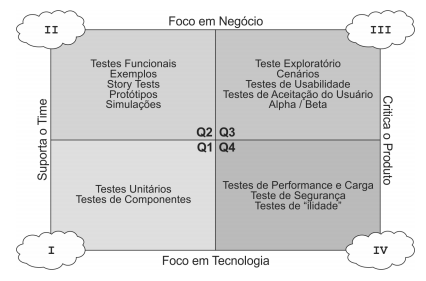

Em projetos com base em métodos ágeis, a abordagem de testes pode se basear no quadrante de testes ágeis como mostrado na figura abaixo.

Os números I, II, III e IV, relacionados aos quadrantes, correspondem, respectivamente, a

SELECT * FROM cidadao WHERE

Um Auditor digitou em um banco de dados Oracle, aberto e em condições ideais, a instrução PL/SQL:

SELECT id, nome FROM cidadao WHERE id = '001' FOR UPDATE ORDER BY id;

A cláusula FOR UPDATE

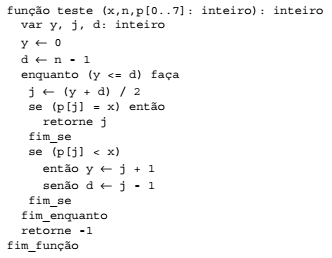

Considere a função abaixo na forma de pseudocódigo.

Se a função teste receber o valor 9 para x, 8 para n e o vetor [7, 10, 42, 88, 100, 123, 401, 502] para p, o retorno

da função será

Um Auditor Fiscal fez uma pesquisa na internet e obteve as seguintes informações:

Há vários critérios para escolher uma ferramenta para esta finalidade, como popularidade, eficácia, desempenho, adequação e simplicidade. Este tipo de ferramenta serve para resolver três problemas: I. registrar a evolução do projeto; II. possibilitar o trabalho em equipe; III. criar e manter variações do projeto. Tanto o Subversion, quanto o Git e o Mercurial atendem estas necessidades.

O Auditor estava pesquisando sobre ferramentas de

Considere o texto abaixo.

"[AuditFile] is a great auditing tool and I love how I can log in while I'm at the client’s office instead of worrying about checking out files like I did with the previous software I used."

− Reviewer A

"AuditFile rocks! I have the opportunity to look at a lot of accounting tools. The sign-up process for AuditFile is one of the easiest I have seen... it only takes a few minutes to be up and running!"

− Reviewer B

"AuditFile.com has been the best project management system we have used, allowing us to easily manage over 20 projects. Their integration of file management and progress reporting has made our practice more efficient. Additionally, the ability to track our target projects with their CRM tool has allowed us to close more deals. Kevin and his team add tremendous value to our small practice."

− Reviewer C

"AuditFile.com has been amazing for our firm. It’s not just a change in platform, but a change in the way we view our audit practice. We now have the reach and resources of firms several times our size. As a small firm who has had parts of their accounting practice in the cloud for years it’s been a goal of ours to move our audit practice to the cloud for quite some time."

− Reviewer D

"AuditFile is a cloud-based audit solution that lets firms track and manage every aspect of the audit, review or compilation process. It's also working on integrating with major online accounting software solutions, so it's more than doing its part to bring audit into the same cloud-based, integrated, automated world that tax and accounting have been in for more than a decade."

− Reviewer E

(Adapted from: https://auditfile.com/)

Afirma-se com propriedade sobre o texto:

A Catastrophe a Good Audit Trail Can Help You Avoid

PUBLISHED ON FRIDAY, AUGUST 15, 2014 BY ADAM BLUEMNER

Ladies and gentlemen, reintroducing your old, but underappreciated friend: the humble accounting audit trail.

Of course, the idea behind the audit trail is simple, really. When you make an entry or change to your accounting records, your accounting software automatically logs the details for future reference. Who did what, when, how, and for how much? It’s the job of the audit trail to make sure that story is always accessible.

As straightforward as the audit trail is, maintaining and monitoring it properly can keep your business out of some complicated messes, including fraud.

The Association of Certified Fraud Examiners estimates that 5% of organizational revenues are lost to fraud. That’s more than $3.5 trillion annually defrauded on a global basis. Brought down to the level of the individual organization, the average occupational fraud case amounts to $140,000 of lost revenue.

The audit trail is the fundamental business tool for both identifying and preventing fraud.

Fraud, of course, doesn’t just happen magically. It takes an accumulation of actions that will leave footprints. For instance, a common scheme involves entering a record into the AP ledger, printing a blank check, and then assigning a phony payee after the fraudster has made payment to themselves or someone else in on the scheme. This sort of fraud is relatively easy to detect − if there is an active audit trail being maintained and monitored.

The audit trail doesn’t just provide a mechanism for fraud detection, ..I.. . The presence of a carefully maintained and frequently monitored audit trail also acts as a powerful deterrant, in precisely the same way as a video monitor, alarm system, or any other visible security measure.

(Adapted from: https://softwareconnect.com/accounting/4-catastrophes-a-good-audit-trail-can-help-avoid/)

A Catastrophe a Good Audit Trail Can Help You Avoid

PUBLISHED ON FRIDAY, AUGUST 15, 2014 BY ADAM BLUEMNER

Ladies and gentlemen, reintroducing your old, but underappreciated friend: the humble accounting audit trail.

Of course, the idea behind the audit trail is simple, really. When you make an entry or change to your accounting records, your accounting software automatically logs the details for future reference. Who did what, when, how, and for how much? It’s the job of the audit trail to make sure that story is always accessible.

As straightforward as the audit trail is, maintaining and monitoring it properly can keep your business out of some complicated messes, including fraud.

The Association of Certified Fraud Examiners estimates that 5% of organizational revenues are lost to fraud. That’s more than $3.5 trillion annually defrauded on a global basis. Brought down to the level of the individual organization, the average occupational fraud case amounts to $140,000 of lost revenue.

The audit trail is the fundamental business tool for both identifying and preventing fraud.

Fraud, of course, doesn’t just happen magically. It takes an accumulation of actions that will leave footprints. For instance, a common scheme involves entering a record into the AP ledger, printing a blank check, and then assigning a phony payee after the fraudster has made payment to themselves or someone else in on the scheme. This sort of fraud is relatively easy to detect − if there is an active audit trail being maintained and monitored.

The audit trail doesn’t just provide a mechanism for fraud detection, ..I.. . The presence of a carefully maintained and frequently monitored audit trail also acts as a powerful deterrant, in precisely the same way as a video monitor, alarm system, or any other visible security measure.

(Adapted from: https://softwareconnect.com/accounting/4-catastrophes-a-good-audit-trail-can-help-avoid/)